Most recent trade:

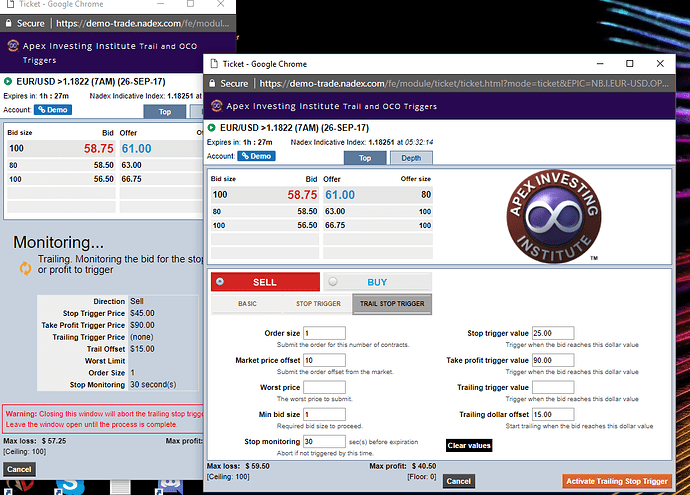

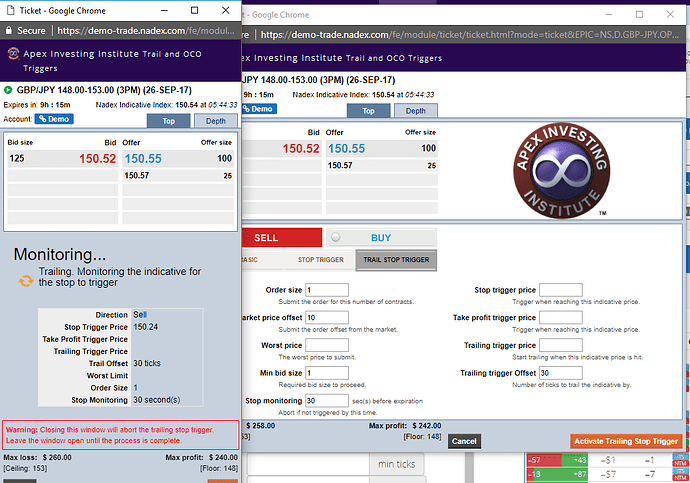

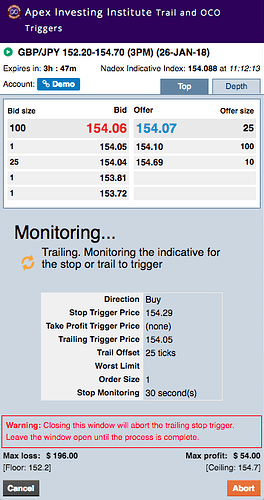

Did a 3pm Daily Straddle about 21 hours before expiration.

Sell GBP/JPY 152.20-154.70 @ 154.50 (for $20)

Buy GBP/JPY 154.70-157.20 @ 155.37 (for $67)

The Buy closed out overnight at 155.80 with an early take profit of $20.

