By Darrell Martin

Binaries are quick and easy to learn and understand, and they can be fast and fun. Although, to really trade them well – and to make the most possible profit – it can be a challenge. This series explains the ins and outs of binaries.

In this third part of the series, the Bull Credit Binary will be covered (including best market conditions to trade it in and strategies to use).

After each binary in the list is covered, the series will continue with the advantages of trading them in combination.

Bull Debit Binary, aka OTM Buy

Bear Debit Binary, aka OTM Sell

Bull Credit Binary, aka ITM Buy

Bear Credit Binary, aka ITM Sell

Out of the money describes one of three ways to identify the “moneyness” of a binary.

A binary is out of the money if its strike is beyond where the market is trading. Therefore, an OTM Buy binary strike would be above where the underlying market is trading. An OTM Sell binary strike, on the other hand, would be below where the market is trading.

These binaries are OTM, have no intrinsic value, and have an expectation of no value at expiration, making their price very low with low risk.

In contrast, the Bull Credit Binary, aka ITM Buy, is in the money. When a binary is in the money, the underlying market is past the strike of the binary. It has intrinsic value, and it is anticipated that it will have value at expiration. Because of those things, its price is much higher than an OTM binary and therefore comes with higher risk.

The other “moneyness” definition is at the money, meaning the strike price is at the same price the underlying market is trading.

You will know if a binary is ITM by its price. Nadex binaries are worth $100.

An OTM is the least expensive binary; its cost and risk will be somewhere below $35. The ITM binary is the most expensive of the three; its cost and risk will be somewhere around $65 and up.

ATM is priced in between the two: $35 - $65. If price is in the middle, you can consider the binary to be ATM – the underlying market is right around the strike of the binary.

Logically thinking, if the price is over $50, the market is higher than the strike and if it is under $50, the market is below the strike.

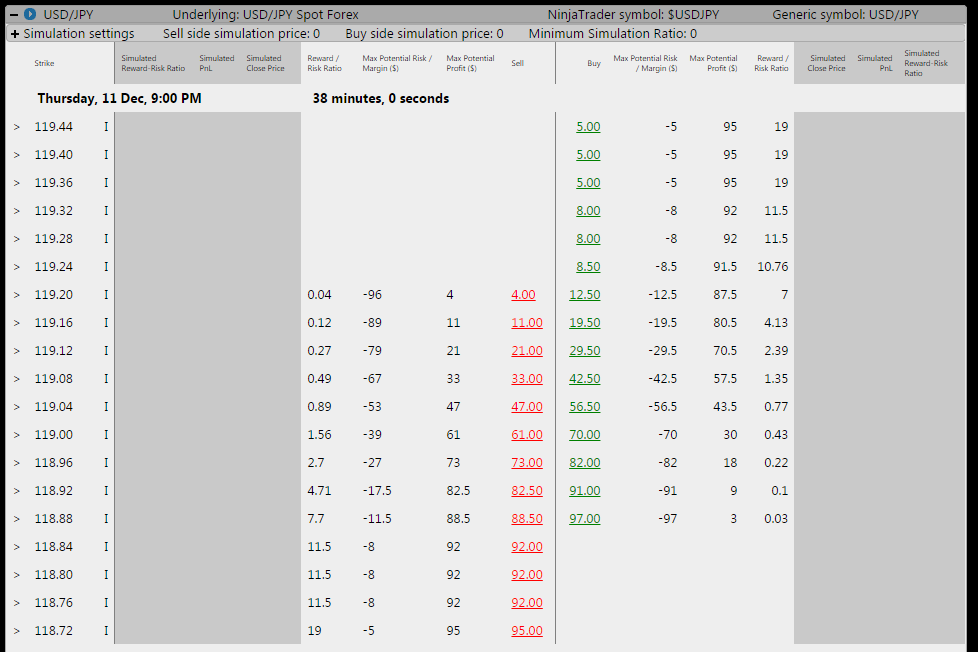

Using the USD/JPY again as an example, you see from the chart below it is trading at 119.06. Now looking at the APEX Nadex Binary Scanner price ladder, you can see the different prices if you were to buy a binary.

Notice the binaries with the strikes of 118.96 and 119.00.

The market is already above those strikes, making the prices of those binaries both above $50. The market is further above 118.96 than 119.00, so that strike has more intrinsic value. There is a higher expectation that the binary with the 118.96 strike will expire profitable – therefore it costs more at $82.00.

Since the binary with the 119.00 strike is closer to where the market is, it is not as far in the money as 118.96. This means the intrinsic value is a bit less and the expectation it will expire profitable is a tad less, so it costs less with less risk at $70.00.

ITM Buy binaries are great choices if you think the market will remain where it is, i.e., above your strike. Therefore, its important to consider the amount of time until expiration.

For example, if you plan on premium collecting, i.e. letting time expire while your binary remains in the money, price will change slowly until very close to expiration. Toward the middle and closer to expiration tends to be better for premium collecting when trading ITM binaries.

Since there is more risk, however, stops are necessary. Understanding how much a binary costs when the market is at its strike can help you manage your risk. Knowing a binary is worth around $50 when the market is at its strike, you can control your risk by exiting at that point.

If you chose the ITM Buy strike 118.96 for $82.00 and the market turned against you, yet you had your stop to exit once the market reached just above the strike price, then you’ve reduced risk from $82 total, to approximately $25 ($82 - $57 = $25).

The advantage to the Bull Credit Binary, aka ITM Buy, is that the market doesn’t have to move for you to make a profit; time only needs to expire while the market stays where it is.

If the market does go up, you can exit with profit that much sooner.

If you would like to learn more about Nadex binaries, go to www.apexinvesting.com, a service provided by Darrell Martin. Apex Investing Institute offers free education, and free access to the Nadex Binary and Spread Scanner Analyzers. Member traders are invited to trade in the chat rooms, take advantage of trade signal services, have key indicators and access the Apex Forum. The forum content is updated daily and includes over 9000 members. In a supportive learning community of seasoned as well as up and coming traders, traders of all levels learn how to trade Nadex binaries and spreads in depth, as well as futures, forex, stock and options, and gain an edge for successful trading overall.