Please read update (bottom):

Hi Darrell. This will be a bit lengthy. This last week I’ve just been watching the sniper training videos listing my questions as I ago, and now posting them all at once. They’re all about the same thing, so really if you condense them together you’d only really have a couple questions.

These are all questions I have about video Setup 2, Market Reviews: “Market Trade Review 20+ Trades, 90% Win Rate” Each of the following trades were ones you verbally recognized as valid trades in your market review.

my post and these pics were done at work, with my iphone, so was not able to use jing

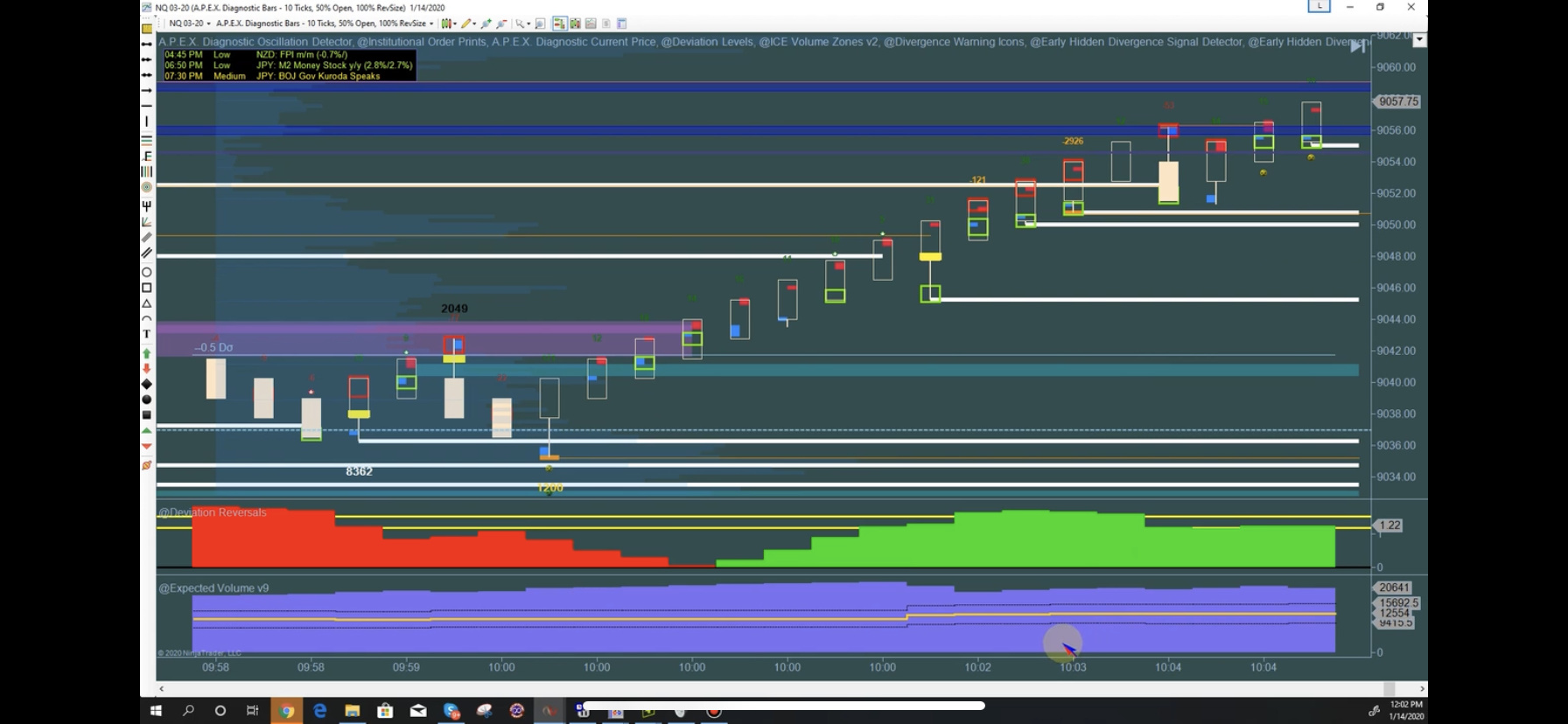

at 2:18, the naked xbox was going against DR. Wouldnt a naked xbox have to go with DR? I did notice that there was a very subtle, almost imaginary, “big hill, little hill” deviation. Is this why the trade would’ve been taken? Do we take a DR into consideration even if the “big hill, little hill” is THAT subtle?

These next two snapshots each show a naked xb trade, though in both examples, the DR indicator bars under each set up bar were not the same color/direction as the DR bars prior to them (11:18 and 12:43 respectively). Was it because OD showed divergence? I wasnt able to see it in the video as it was zoomed in too close. It was taught that these two bars should both either be red or green.

