- I watched the video on Iron Condor and instructions say to copy over, but the new spread scanner does not allow copy. How do I copy from the new scanner and what should I copy over? (I use Chrome on Mac)

- What’s the best time to put on IC?

- It seems like Iron Condor is better than Straddle since Straddle’s proximity is much bigger. Correct?

Please advise. Thank you.

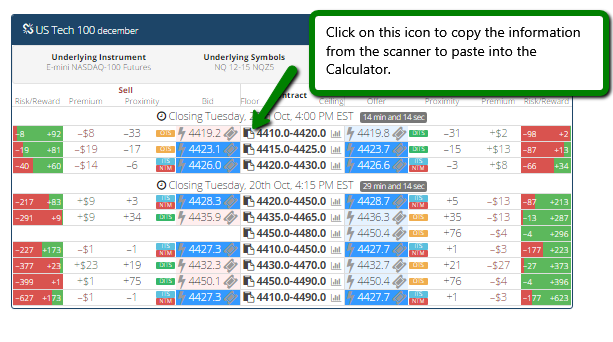

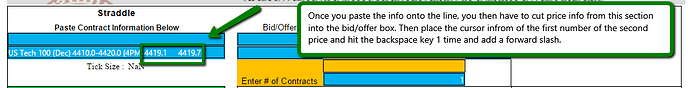

1: The new scanner will allow you to copy the info, use the screen captures below to help you with this.

2: Iron condors are great trades for news events, low volume flat days, etc.

3: IC vs Straddle - For this you definitely want to utilize your expected ranges to determine that answer. For example most news trades call for a IC looking for a certain profit target, but let’s say the profit isn’t there (i.e. IC calls for minimum profit of $35 but both wings only add up to $19) in this case you might look at the straddle and see where your 1:1 profit targets fall with respect to the expected ranges and I would even use the expected time indicator to determine if the target is reachable within the time constraints of the contracts.

If you are unsure how to use the indicators I mentioned above, you can review them in the forum under S6: Study - Apex Indicators.

I hope this helped, but if you have more questions just keep posting.

Peter

1 Like

Thank you, Peter! That’s very helpful. Some more questions:

- When I put “1” in the box “Reward/Risk Ratio”, it’ll give me the spreads that have 1:1, correct?

- How do I get the expected ranges and expetected time indicator?

- I’ve been using Straddle with binary and keep losing. The reason is market did not move enough distance to make profit. Hopefully IC will solve that problem.

- Do you suggest expiry daily for IC or setting stoploss?

You would need a trial or paid memebrship to one of the Apex memberships in order to use the indicators asked about above. You do not always have to use dialy spreads on iron Condors, you may be abel to find smaller timeframe spreads that have good premium in them as well, and can spot those pretty quickly using the spread scanner. I would always suggest using a stop on IC in case the market goes way against you