Hi Apex,

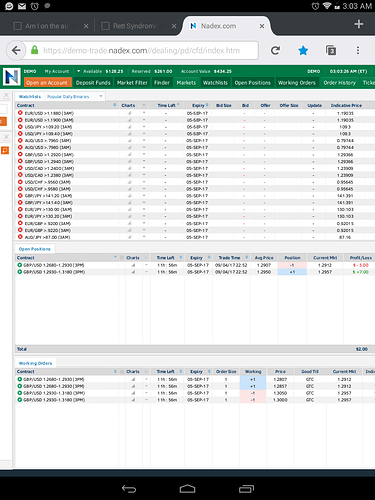

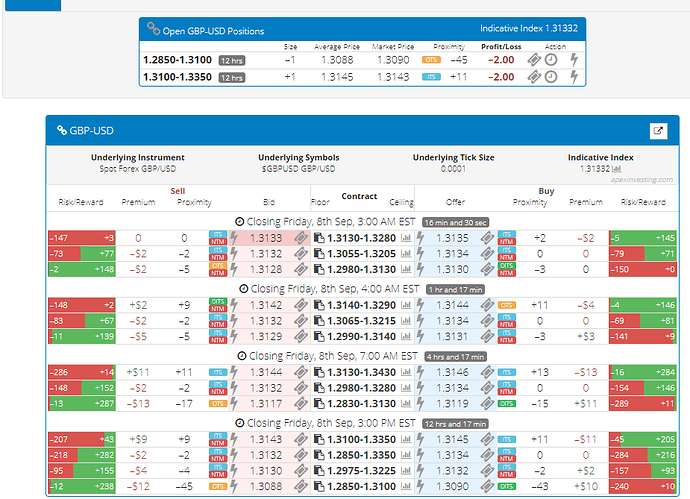

I just started trading spreads in Nadex demo account because I continue to lose money trading binaries. I am having a hard time understanding spreads completely, though. I understand that there’s a floor and a ceiling. However, when it comes to the price I sold/brought it at and the indicative price how does that work? I am sorry if it sounds like I am asking a stupid question. Here are pictures below of a trade I took the other day.

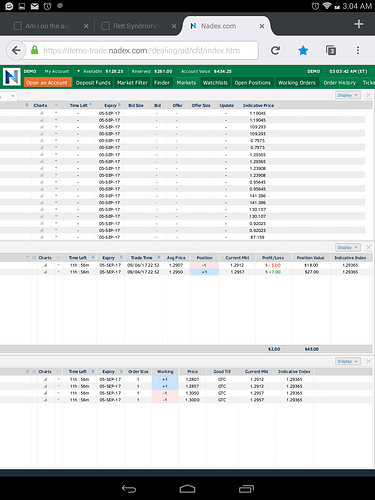

In the first picture you can see that the floor in the first trade I took, was 1.2680 and the ceiling was 1.2930. I sold it at 1.2907. On the second trade, the floor is 1.2930 and the ceiling is 1.3180. I brought it at 1.2950. In the second photo you can see the indicative price is 1.29365. On the trade that I sold, if the indicative price moves from 1.29365 and below 1.2907 to let’s say, 1.2857, will I be $50 in the money? On the trade that I brought, if the indicative price moves from 1.29365 and above 1.2950, to let’s say, 1.3000, will that also be a $50 profit? Again, I am sorry. I am just now figuring out how they work. I hope that I didn’t confuse you.

First, there are no “stupid” questions… other than ones that aren’t asked.

Chances are someone has had the same exact question before or has experienced a similar situation.

Second, while initially harder to understand you will find that Nadex Spreads are much more forgiving than the binaries. Nothing wrong with binaries… but personally if I am going to lose $35+ on a trade… I rather it be because the market went against me said 35 + ticks.

As for your questions… hard to say. on your sell trade you got in near the ceiling and on your buy you got in near the floor. So the spreads wont move as fast as the indicative

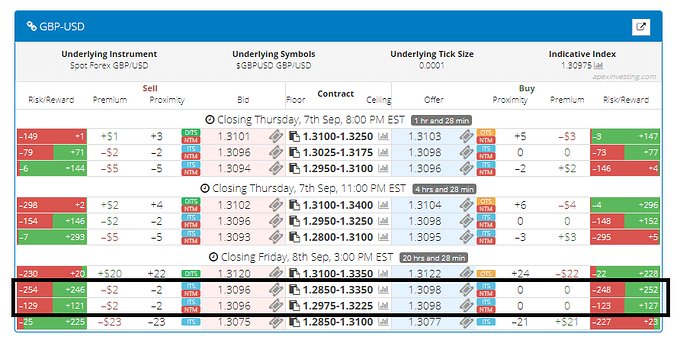

When you want to mirror the market in a directional trade, you want to choose a Near The Money (NTM) Spread… that will generally match the markets moves tick for tick.

