By Darrell Martin

Monday morning, August 8, at 8:30 AM ET, will see the first Canadian financial news for the week. Statistics Canada will release Building Permits, the change in total value of new building permits issued. This can create implied volatility in the USD/CAD currency market and can be traded using Nadex spreads having limited defined risk.

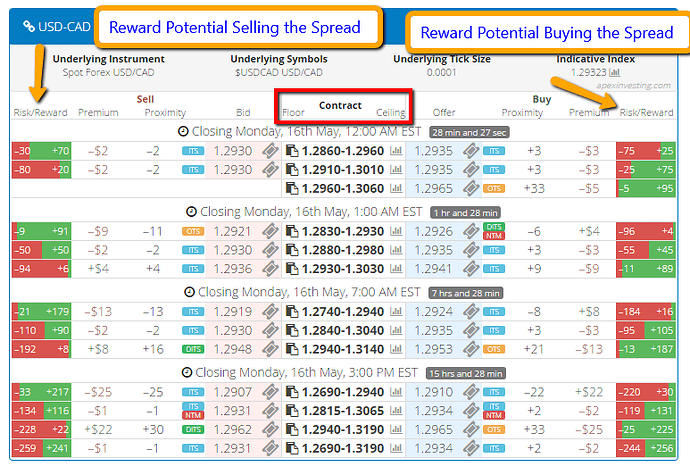

Spreads have a ceiling and floor that denote the price range of the market, which can be traded long or short. Price can move beyond the floor or ceiling without being stopped out. Profit and loss is limited only to the floor and ceiling.

For this trade, an Iron Condor trade strategy works well, buying a spread below the market with the ceiling where the market is trading at the time, and selling a spread above the market with the floor where the market is trading at the time. This strategy is set up to profit at settlement when, after making any moves, the market returns to where it was at entry, between the two spreads.

Each spread should have a profit potential of around $15 or more, based on an average 30-pip move in reaction to this news. The combined profit between the two spreads is $30 or more. Doubling that amount will define the number of pips away where the stops should be placed. Stops for this trade should be placed where the market would hit 60 pips up and 60 pips down. If the market settles anywhere between where it would hit 30 pips up and 30 pips down, it will make some amount of profit. The trade can be entered at 8:00 AM ET for the two-hour 10:00 AM ET expirations.

Trading Iron Condors with spreads can seem complicated. Using the Apex spread scanner makes it easy with its risk/reward columns. Simply look down the reward columns of the 10:00 AM ET USD/CAD spreads for the profit potential amounts. Once narrowed down, verify ceiling and floor parameters, open the ticket, verify max profit amounts and place the trade.

Free day trading education and free access to the Apex spread scanner are available at Apex Investing.