By Darrell Martin

Every Thursday, at 10:30 AM ET, the Energy Information Administration (EIA) for the United States releases the Natural Gas Inventory Report. You may have noticed lately that the Natural Gas charts have been trading in a channel. Could you use this to your advantage?

This is a simple, weekly, range-bound pattern, which could be used in your favor. Your timing does not have to be perfect for this strategy. You barely have to watch it at all. This is a “set it and forget it” type of trade.

A look at your Natural Gas chart shows the market settled at 3.050 on September 27, but hasn’t returned to that level since. October 3, brought the market to its lowest point in recent times, hitting around 2.866 before settling at 2.923. This gives you a wide range for trading, and the perfect arena for setting up the neutral trading strategy of a binary butterfly.

For this strategy, buy one contract slightly below the bottom of your range and sell a contract slightly above the top of your range. As long as the market stays between those strike prices, you profit on both. To get the pricing you want, you may not be able to enter both sides of the trade at the same time. This will be shown in the example.

To have the best probability for profitability on this trade, look at the weekly contracts expiring Friday, at 2:30 PM ET. Consider what binary strike price you think the market will be above, and what price you think the market will be below. This is how you figure the range.

Let’s use the range mentioned above, when looking at the Natural Gas chart, being between 2.860 and 3.050, for the example. As seen below, when you consult the available strike prices at Nadex, you will see 2.850 and 2.750 offered for the lower buy strike. The 2.750 will give you a little more wiggle room. Pull up a ticket and put in the price you want. The suggested buy price for this trade would be around $75.

Next, choose the upper level of your trade. For this example, let’s use 3.050 and put in the sell price of $25. When you place the orders, they will go into working orders. The market must oscillate to have the orders filled.

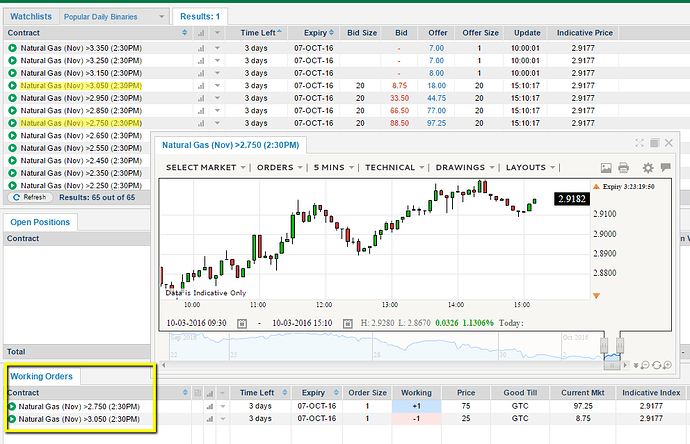

The image below shows the two different strike prices that make up the binary butterfly: the 3.050 and the 2.750. It shows market movement on the chart with the indicative price of 2.9182, along with both sides of the butterfly trade in the working orders. In the working orders area and the bid/offer section, you can see the current bid (sell) and offer (buy) prices. Since you want to buy the 2.750 contract for $75 and its current price is 97.25, you can see why your order hasn’t been filled. The same is true for the 3.050 contract, which you want to sell it for $25 and the current market price is 8.75.

Here is the most important thing for you to learn. If your orders are filled, the potential profit on the bought contract is $25. The most you can make on the sold contract is $25. The most you can lose is $75 on each side. While this seems like a bad risk/reward ratio, when you put both together, the market cannot finish both above 3.050 and below 2.750 at the same time. As long as both sides fill and you leave the trade alone, one side will profit. You will make $25. If both contracts fill and the market stays in the range as of expiration, you will make $50. However, you could lose $75 on the other side, if it doesn’t stay in the range. Your worst-case scenario is that you lose $50.

Remember, the one price you can always count on in trading binaries is the mid-price. For example, suppose the 2.750 contract is filled. If the market drops down and hits 2.750, you know at that point your contract will be worth around $50. Have a planned risk or a stop loss set to exit once the market hits your strike price. You would then have a $25 loss instead of $75. Don’t just hold it and see what happens.

Finally, if the market is range-bound, this is a potential weekly trading opportunity. You can place it Monday morning before work, or any time early in the week. Do not force the trade. Do not take a closer strike just to have your order filled. Allow the market to oscillate to give you the best probability.

Examples do not include exchange fees.