by Darrell Martin

For nighttime traders, this week Australia will be releasing the Trade Balance, the difference in value between imported and exported goods and services. The report is released monthly and can make for a high probability trade with the right strategy. The news is scheduled for release on Thursday, January 5, at 7:30 PM ET.

Trading Nadex spreads with capped risk one can enter as early as 6:00 PM ET for 11:00 PM ET expiration. In reaction to the news, it is impossible to know exactly which direction the market will go. Tracking consistency in the kind and distance of the movements can help to choose the right strategy. Looking at past reports over 12 - 24 months, the market typically reacts and then pulls back; making an Iron Condor strategy used for ranging markets the ideal strategy.

To set this trade up, one Nadex AUD/USD spread is bought below the market and one spread is sold above the market. The ceiling of the bought spread should meet the floor of the sold spread and be where the market is at entry. For this trade based on previous market movement, a combined profit potential of $30 minimum is recommended.

The market can react a number of ways and the trade can profit. It can stay where it is, it can range, or it can make a move and pull back. The only move that is undesirable in this case is a strong trend that does not pull back. In that case, stops should be placed 60 pips above and below from where the market was at entry, the 1:1 risk reward ratio points.

Max profit is when the market pulls back to center between the spreads and is there at settlement. Profit is made when the market settles anywhere in between the breakeven points of 30 pips above and below from where the market was at entry.

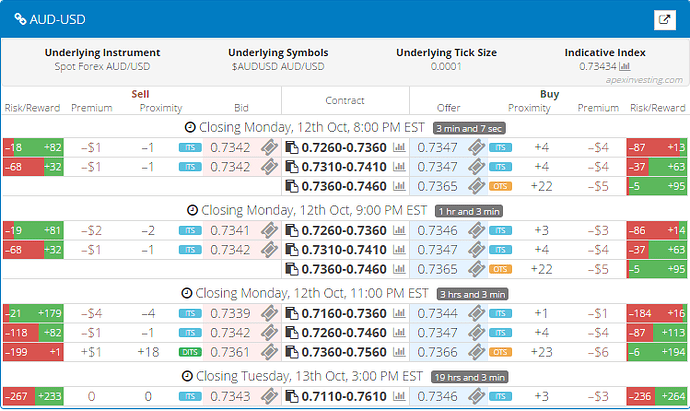

The spread scanner is the ultimate tool for quickly learning how to trade spreads as well as promptly identifying and entering into the right spreads for the trade. See below for an image of the spread scanner.

Free access to day trading education and the spread scanner is available at www.apexinvesting.com.