By Darrell Martin

Monthly US Existing Home Sales are reported, measuring the number of residential buildings that were sold during the previous month, but is issued in an annualized format. These sales exclude new construction. Housing sales is a leading indicator for economic health and can be a trade opportunity. This month the report is released Thursday, October 20, at 10:00 AM ET.

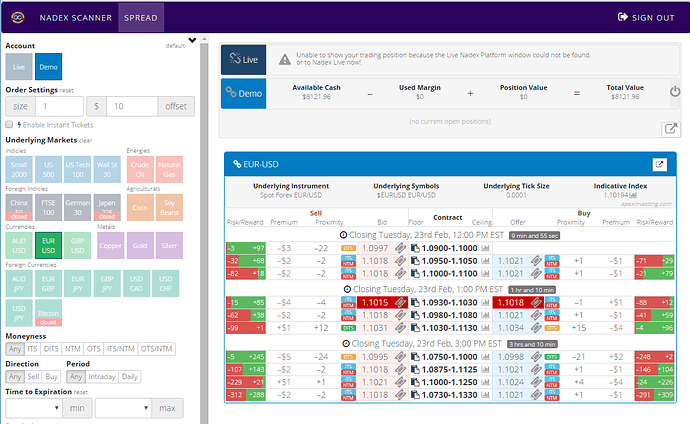

The market to trade is EUR/USD using Nadex spreads. The strategy is a neutral one not caring which direction the market will go. Neutral is ideal for scheduled news events, as it is never known which direction the market is going to go. The Iron Condor includes two spreads: one bought and one sold.

Based on previous market moves and then pullbacks after this event, the bought spread is bought below the market and the sold spread is sold above the market. The ceiling of the bought spread should meet the floor of the sold spread and be where the market is trading at the time. It is set up to make profit when the market pulls back. The trade can be entered as early as 9:00 AM ET for 11:00 AM ET expiration.

Profit potential should be $30 or more combined between the two spreads. Stops should be placed at the 1:1 risk/reward ratio points of 60 pips above and below. If the market settles anywhere between the two breakeven points at expiration, between 25 pips above and 25 pips below, then the trade makes some profit. Max profit is achieved when the market pulls back to center between the two spreads. More spreads can be traded as long as the trade stays balanced with the same number bought as sold. For a visual to see how each spread in the Iron Condor trade profits or loses based on the moves of the market, see below image.

For free access to the spread scanner, visit Apex Investing.