By Darrell Martin

Wholesale Sales for Canada rose higher than expected with the last release on August 22, 2016, due to motor vehicles and parts. The forecast for Wednesday, September 21, is an increase of 0.3%. The numbers come out at 8:30 AM ET, and can be traded with the right strategy.

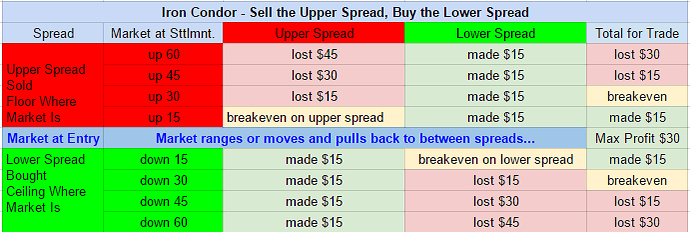

This is a scheduled news event released monthly. Based on previous month’s market reaction to the release, profit potential should be around $30 or more using an Iron Condor strategy. This strategy is neutral, meaning the market can go up or down and there is still opportunity to profit. Since the direction a market moves in response to news is never known, using a strategy prepared for movement in either direction is prudent.

This Iron Condor strategy uses Nadex USD/CAD spreads entering at 8:00 AM ET for 10:00 AM ET expirations. Two spreads are traded. One range spread is bought below where the market is trading and the other range spread is sold above where the market is trading. The ceiling of the bought range spread should meet the floor of the sold range spread, and be where the market is trading at the time. In this way, the sold spread will be directly on top of the bought spread, if they were drawn on a chart.

The profit potential should be $15 or more each spread. The market can move up to 30 pips in either direction. If the market is past those points at settlement, there will be some loss. However, if it settles anywhere between those two points, the trade makes profit. After this kind of a scheduled news event, the market will oftentimes pullback after its move. That is when the Iron Condor is poised to profit. The maximum profit is made when the market pulls back to center between the spreads and is there at settlement.

If the market takes off and goes beyond the breakeven points of 30 pips up or down, then stops should be placed ready to exit the trade. To keep the risk of this trade to a 1:1 ratio, stops should be placed 60 pips above and below from where the market was at entry. The chart below shows what the profit or loss would be at settlement, based on various possibilities of different 15 pip moves.

For free day trading education and access to the spread scanner, go to Apex Investing.