By Darrell Martin

The Office for National Statistics in the United Kingdom will release several news reports on Wednesday, February 21, at 4:30 AM EST. These reports include:

-

Average Earnings Index including Bonuses

-

Claimant Count Change

-

Public Sector Net Borrowing

-

Unemployment Rate

-

Average Earnings Excluding Bonuses

-

Public Sector Net Cash Requirement

Most traders in the United States would rather sleep at this time of day, but knowing these UK news releases can cause volatility in the market, they may want to take advantage of a trading opportunity.

A Straddle strategy is low risk and ready for the market to move in either direction. It can be put on the night before, entering as early as 11:00 PM EST using the 7:00 AM EST expiration contracts.

Utilizing two Nadex GBP/USD spreads to comprise the Straddle strategy, one is sold with the ceiling being where the market is trading at the time, while the other is bought with the floor being where the market is trading at the time. This strategy is opposite of an Iron Condor. As an example of the limited low risk, the max risk should be $20 for each spread for a combined total risk of $40 for the trade.

A spread has a floor and a ceiling, which identifies the range of an underlying market to be traded. There is no profit or loss past the floor and ceiling, which provides defined capped risk. Since this trade has such low risk, there is no need to set stops.

Once the trade has been entered, place your limit take profit orders. Based on previous market reaction to the release of 12-24 past months of these reports, it was found that a Straddle strategy with a max risk of $40 is high probability for a profitable trade. For a 1:1 max risk/reward ratio, set your limit take profit orders where the market would move 80 pips up or 80 pips down. The breakeven points would be where the market hits 40 pips up or down. These reports tend to move the market, and if one side profits, leave the other side on should the market pull back, the other side may profit as well.

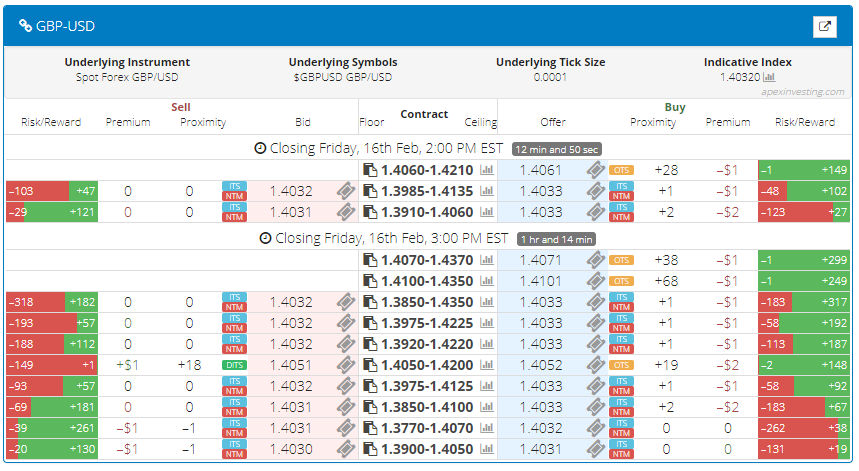

Be sure to use the spread scanner available at www.apexinvesting.com. The image below is an example of the GBP/USD spread scanner.

This easily helps you find just the right spreads at a glance to meet the parameters of your trade. Remember, if all stipulations of the trade cannot be met, there is no trade. Never force it.