By Darrell Martin After a long day at work, have you ever been anxious to trade the markets only to find very little movement? You look at the chart and see that it is flat. You might think that you cannot use your favorite strategy on a flat market and you may be right.

There is not a single strategy or system that works 100% of the time in ALL market conditions. It is important to have many different strategies and systems in order to adapt to varying market conditions. They can be referred to as multiple plays in your book.

Nighttime trading brings its own peculiarities. What markets can be traded at night? Not all of the markets are open at night and those that are do not have a lot of movement or offer as many trades as other markets. Because of the time difference, the Japanese and Australian markets are open and offer quite a lot of movement. The markets with the most movement are the forex pairs.

Be aware that there are fewer expiration times during nighttime trading than during the day. There are five forex pairs with hourly expiration times and the fastest moving nighttime trades: AUD/USD, EUR/JPY, EUR/USD, GBP/USD and USD/JPY. The other forex pairs (USD/CAD, GBP/JPY, USD/CHF, EUR/GBP and AUD/JPY) have daily expiration times of 3 AM, 7 AM, 11 AM, 3 PM, 4PM, 7PM and 11 PM. Five- and twenty-minute binary options are only offered during daytime trading hours.

Sometimes the market does not trend, but that does not mean that you cannot trade. You can trade in flat markets. When the market is not going crazy, when it’s not going straight up or down and it seems to be staying flat or in a channel, it is known as range-bound.

To build up the number of plays in your trading playbook, start with one strategy. Perfect it in demo and then move it into live. If the first play was a trending strategy, add on a range-bound or choppy market strategy. If you do this, you can take advantage of the different market conditions each day.

What is needed for a range bound strategy? In the two trades that follow, you can see this trader made sure these nighttime trades were performed in non-trending, flat markets. She used a strategy that didn’t require movement to remain profitable and she chose ITM (in the money) not ATM (at the money) or OTM (out of the money) strikes. Because an ITM strike trade is already profitable when it is initiated, there are three ways it can remain profitable:

The market can continue moving in the same direction as the trade It can stay right where it is It can move slightly without reaching the strike price before expiration

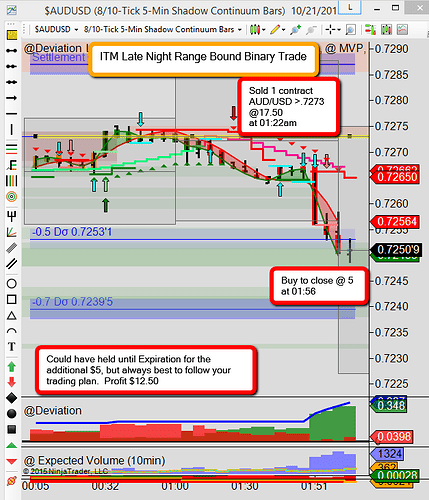

This range-bound trade took a little longer, oscillating slightly before breaking through the range and hitting the trader’s take profit.

Identifying the trading range and using ITM binary options is another alternative to trade flat markets. The next time you look at a chart, thinking there is not a trade to be found, perhaps looking a little closer and add this strategy in your playbook could possibly help you bring in some nighttime profits.

Remember trading involves risk. When initiating ITM binary trades where you have an immediate advantage, you have more dollars at risk. Initially you have to pay for the trade advantage which is a higher portion cost out of the $100 settlement payout at expiration.

In this example, selling the AUS/USD > .7273 @ 17.50 results in a higher proportional cost which is $82.50 per contract (100 – 17.50) because the AUS/USD is already below the strike level. At expiration if the binary trade works, your profit is $17.50 but if the AUS/USD rallies and finishes above the strike, your loss is $82.50. (Note: Exchange fees not included in calculations)