By Darrell Martin

In a previous article, it was shown how you would want to either buy or sell the binary strike price that is ITM (In The Money) when the market is flat. An example was given showing the trader who buys has an immediate advantage, but has to pay a larger portion of the $100 settlement value per contract.

In this article, let’s look at the opposite. Perhaps you see a channeling market that is experiencing some resistance on the upper side. It seems to be staying between two main points on the chart, but hitting a definite upper line. The line could be yesterday’s settlement, a deviation level or just an area of resistance. Whatever the case, this may be a good market for you to sell an ITM binary option. Remember that even in a flat market, you can be profitable. To receive the full settlement payout of $100 of the binary at expiration, the underlying market price needs to be lower or equal to the strike level for a binary seller.

As a binary seller (ITM) , it is a trade-off as you have more dollars at risk but it’s a higher probability trade. When initiating the trade the underlying market is already trading below your strike level. Let’s look at an example from the USD/JPY market.

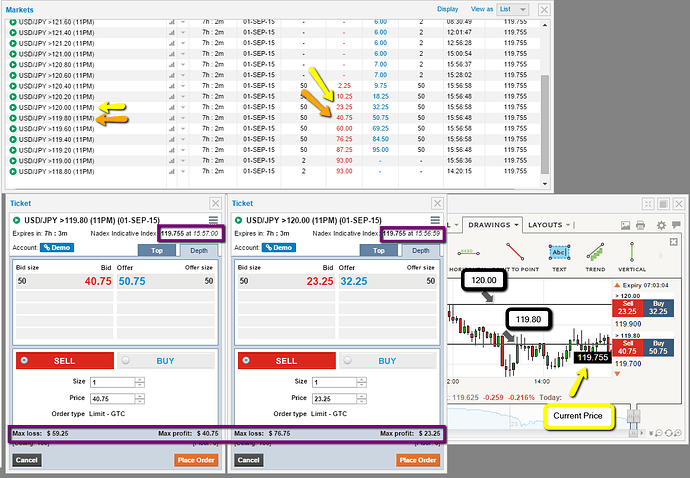

This image gives two examples on the same market. When you look at the chart on the right, you can see that the market is trading well below the 120.00 strike level. You could choose to sell this ITM strike at 23.25 for a cost of $76.75 per contract, which is your max risk. You expect that the market will remain at or below 120.00 at the 11PM expiration and if it does, your max profit will be $23.25 per contract. Your initial cost is a higher portion out of the $100 expiration payout due to the underlying being 24.5 pips below the strike. As a result you are paying for the advantage as it is a higher probability trade when initiating.

Another choice could be to sell the 119.80 strike for 40.75. As a binary seller, you believe the market will remain at or below the 119.80 level at 11 PM expiration. If the binary finishes in the money, you receive the $100 settlement per contract to have a maximum profit of $40.75. Here your initial cost is less compared to the other strike because there is less of an initial trade advantage. The underlying market is only 4.5 pips below the strike so the result is a $59.25 initial cost which is the maximum risk on the trade.

You still have over seven hours until expiration. If there you feel there is too much time where the underlying market can go against you, then you don’t want to initiate the trade. It is a balancing act between time and initial trade edge to whether you initiate the trade given your underlying market opinion. Remember if you are in a binary position and the market is going against you, then offsetting early is an option to cut losses prior to expiration.

So know when you see a market that is moving sideways and experiencing some resistance to the top side, there maybe an opportunity to sell an ITM binary and profit in a flat market.