By Darrell Martin

Every month, around 40 days after the month ends, Australia releases the change in the number of new loans approved for purchasing houses. The Australian Bureau of Statistics will release the percentage number at 7:30 PM ET, Thursday, February 11, 2016 and you can enter your trade as early as 7:00 PM ET for 9:00 PM ET expirations. This is news important to traders looking for signs of strength or weakness in the housing market, which can affect the economy overall. When traders clue into news, then that usually means there can be implied volatility in the market and a good time for a trade using a neutral strategy.

A neutral strategy is essential when it’s unknown which direction the market will go. Unless you know ahead of time the outcome of the news and how the markets will react, neutral strategies are best for trading the news. After 12 - 24 months reports and analysis of market reaction, it was found that an Iron Condor with a $30 profit potential or more, is a high probability trade strategy for this event. It was found that the AUD/USD market tends to react after the news, but then pulls back and settles.

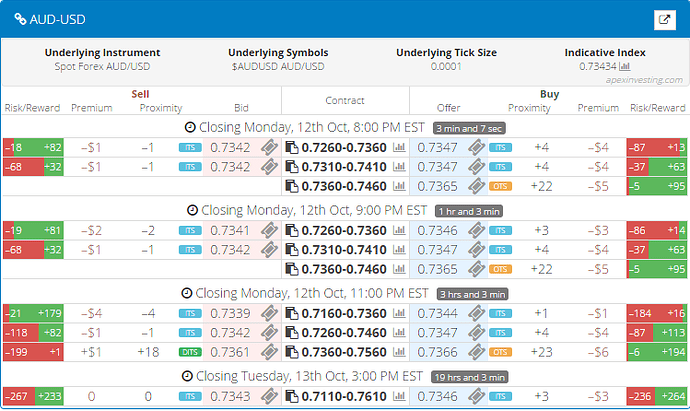

An Iron Condor strategy takes advantage of this kind of movement by buying a lower spread below where the market is trading, and selling an upper spread above where the market is trading. When you buy the lower Nadex AUD/USD spread below the market, the ceiling of the spread should be where the market is trading at the time and should meet the floor of the Nadex AUD/USD spread you sold above the market. Each spread should have a profit or reward potential of around $15 or more.

With this setup, the market can move up 30 pips and you would profit on your bought spread and lose on your sold spread. At that point, you would be breakeven. The same thing happens if the market moved down 30 pips. You would profit on your sold spread but lose on your bought spread and again be at breakeven. However, for every pip closer the market is to the middle between your two spreads, you make $1 profit. The market has a 60-pip range to make profit within, 30 pips up or 30 pips down, from the center between your spreads, and a max profit depending on your exact entries of $30.

If for some reason the market should take off and really move, going past the breakeven points then your place of exit is at the 1:1 max risk/reward ratio points. The market would have to move up 60 pips or down 60 pips for that to occur. Once you have your trade on, you can set your take profit orders and stop loss orders.

To find all the spreads of your choice at a glance, just visit www.apexinvesting.com for a free login to the spread scanner. There, in the scanner, you can see all the spreads listed in the center showing their floor and ceiling for a desired market. The reward potential is listed in the left outside column for selling a spread and the right outside column for buying a spread.

You also need a demo or live account with Nadex, which takes just moments to open. Nadex is a CFTC US based exchange and can be traded from 48 different countries.

At www.apexinvesting.com you will find free education on how to trade Nadex binaries and spreads as well as how to trade futures, forex and CFDs. Visit the Apex Forum with over 17,000 members in a supportive traders helping traders culture.