By Darrell Martin

With the lack of high volatility in the markets lately, one might be looking for any possible trade to be found. Sometimes various news releases will generate trades. Entering an overnight news trade may seem risky, but if all parameters are met, the trade can be placed and the trader can rest easy.

Early Friday morning at 3:15 AM ET, the Federal Statistical Office in Switzerland will release the Producer Price Index (PPI) reports for both Month over Month and Year over Year.

A leading indicator of consumer price inflation, the PPI measures the average changes in the price of goods sold by manufacturers. If there is a rise in PPI, it usually leads to a rise in Consumer Price Index (CPI), which in turn can cause interest rates and currency to rise. If this happens during a recession, because the producers are unable to pass along the rising costs of materials to the consumer, profitability is lowered, the recession is deepened and eventually, there is a fall in the local currency.

Year over year (YoY) and month over month (MoM) are methods of evaluating results when compared to the same time period of a comparable time period, whether yearly or monthly.

Both reports are forecast to remain at their present levels. However, if the reading comes in higher than expected, it can be taken as positive or bullish for the CHF whereas if it is lower than expected, take it as negative or bearish for the CHF.

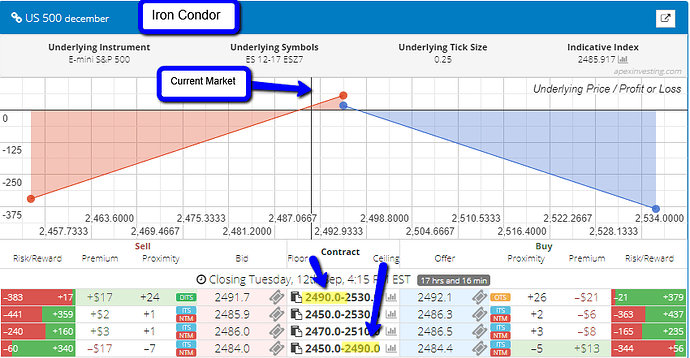

Trading Nadex USD/CHF spreads, an Iron Condor strategy within the right parameters offers an overnight trading opportunity. Enter Thursday night, as early as 11:00 PM ET with an expiration of 7:00 AM ET for a minimum profit of $35.

To set up this trading strategy, one spread is bought below the market with $17 or more profit potential. Simultaneously, another spread is sold above the market with at least $17 profit potential. The ceiling of the bought spread should meet the floor of the sold spread and be where the market is trading at the time of entry. The iron condor strategy profits when the market ranges or makes a move and then pulls back. Additionally, the range in which the market can settle and the trade can profit is quite large.

Stops should be placed at the 1:1 risk/reward ratio points where the market would hit 70 pips above or below where it was at entry. As long as the market settles between the breakeven points of 35 pips above and below where the market was at entry, some profit will be realized. The greatest profit will be made if the market settles right between the two spreads.

Use the scanner to make sure all parameters are met before placing the trade. If not, do not force the trade. An example of an Iron Condor as shown on the scanner is shown below.

Notice how the floor and the ceiling levels are the same. The current market is close to those levels. The potential profit amounts are shown in the risk/reward columns.

Free access to the spread scanner is available to all traders along with free day trading education at www.apexinvesting.com. Apex Investing is a supportive community of Traders Helping Traders to reach their desired trading goals.