By Darrell Martin

Each week, Apex Investing Institute posts several upcoming news reports and gives an example of a news trade that would work well for that report. It usually contains what the report is about, what country is releasing it and a little bit about the forecast.

Then Apex Investing Institute gives some guidelines that they hope will help you in your trading. But what if you don’t know an Iron Condor from a Straddle, or the difference between a butterfly and a strangle? Apex Investing Institute can help you learn all about each of these different strategies.

Today, let’s clarify what makes an Iron Condor.

An Iron Condor is a way to collect premium on Nadex Spreads. Because Iron Condor trades can be done day or night, this is a good strategy for news events.

When placing an Iron Condor trade, you want to look at where the market will potentially move and be able to find the proper spread contracts that will help you meet your profit goals. You will need to take into account the expected move, the diagnostic deviation levels and the implied volatility.

When you have determined where you think the expected move will be, you will want to buy a lower spread within the expected move that you believe has enough time to allow the market to move the expected distance.

You will buy a spread at a strike above the market but below the expected move. Then you will want to sell a spread below the market with the same expiration time as the spread you bought and the distance that will give you a risk/reward ratio of 1:1 or better. Make sure that the ceiling of the spread you buy is equal to the floor of the spread you sell.

As an example, let’s suppose that the weekly oil inventory report is coming out and it is suggested that you do an Iron Condor. You are looking far enough ahead that even though you cannot find anything that meets your immediate criteria, you are able to find one for the next day. You can often enter the trade the night before the news event.

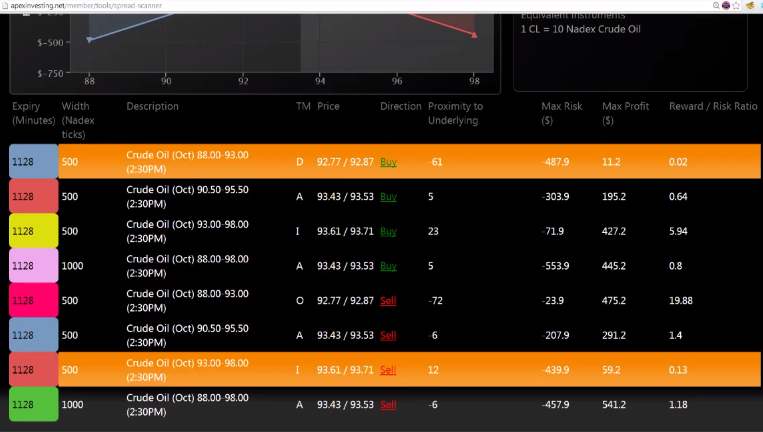

Simply place the trade and go to bed. You don’t have to watch it all night. The following image shows the spread scanner available at Apex Investing Institute that helps you find contracts that will make up your Iron Condor trade.

You will notice that the lower spread, 88.00-93.00, is the one that you bought and has a ceiling of 93.00. The upper spread, 93.00-98.00, is the one that you sold and has a floor of 93.00. The floor and the ceiling are both 93.00 and that number is equal.

When the floor and the ceiling are equal, you will make money if the market goes up; you will make money if the market goes down.

When placing your trade, you may think that you will make max profit, but don’t expect this.

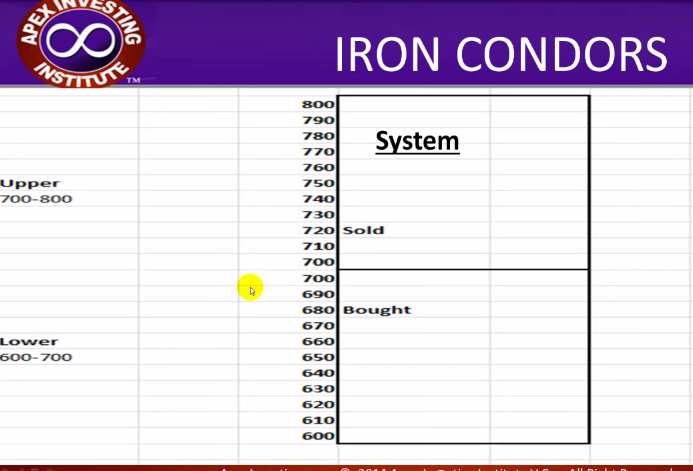

Why? Because the market may move. When you look at the following image, you will see a diagram of how you buy the lower spread and sell the upper spread.

The lower spread was bought at 680 on a 600-700 spread. The upper was sold at 720 on a 700-800 spread. The only way you would make max profit is if the market expired right in the center at 700; then you would make 20 on each side.

You should expect that one leg will lose and one leg will be profitable. The profitable leg needs to make enough to cover the losing leg. For a simple example, if you have risked $10 on each leg, the profitable leg would need to make $30: $10 to cover the losing leg and $20 to make the risk/reward 1:1, which is not including exchange fees.

Keep in mind that trading spreads is different from trading binaries. Binaries are all or nothing. Spreads offer a variable payouts. On all spreads each tick equals $1.

The biggest mistake traders make when placing an Iron Condor trade is doing it in the wrong direction. SELL the upper. BUY the lower. This trade is the opposite of a straddle.

There are a few other helpful hints to remember when using this strategy. Unlike some other strategies, normally this one is held until expiration. Use a 1:1 stop loss and expect the market to pull back most of the time. There is no bid/ask at expiration and do not watch P/L! You’ll scare yourself to death!

Next time you see an article from Apex Investing Institute suggesting you place an Iron Condor for an upcoming news event, you’ll know how! If you would like more information on how to place other trades, use other strategies or systems, go to www.apexinvesting.com. Apex Investing Institute offers free education, and free access to the Nadex Binary and Spread Scanner Analyzers. Member traders are invited to trade in the chat rooms, take advantage of trade signal services, have key indicators and access the Apex Forum. The forum content is updated daily and includes over 9000 members. In a supportive learning community of seasoned as well as up and coming traders, traders of all levels learn how to trade Nadex binaries and spreads in depth, as well as futures, forex, stock and options, and gain an edge for successful trading overall.