By Darrell Martin

For evening traders, the Federal Statistical Office of Switzerland is releasing the Producer Price Index (PPI), in the middle of the night US Eastern time, making for a trade opportunity entering the evening before. The PPI, released monthly, is scheduled for Thursday, January 19 at 3:15 AM ET. The event tends to motivate the market to react with a move and then pull back. Setting up an Iron Condor trading Nadex spreads can make for a high probability trade.

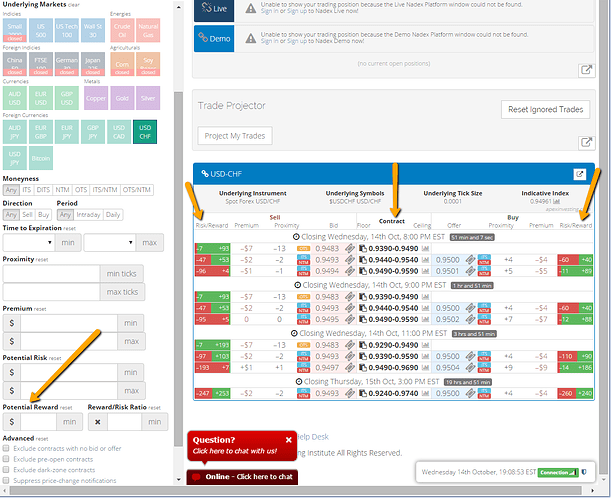

Entering at 11:00 PM ET Wednesday evening, one spread is bought with the ceiling where the market is trading at the time and one spread is sold with the floor where the market is trading at the time. Each spread should have a profit potential of around $17 for a combined profit potential of $35 or more. When minimum profit potentials for this trade are met, then the long spread is bought below the market and the short spread is sold above the market.

With this setup, the Iron Condor is positioned to profit on the pull back. The market settling anywhere in between the breakeven points, of 35 pips above and below from where it was at entry, will bring a profit. If the market moves beyond 35 pips up or down, there is a potential of some loss if the market remains there until settlement. Stops can be placed where the market would hit 1:1 risk reward ratio points being at 70 pips above and below from where the market was at entry.

Even for beginners, placing this news trade is simple using the spread scanner. Just starting out, trades should always be done in demo. The spread scanner has filters to narrow down the spread selection to the desired market and expiration times. In this case, the Nadex USD/CHF, entering at 11:00 PM ET for 7:00 AM ET is ideal for this trade. Once filtered, simply look at the visual green and red bars with corresponding numbers showing the potential risk reward. As mentioned, spreads both short and long, with a $17 reward potential or more on each spread, is what is needed for the trade.

The market can stay, move slightly or even move significantly and pull back and the trade will profit.

Free access to the spread scanner, along with free day trading education is available at www.apexinvesting.com.