By Darrell Martin

The appeal of trading binary options may lie in the simplicity of the trading instrument as it identifies exactly the total risk and reward of the trade at expiration. The binary option has a price trading range bound from zero, (the floor), to 100, (the ceiling). It can never go below zero or above 100. The contract will always have a settlement value of $100 per contract at expiration. The question at expiration is who receives the settlement, either the binary buyer or seller.

Collateral and Risk

Since both the buyer and the seller put up collateral to cover their respective sides of the trade, all contracts are fully collateralized. The collateral is the maximum risk on the trade. The buyer’s collateral is the difference between the buy price and zero. The seller’s collateral is the difference between the sell price and 100. The combined risks of the binary buyer and seller equal the expiraiton settlement payout of $100 per contract.

Reward

Maximum reward is figured for the buyer by taking the difference between the buy price and 100. As a binary buyer, you are long at the trade price and want the contract to expire at 100. The seller’s maximum reward is the difference between the sell price and zero. As a binary seller, you are short at the trade price and want the contract to expire at zero.

Example

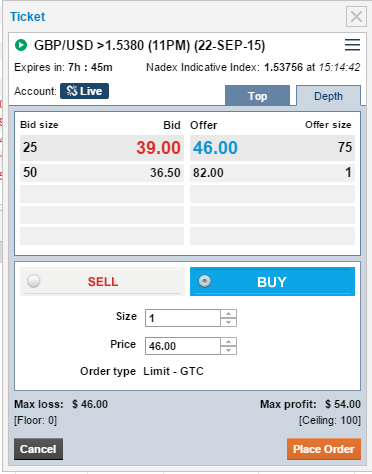

Let’s look at an example. This ticket shows that this buyer is willing to risk $46 for the opportunity of a $54 reward. The buyer is saying that they want the contract to be greater than 1.5380 at the 11:00 PM expiration. If this order is filled, it means that there is a seller who is risking $54 for the opportunity of a $46 reward. The seller is saying the opposite of the buyer. They do not believe that the contract will be greater than 1.5380 at expiration. You can see that both parts, the risk of each side, make up the total $100 collateral of the contract trade.

The ticket also shows that the indicative price of the underlying market is currently at 1.53756 with seven hours and 45 minutes left until expiration. This information is located near the top of the ticket. At the bottom of the ticket, you can see the max profit and max loss amounts listed. All of this is helpful information as you set up your trades.

How does this example play out?

For this example, let’s say at expiration the GBP/USD is greater than 1.5380. The binary settles at 100. The buyer would receive the $100, which includes the initial $46 paid to enter the buy trade, and $54 in profit, not including exchange fees. The seller would receive zero, because binary options are all or nothing settlements.

However, you can exit before expiration in order to cut your losses or protect your profits.