By Darrell Martin

Rates are expected to go up in 2017 and have already done so since summer. This could affect the US Pending Home Sales numbers. This monthly report when prepared with the right strategy can offer a high probability trade.

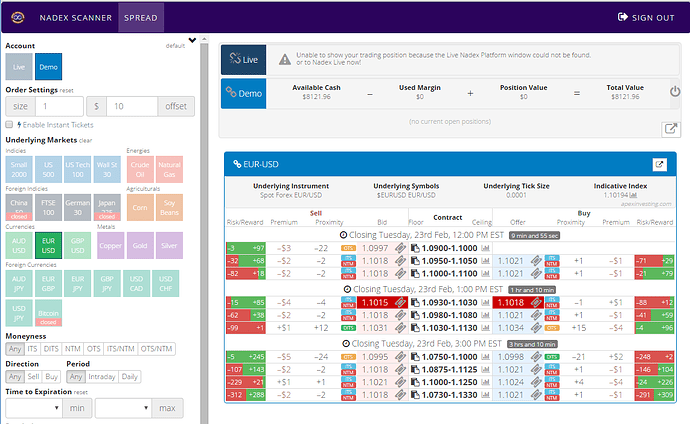

Pending Home Sales includes all homes that are under contract and scheduled for closing, excluding new construction. Wednesday, December 28, at 10:00 AM ET, the news will be released. An Iron Condor strategy, using Nadex EUR/USD spreads, entering at 9:00 AM ET for 11:00 AM ET expirations is a great way to be prepared for whichever direction the market goes.

The strategy includes a lower spread that is bought below the market and an upper spread that is sold above the market. The lower spread is ready should the market move up and the upper spread is ready if the market goes down. Typically, on regular news events, the market makes a move and then pulls back. This strategy is ideal for this kind of move, as well.

The floor of the sold spread should meet the ceiling of the bought spread and be where the market is trading at the time. Each spread should have a profit potential of $12 or more, for a combined profit potential of at least $25. More contracts can be traded as long as there is the same number on each side of the Iron Condor.

Stops can be placed where the market would hit 1:1 risk reward ratio points. This would occur where the market went so far in one direction that the loss from the losing spread would exceed the profit potential of the profiting spread. To determine those points, simply add double the total profit potential of the trade. In this case, it would be 50 pips above and below from where the market was at entry. As long as the market stays within the breakeven points of 25 pips above and below, the trade will profit.

To easily find the spreads that meet this trade’s parameters, simply use the spread scanner available free for all traders to use. The spread scanner, designed by traders to easily trade spreads with tools for both beginning and advanced traders, makes trade execution simple and accurate. Filters are used to bring forward the markets of interest in the right time frame. Color and number visuals show the risk reward potential of each spread whether buying or selling it.

The spread scanner and free day trading education can be found at www.apexinvesting.com.