John: For the ITM Strategy towards the end that incorporates the only the Trend Flip and Expected Range, what are the chart settings you suggest with regard to types of bars (Diagnostic, Shadow, Continuum, etc.), as well as OHLC/Candle and any other specific settings with regard to Expected Range…thanks…

Drew each instrument moves a little differently and has some effects of seasonality. The best thing to do is to select the instruments you want to trade and do some backtesting to see what bar size best fits the move of the markets. What bar size actually gives you a good amount of entries, but not too many that flip back and forth on you int hose last 15 mins. personally i would use diagnostic bars and not time based bars

OK, new question regarding this particular EPC strategy: does the Trend Flip Indicator actually HAVE TO literally FLIP in order for a trade signal to occur before the end of the hour/20 min, etc.?? For example, if a green “stair step” line is moving along that way all throughout, can a trade be placed to go LONG as long as the binary price fits the ITM metric ($75 to $80 cost), OR is there no trade to be placed UNLESS with enough time left in the trading window, that green line FLIPS to red/pink and that FLIP would result in a signal to sell an ITM binary with the same $75 to $80 risk??

I’ve been demo trading this today and doing pretty well, but with the market in NQ and TF being fairly flat, there just aren’t any actual FLIPS in the Trend Flip, so I have just been buying/selling based on the existing status of the Trend Flip line.

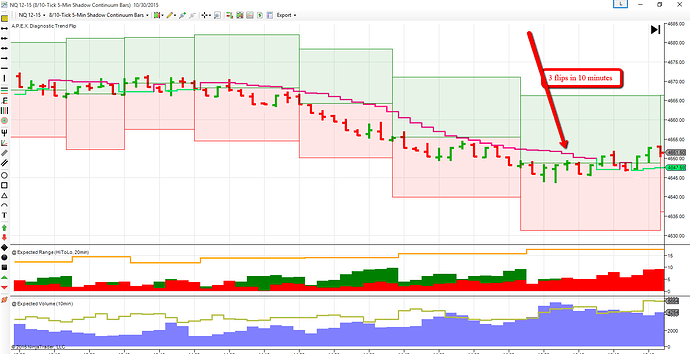

And, take a look at the most current 20 min Expected Range in this chart:

That’s 3 flips in the last 10 minutes or so…is it all just too flat to trade for Premium Collection???

Feel free to test whatever rules you would like to use this is simply an example.

The trade happens in the last 15 minutes before expiration. You can trade just when it flips or you can trade in the direction for the trend flip if it is already flipped. Be ready to exit if the flip goes the other direction AND hits your strike (this keeps you out of whipsaws). Continuations allow you to trade in flat and really good trending markets without many pull backs. Just don’t try to prove it right hoping it will come back risk is to high not to exit if strike is hit.