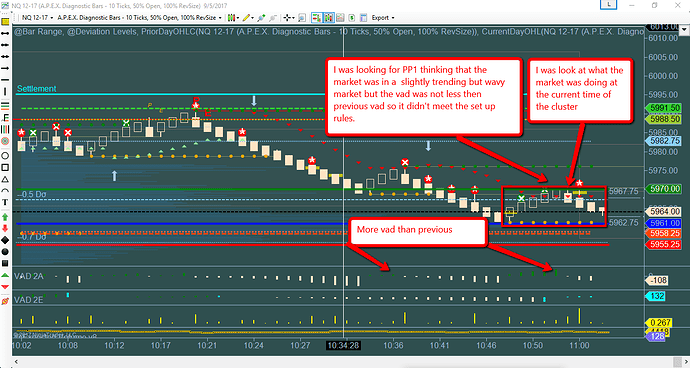

Hello Kellie, I have a question about trying to recognize the market condition to see what power play to be looking for. When a Cluster comes up are you looking for the current market condition or the over all condition. Some time the present condition could be a slightly trending waving market, which PP 1 and PP2 would be for that, but the overly condition might have been a trend. Now that I look back on it I can see it a little more clearer, but if you could look at the charts and give me your advice I would really appreciate it.

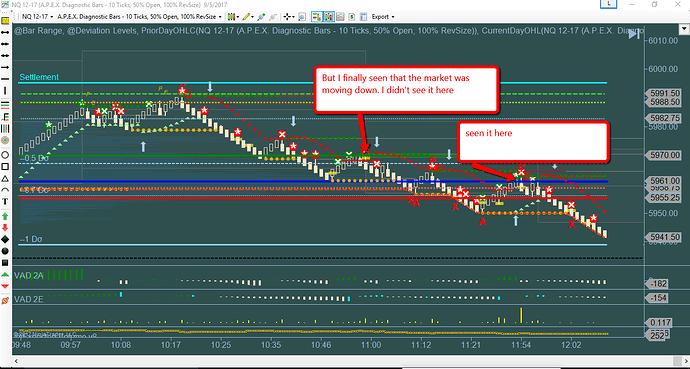

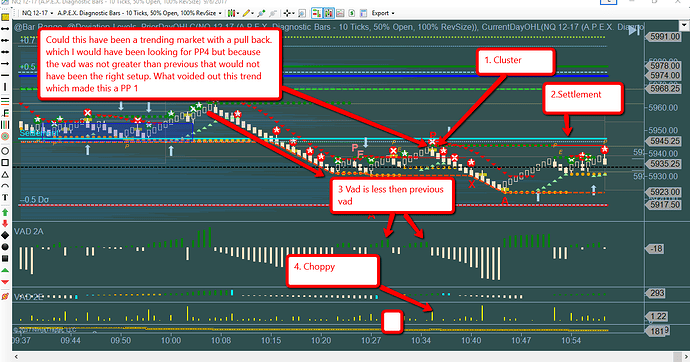

Here is another one Kellie, the market started out in a super trend than pull back, the over all looks like a trend but when the cluster appeared the market was kinda in Slightly trending wavy condition. What Voided this trend out? To let you know that you are looking for PP1 or PP2.

On the first chart… don’t really see a PP #1 because the market appears to be in a clear down trend… it is making lower lows and lower highs… so if looking for anything… it would PP #3 (Hidden Divergence). That being said, look at all the major levels underneath that you would be going into on a short… you have Blue ICE, LOD and Red ICE… so would really need to use caution or wait for the next setup… also keep in mind the market has made like a 120 tick move… so maybe expect chop for a while

pretty much the same when looking at second chart… looks like the market is still in a clear downtrend… lower lows and lower highs… so would be looking for HD PP #3 trades

On the third chart… to answer the question about when to recognize the trend might be ending is when the market started to make higher highs. Technically, that could be a PP #1… you had all four necessary components… and what is nice is that the reversal bar, in addition to the cluster, was a Power P and a Power X (simultaneously)… making it even stronger.

Thank you for help

Thank you TRADE… for helping out!!

Kellie

No worries Kellie… glad to help