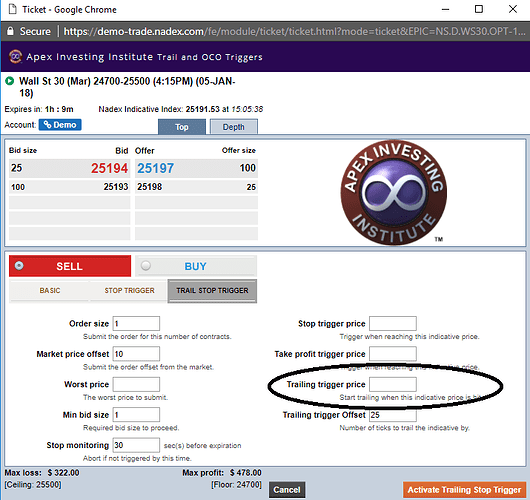

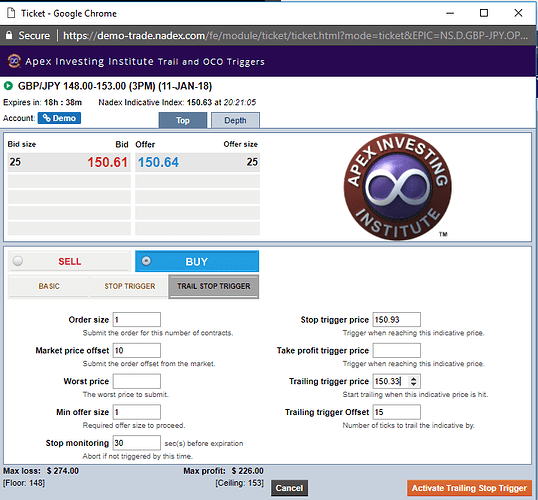

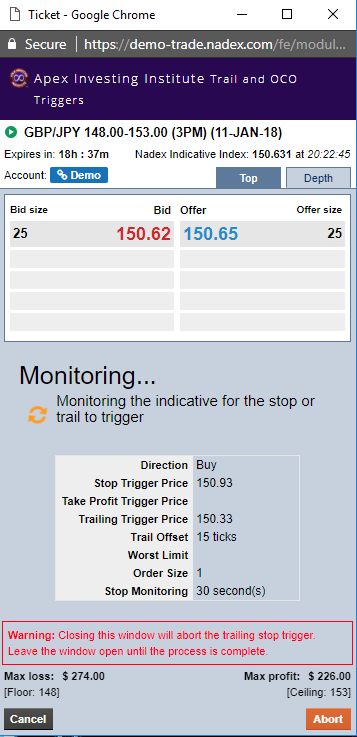

Although the Sell was still open in the morning, the market was moving down, potentially making this Straddle trade potentially profitable on both sides. Decided to try the Trail Stop Trigger.

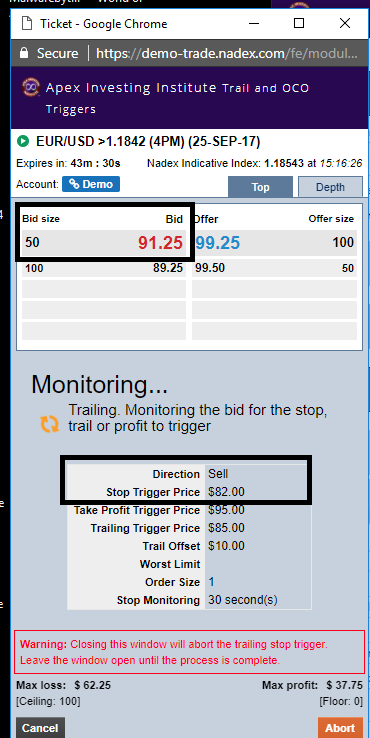

The market was moving up and down but decided on the Trailing Trigger Price of 154.05 and the Trail Offset of 25 (increased it from the usual 10 that I use).

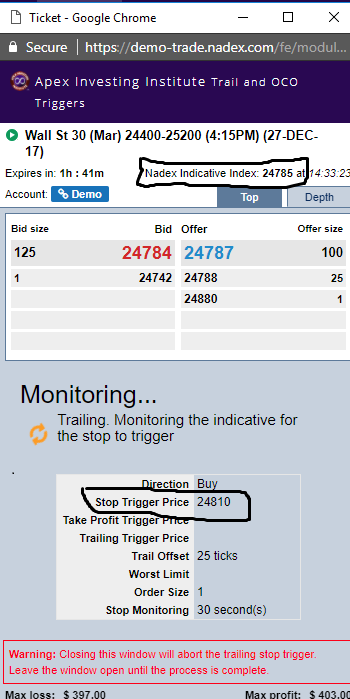

Once it triggered, the Stop Trigger Price appeared at 154.29. It stayed at that price when the market moved up. When the market went down, the price went down with it (trailing, I guess).

This is where I get confused:

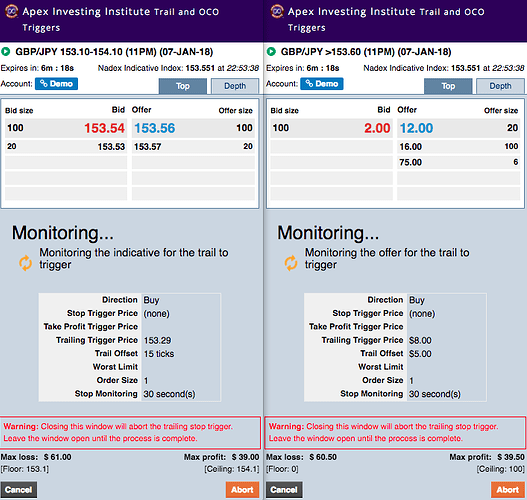

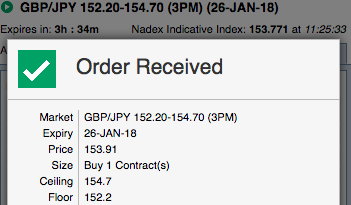

The ticket closed. I remembered to get a screen shot of the ticket before I closed it. 153.91 was the price that was showing.

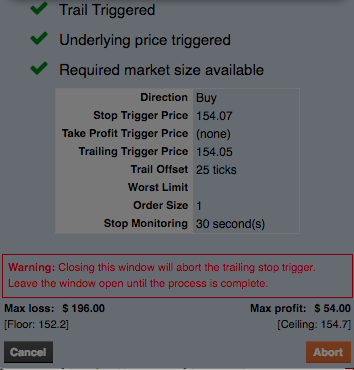

The Stop Trigger Price was 154.07, the Trailing Trigger Price was 154.05, and the Trail Offset was 25 ticks.

