By Darrell Martin

When you are starting out as a new trader, or even if you have been trading for a while, you may not understand how to know how much you are risking on each trade you enter whether it be in futures or Forex.

The simple answer is that the risk is based on the entry to the stop price difference. That may be the simple answer, but you may still be shaking your head and asking, “What?”

In order to clarify, it may seem that the answer must first be made more confusing, but just hang on and try to wrap your head around all of this. If you do, you will have the clarity and understanding you desire.

You will probably be able to answer this question for someone else when they look at you with that puzzled expression and say, “But I just don’t understand how to know how much I’m risking per trade on futures and Forex!”

It’s important to be able to answer two vital questions:

What is the tick size? (Pip size on Forex.) What is the tick value? (Pip value on Forex.)

For example:

ES (E-mini S&P 500) ticks in .25 at a value of $12.50 per tick

TF (E-mini Russell 2000) ticks in .10 at a value of $10.00 per tick

CL (Crude Oil) ticks in .01 at a value of $10 per tick

GC (Gold) tick in .10 at a value of $10 per tick

EU (EUR/USD) pips in .0001 at a value of $1.00 per pip

GU (GBP/USD) pips in .0001 at a value of $1.00 per pip

AU (AUS/USD) pips in .0001 at a value of $1.00 per pip

UJ (USD/JPY) pips in .01 at a value of about .87 per pip (on current USD to JPY conversion)

Without this essential information, you won’t be able to determine your risk per trade as you will see the following formula:

Entry Price minus Stop Price divided by Tick Size multiplied by Tick Value equals The Worst Case Loss you are setting and you do desire to move that stop up sooner rather than later. It is suggested that the stop be moved to approximately 50% of the entry price to the target price.

So, let’s plug in some numbers to make sense of this formula. For this example, lets say you were able to enter an ES contract for 1186. We set our stop loss at 1182. You now have 1186-1182/.25*12.5=200. 200 is the amount you are risking per trade. Of course, there is still slippage and fees that would apply to and add to this number and you can’t forget about margin.

Margins will vary depending on the broker. The broker’s site will list the margins for each contract. Margin is not the same as risk on futures/Forex. Margin is the amount that your broker sets aside in the event you lose everything. When this happens, your trades can be closed without you owing them money and them owing the exchange money. However, this is not an insurance policy that protects you from losing everything. Things can happen quickly especially during news and gaps between open, close and at other times. Forex in the US is at 50:1 leverage on margin.

The next question you need to ask yourself is: What live account size are you anticipating trading with? If you are a trader with a limited account size, you may want to consider trading using Nadex spreads. Although they are a little more complex to understand at first, they offer a much lower risk of $1.00 per tick/pip. Everything on Nadex ticks or pips in increments of 1 (i.e. 1, .1, .01, .001, .0001.) For a more detailed explanation of how Nadex ticks and pips work, click HERE for an article titled “Ticks and Pips and Cents, Oh My! Nadex Makes It Easy to Trade Forex and Futures.”

The exciting thing about trading with Nadex is that it is all capped risk. To understand what that means, you need a basic understanding of leverage.

Leverage is what increases your ability to make or lose money. Buying something with no leverage is like going to the store and paying $100 for something that costs $100. If that item goes up in value to $150, you have made $50 on your $100 investment, or 50%. If you buy something with leverage, you put up $50 to buy something that costs $100 and then it goes up in value to $150. You still only make $50, but you only used $50, so you make 100% on that investment.

Leverage allows you to use less money to place a trade which potentially increases the risk or the return on your investment (ROI) per dollar invested, so you can do more with less. When you trade with Nadex which has capped risk, you know your risk when you enter the trade and it does not change. If you trade with an uncapped risk, you can easily lose more than you have invested in the trade as well as even more than you have in your account. If the market moves against you and you are in a trade with uncapped risk, you may receive a margin call. This would require you to immediately put more money into your account. To view a short video about undefined and defined risk, click HERE.

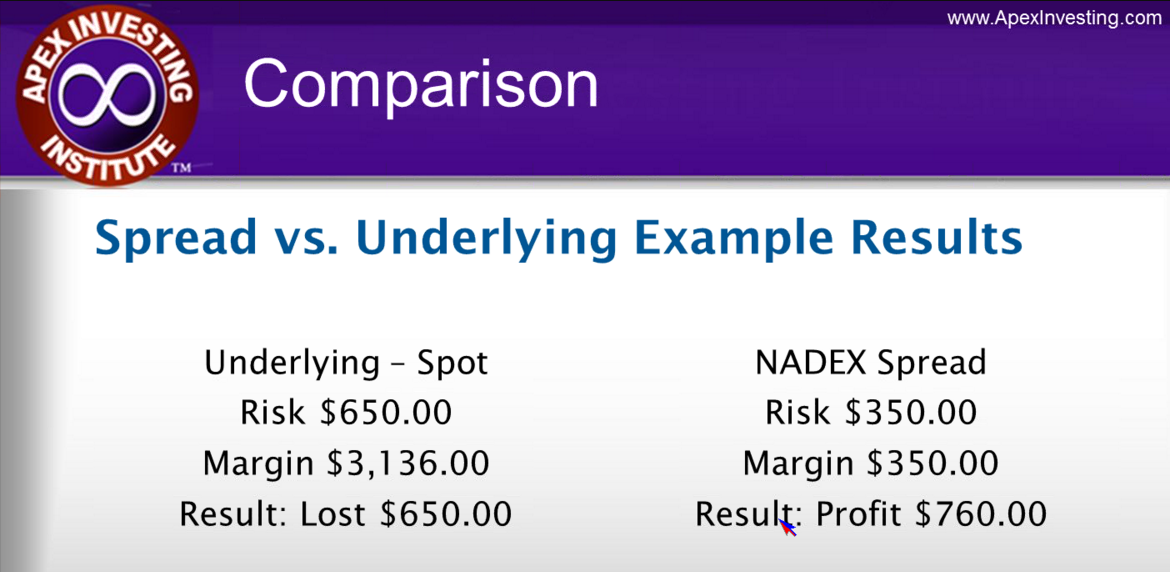

By looking at this image, you can see that with Nadex, your risk is your margin. When you trade the underlying, you are required to risk more and have a huge, in comparison, margin. The way this particular trade turned out, the spread was profitable, whereas the spot lost. As was stated before, it may take a little bit of time to understand how Nadex spreads work, but it is definitely worth the investment!

Each Brokerage has their own charts for margin requirements, if you should choose to trade with undefined or uncapped risk. Visit their respective sites for this information. Of course, the Profit and Loss (P/L) will fluctuate in addition to this. The bottom line in calculating how much you’re risking per trade should you enter and exit at the worst stop price, use the formula provided above.

If you would like more education to help you in your trading, go to www.apexinvesting.com. Apex Investing Institute offers free education, and free access to the Nadex Binary and Spread Scanner Analyzers. Member traders are invited to trade in the chat rooms, take advantage of trade signal services, have key indicators and access the Apex Forum. The forum content is updated daily and includes over 9000 members. In a supportive learning community of seasoned as well as up and coming traders, traders of all levels learn how to trade Nadex binaries and spreads in depth, as well as futures, forex, stock and options, and gain an edge for successful trading overall.