At 12:57, this short naked trade also went against DR. Is this another case of imaginary big hill little hill?

at 15:37, also a naked xb trade going short (the bar with the cluster in it), but going against DR. this time DR showed NO “big hill, little hill” no matter how hard I tried to imagine it. It did become coil chop on the second bar, but why would we go into the trade to begin with if it was against DR?

Please do not mind the interrogation-like tone of this post!  This is only due to me writing my questions down and posting them all up in one go. Nonetheless, I am curious to know why it was DR was saying no to all these valid trades. If it wasn’t OD divergence, was it something else I missed?

This is only due to me writing my questions down and posting them all up in one go. Nonetheless, I am curious to know why it was DR was saying no to all these valid trades. If it wasn’t OD divergence, was it something else I missed?

Update:

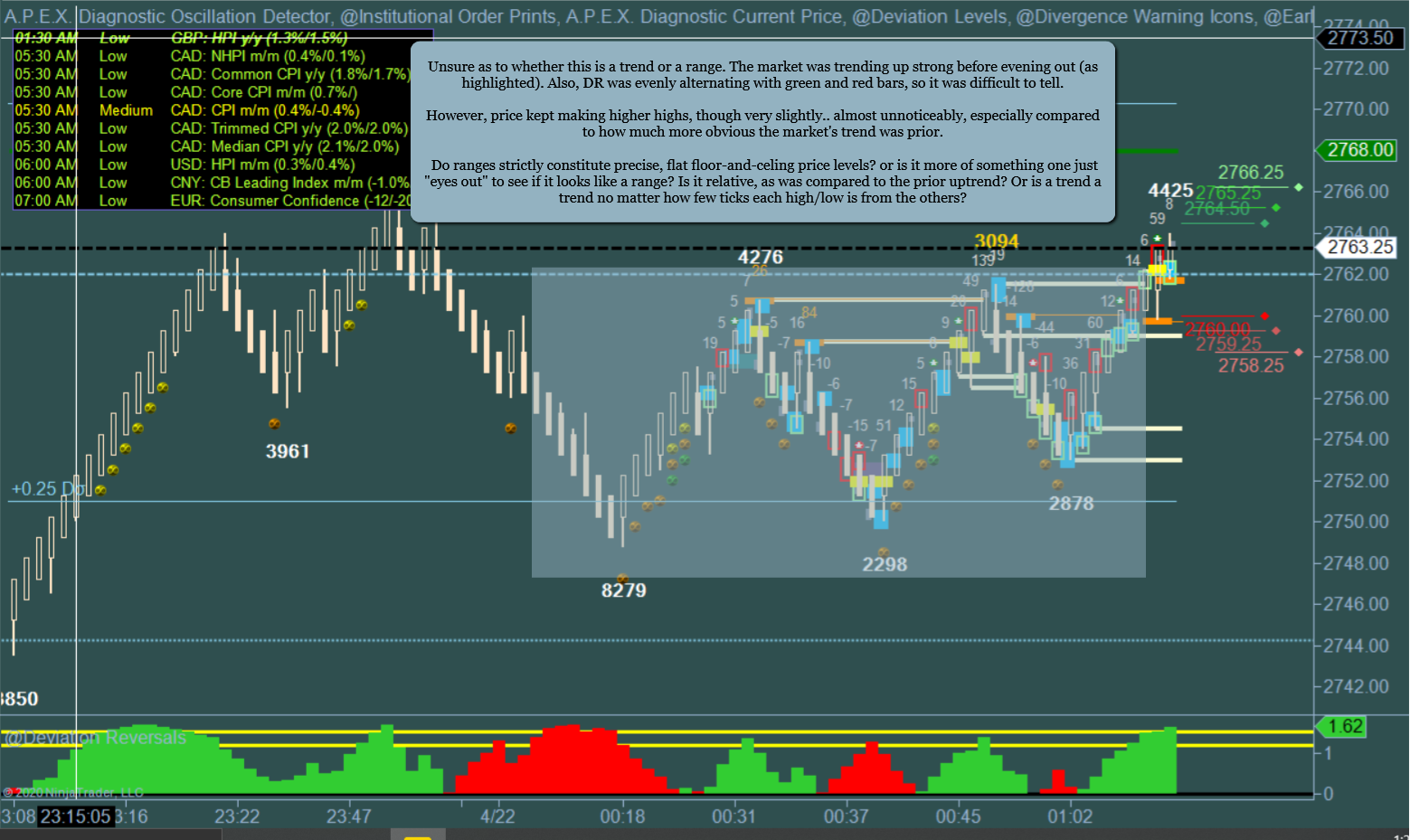

I just remembered something: were the above trades in range bound markets, by chance? Also… is the below (highlighted in box) a range? I was trading on demo just now and found that the first few profitable trades I missed all SEEMED to be going against DR… then I remembered that DR doesnt matter in range bound markets. Does the same go for OD? Thank you in advance.

Bit of a rabbit hole situation here, with each question leading me to think of more… but is this a trend or a range? (see notes in image) Thank you so SO much in advance. ANYONE’s feedback is appreciated!