By Darrell Martin

One of the best things about trading Binary Options is knowing your risk before you ever hit the button to enter the trade. Whether you are trading contracts with longer or shorter time frames, you will always know how much you stand to lose or gain in each trade. Once you have mastered this basic concept and have some experience in how to place a trade, you should be ready to try some more advanced strategies.

The following is slightly advanced, but not too difficult. As with any new strategy, be sure to try it out in demo for a while until you understand how it works and to make sure it works for you.

Strangle Strategy

This is the strangle strategy. It is a simple strategy, but it must have volume exceeding expectations when you enter the trade. If you attempt this trade in a flat market, your account can just get hammered!

The Set Up

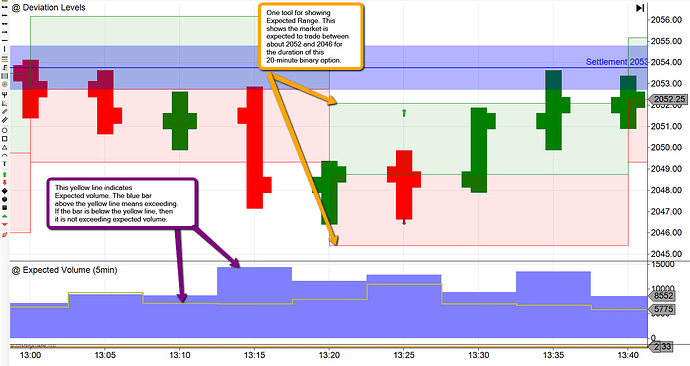

First, check the volatility or volume of the instrument you want to trade. If it is exceeding expected volatility, by exceeding volume, you will next want to have some indication of what the range should be while you are in this trade. After checking those two things, you have the necessary information to look for the binary options that will set up your trade. For this example, let’s say that we saw that volatility on ES had exceeded its expectation, by seeing that volume had exceeded expectations, so you then checked the range for this trade and found that it should trade between 2046 and 2052. This trade is formed by buying the upper strike and selling the lower strike with a combined risk of around $30.

Example

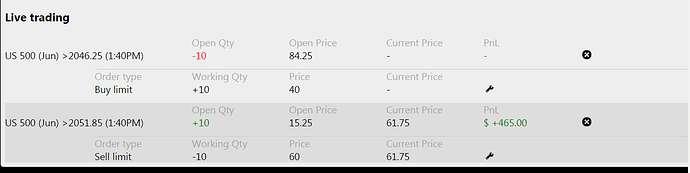

Looking at the list of available strikes for 20-minute binary options, you were able to buy the 2051.85 strike at 15.25. You were able to sell the 2046.25 strike at 84.25. Remember, the cost on the sell side is the difference between the price you sold at and $100. In this example, $100 - $84.25 = $15.75. Let’s say you purchased 10 contracts on each side: bought 10 anticipating the market was going to go up and sold 10 anticipating the market was going to go down. Keeping the math simple, you could basically say that you bought one for 15 and sold one for 15, which gives you the $30 combined risk, but then times that by 10 for each side, so $150 per side.

Covering Your Loss

For the strangle strategy, you expect one side to lose, so you have to figure that loss into your potential profits which helps you choose a take profit point. It was already figured that you have risked approximately $30 on this trade. You need to make $30 to cover that initial $30 risk. Each side has approximately $15 risk, so in order to cover whichever side loses, you need to add the $15 to your potential profit: 15 + 30 = 45. Set your take profit goal at $45 by the end of the 20 minutes. This means you would buy back around 40 on the sell side and sell back around 60 on the buy side. The total gives you a 1:1 risk/reward.

Oscillation

After you entered the trade, the market dropped and you were profitable on the sell side. You could have closed out the trade when it was up $200, but the other side would have lost $150 so you would only be up $50. There is oscillation in the market. It could go up and down, making money on both sides.

Take Profit

Right after you place your trade, you set your take profit. On this trade, it did not take the market long for it to hit your take profit goal.

The image above shows that the trade was closed out when PnL (Profit and Loss) hit $465.00 on the buy side. The sell side had lost $150, but you would still net somewhere over $300 in less than 20 minutes.

Simple Trade

The Strangle Strategy is a simple trade to place. Look for about a $30 risk, but don’t be too picky about it being exactly $30. Make $45 profit on either side so that it covers the loss on the opposite side. Make sure that volume is exceeding expectations and you know what the expected range is so that you are not just randomly buying strikes. Again, be sure to try it out in Demo before you risk real money. Get the concept down.

To learn other trading strategies, visit www.apexinvesting.com, a service of Darrell Martin.

You can watch the video clip of Darrell Martin explaining this trade in its entirety.

Duration: 12 minutes