I would want to choose one of the 2 Spreads in the box… ideally the 1,2850 - 1.3350 one because that offers the most profit potential on either side.

Also… since both spreads had a floor/ceiling of 1.2930 were you specifically trying to do what is called a straddle?? (Selling a spread below the market and buying a spread above the market)

.

Thanks a lot, Mat. I am not starting to understand what spreads are. Yes, I think I was trying to do a straddle.

I was trying to buy deep out of the money spreads going in opposite directions, at about $20 each, set a take profit for $50, and hold it overnight. I just wasn’t sure whether or not the price I got in at would move with the indicative, or whether I had to wait for the indicative price to reach the price I got in at, and then I would start profiting. I don’t know, though. I guess my question is, how do I figure out where the indicative price has to be, in order for me to reach my $50 take profit.

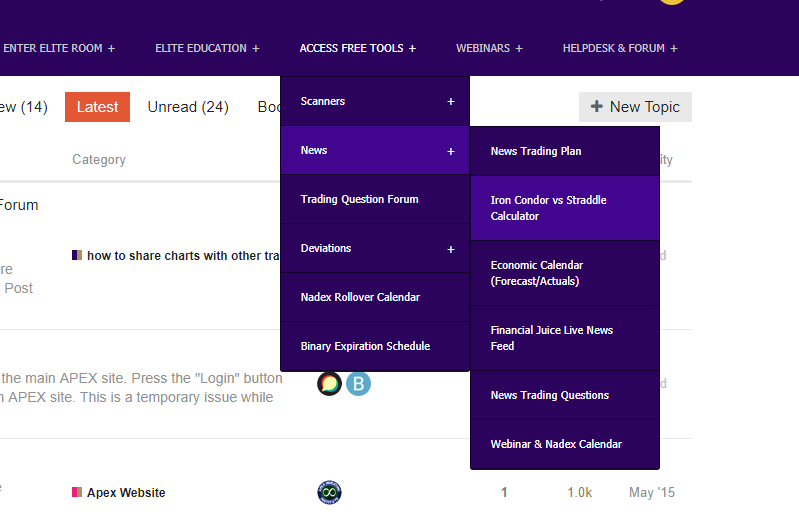

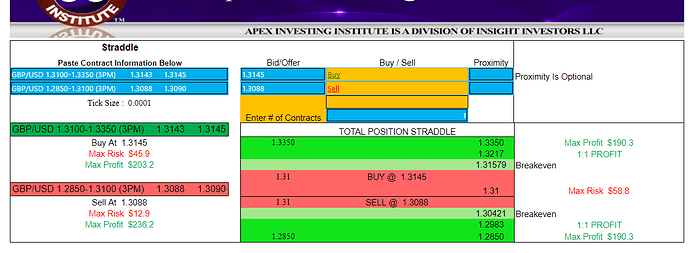

Easiest way to have all that information figured out for you automatically is to use the Apex Iron Condor/Straddle Calculator.

Found on the main webpage

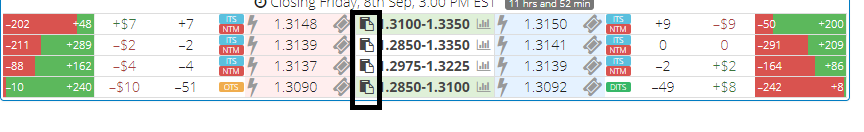

Here is the trade that I will be basing the information entered into the calculator on.

The Calculator itself is pretty straightforward

To copy and paste the contract information… click the little things that look like clipboards and then select the appropriate tile and paste it in (Ctrl - V)

The Bid/Offer Price you can just directly copy from the scanner.

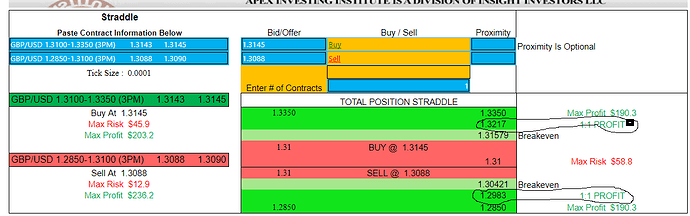

Once all the information is entered, you will get something like the screenshot

- Showing you your Max Risk (what you originally entered at)

- Your Max Profit

- Break even Price (where the market needs to move for you to basically break even)

- 1:1 Profit (which is your 1:1 Risk to Reward ratio.) Generally that is goal of every straddle. to make as much as you risk.

Since my risk is around $60… I would want to see if I could come away with a $60 profit.

Your 1:1 Profit is automatically filled out. (forgive the terrible circle drawings lol) That is the number you would enter in the Take Profit Field.

Some other things to consider… You will only want to take these trades when you are expecting a sizable move in one direction . Mainly news events or other big events.

Generally you would want to take one of the intra-day ones (because the market doesn’t have to move as much for you to make a profit)

1 Like

Okay, thanks Matt. Sorry for the late response.