By Darrell Martin

Included in the first article in this series was the definition of Out of The Money or OTM. The first article also included some tips to help you when trading OTM binary options. (See OTM Binary Options: Introduction And Tips) This article will explain a strategy to use when trading OTM binaries.

A strangle is a strategy opposite of a butterfly. When you place a binary butterfly trade, you buy a lower strike and sell an upper strike. With the strangle strategy, you have to think oppositely of what you have probably heard most of your life. For this strategy, you will buy high and sell low. Buy an upper OTM strike and sell a lower OTM strike. Strangles are good for volatile markets when movement is expected, but direction is unknown. You are expecting one side to lose. Determine your risk and then make up for the amount lost on one side.

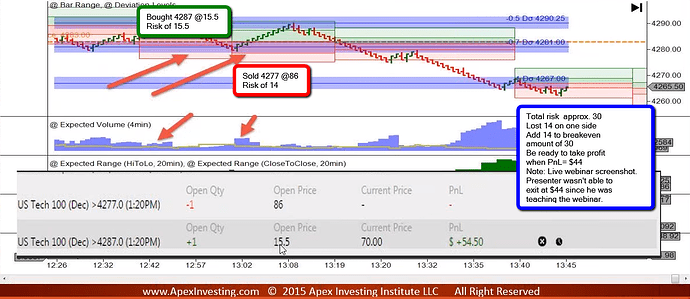

The image below shows a 20-minute binary strangle done on the US Tech 100. The 4277.0 strike was sold at 86 with a risk of 14. The 4287.0 strike was bought at 15.5 with a risk of 15.50. Combined risk is rounded to 30.

As you can see, the sold side lost. Because you want to recover the amount lost, you add that to the amount of the risk, which is also equal to what you need to break even. Since $30 was risked, and $14 was lost on one side, you can prepare to take profit when your P/L shows you are up $44. If you look closely at this chart, you can see that both sides would have lost if held until expiration because it expired at about 4280, right in the middle of the two strike prices.

Do not get greedy and do not hold until expiration. There will be times when you will look back and see that you could have made more money, but take your profits and run. Know ahead of time where you plan to get out and stick to your plan.