The notification that was sent to me said the closing price was 153.81 which was different from the 153.91 that showed on the closed ticket.

What does all of this mean? Why did the ticket close where it did?

Any significant profit made was fine with me. Before the Trailing, I chose 153.60 as my early Take Profit. Ironically, I think it got to that point (after the ticket closed). Either way, I still made a profit, and the Trail Stop Trigger is starting to work for me.

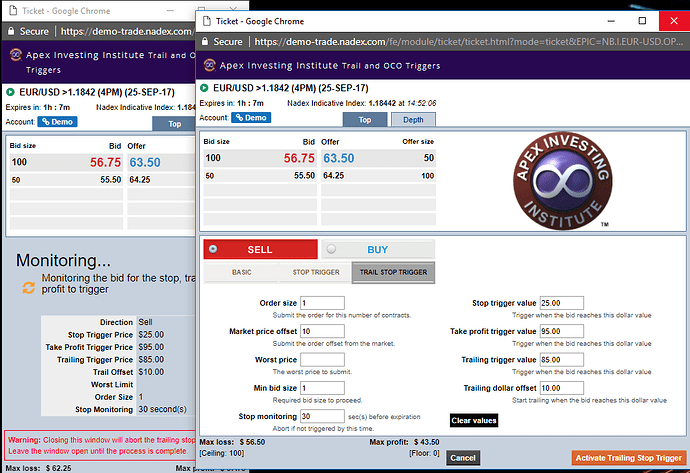

An earlier example:

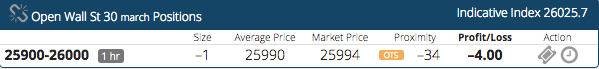

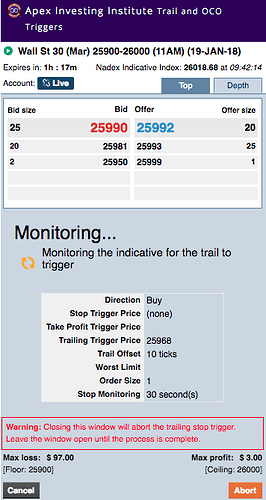

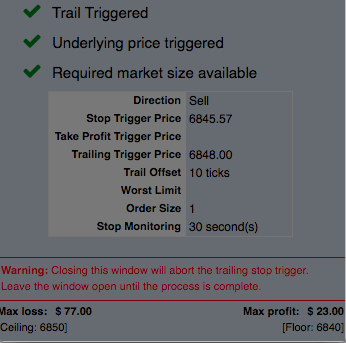

A few days ago, I was in an NQ trade right before it skyrocketed upward.

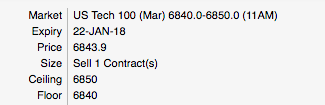

Buy US Tech 100 6840.0-6850.0 @ 6844.6

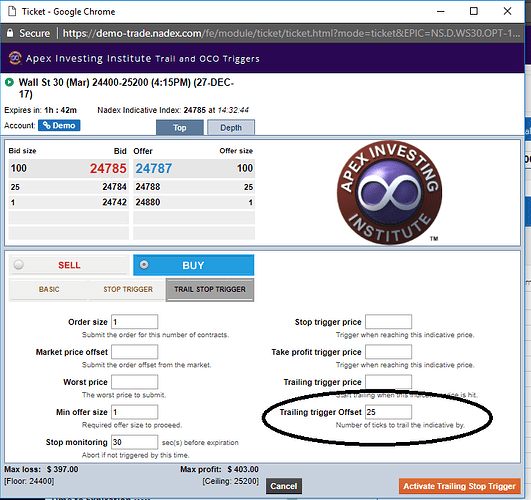

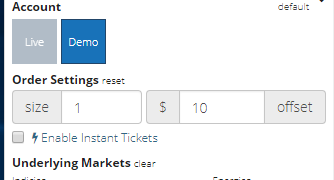

My goal was a minimum Profit of $30. So, I set the Trailing Trigger Price at 6848 and Trail Offset at 10.

(Note: This is part of the closed ticket. I didn’t make a copy of the original ticket.)

When the ticket was triggered, it closed at 6843.9 and my notification said 6844.9, which, either way, was nowhere near what I wanted.

I made $1. I don’t remember how far up NQ went, but I know it went way past the Spread max of 6850.

What happened here? Did I enter a wrong number?

With this Trail Stop Trigger, is there a difference on the use of ticks for the Trail Offset between Forex and Futures/Commodities? If so, what is it?

Just to let you know:

Other members are monitoring this post. Considering the financial potential, it’s sad that many have simply given up on this tool. What you are doing here is really helpful. I just wish an updated webinar could be done.