By Darrell Martin

Manufacturing news for Canada will be released Thursday, June 15, at 8:30 AM ET. Last report, it was up by one percent and this coming release, it is forecast for a nine-tenths percent increase, nearly as much. The Iron Condor strategy, trading Nadex USD/CAD spreads can be a possible ideal setup for the typical market reaction. This is a slight move and then pullback or little to no reaction at all.

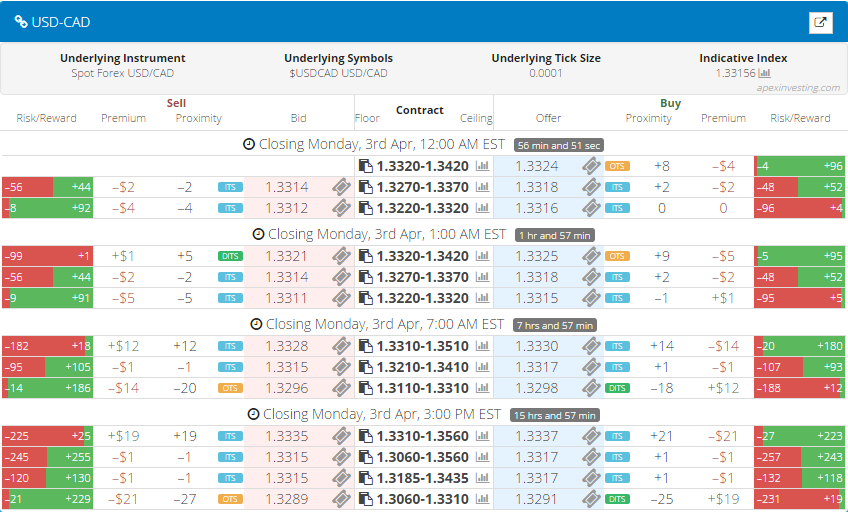

For the setup of this strategy, two spreads are traded. The first Nadex USD/CAD spread is bought around 13 pips or more, under where the market is trading. The second is sold for around 13 pips or more, above where the market is trading. The ceiling of the bought spread should meet the floor of the top spread and be where the market is trading at the time of entry. In this way, each spread should have at least $13 profit potential, for a combined potential of around $26, depending on exact entry.

Buying below market and selling above market will mean profit, if the market moves slightly or if it makes a move and pulls back. The range where the market can settle and have the trade profit of around 50 pips, is basically anywhere between 26 pips up or down from where the market was at entry. This is quite a large range. Entry can be as early as 8:00 AM ET, when the 10:00 AM ET expiring trades become available to trade.

In the event the market takes off and makes a big move, far beyond the 26 pips above and below from where the market was at entry, there should be stops set to exit the trade. The 1:1 risk reward ratio points are found by doubling the potential combined profit for the trade, which at $26 x 2, would be around 50+ pips above and below from where the market was at entry. This would depend on the exact entry points and profit potential.

All of the above can be set up quite quickly and easily, even for beginners, using the spread scanner designed for both beginner traders just learning and strategy savvy advanced traders. All pertinent information on each spread, as well as spreads for multiple markets, can be viewed in one screen. The powerful browser-based platform provides ease of execution and immediate entry. For Iron Condors, the trader merely looks to the obvious green and red risk reward bars to find the ideal spreads. For this trade, that is $13 or more profit potential for selling and buying. See screenshot below.

For free access to the spread scanner and for free day trading education, see www.apexinvesting.com.