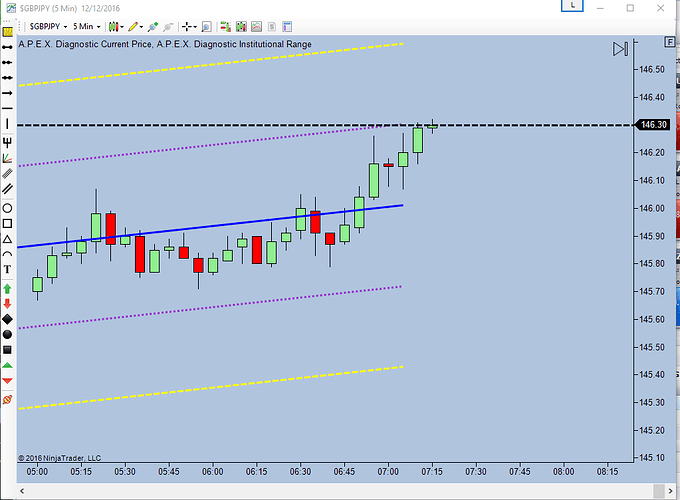

Couple trades with assists from VAD and the Institutional Range Indicator

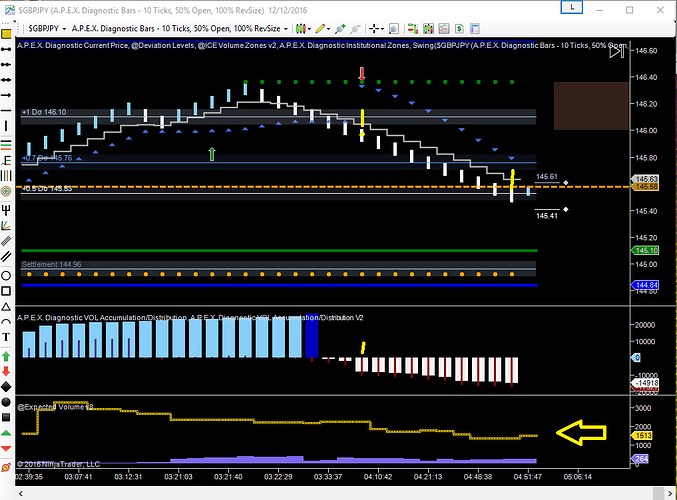

Entered at the yellow lines. ( I should probably take a course in how to mark up charts ![]() )

)

Followed it down until the +.5 Deviation, where I had a tight stop to protect profits

![]()

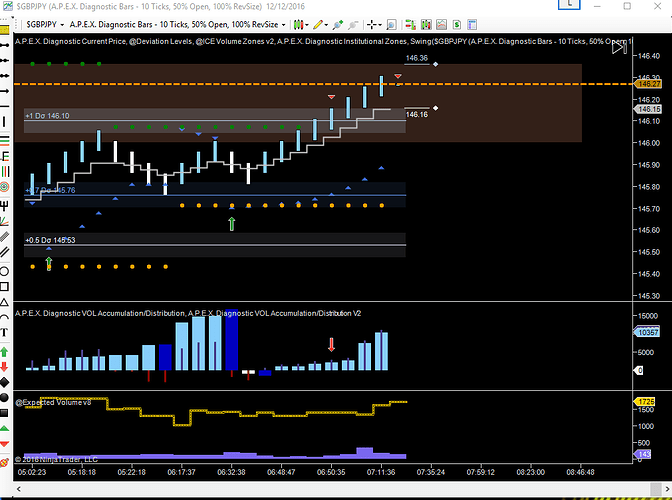

Waited for it to break the +1 Deviation and then entered on the rebound.

Using the Institutional Range Indicator (IR) saw that it was most likely going to enter a tight chop area (add in the fact that it was already passed the +1 Deviation) was probably a good idea to get out. Plus i was having issues with the Expected Volume.

![]()

But 15 pips is 15 pips. (And a large pizza) ![]()