By Darrell Martin

Risk tolerance is different for every trader. A good guideline to follow is to stop trading if you are down five percent in a day. Another helpful guideline is not to risk more than one to two percent of your account per trade. When you know this amount, you can then determine where to place your stop.

For example, if your trading account has a balance of $20,000 and you are willing to risk two percent per trade, that means you can risk $400 per trade. If you set your initial stop 20 ticks away, that would be a $200 risk on futures, which are $10 per tick. Therefore, you could trade two contracts. Don’t base your stop on your risk; base your size on your risk.

How much are you willing to risk on the trade?

Always start with the question of how much you are willing to risk on the trade. When you can answer this question, it can be amazing because you may get really tight trades of five to ten ticks enabling you to do four or five contracts for the same amount of risk. If you can risk $400 per trade and it is a 10-tick move, you can do four contracts.

Use an objective point for your stop

Make sure that you base your size on the amount of risk you are taking, based off the percent of your account you are willing to put at risk on a trade. Then choose a stop based on stop action. For example, Martin has developed an indicator known as the MVP: Momentum Volatility Predictor to trail his stops. Likewise, you need to use an objective point to put your stop in place right out of the gate or you will risk way too much money, because you will want to be right. By using something objective, it is as if you are saying that if the market hits a predetermined point, you are no longer right and you will exit the trade. Being objective allows you not to overtrade your account.

Handling winning trades

Most traders are not good at handling winning trades. They cut their profits short because they are so happy finally to see a win. You get out when you profit $200 because it is so much more pleasurable to take profit and feel good about it, but this was a day or a trade that could have made thousands! You can make a great deal more money if you trail your stops objectively.

Go for the middle third

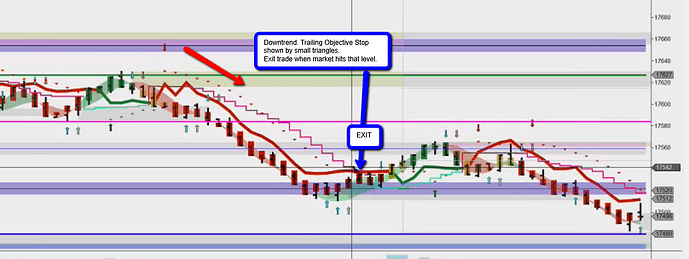

Dr. Alexander Elder taught that the best traders are trying to get the middle third on a trend. If you can get the middle third of a trend on a consistent basis, you can be a very wealthy trader. The image below shows a down trending market.

This downtrend started at approximately 17630 and ran down to 17496. Following predefined rules, Martin would have entered the trade at 17583 and exited at 17540. The range of this particular trade is more than a third, but it would have been traded using objectives, i.e. enter when it pulls back or when it breaks the low; place a stop at the top of the high and then trail it with the MVP. Trailing stops are based on market conditions. They are very mechanical and without emotion. This applies to trend trading, not scalp trading.

Too much risk?

Start out with a defined stop and let that calculate the amount of your risk. If that is too much risk, then you need to trade a smaller contract such as mini oil instead of oil or try a Nadex oil spread, which is $1 per tick. The markets you trade may also be determined by your account size, and then the number of contracts you trade is based on that risk. Execute your trade, place your stop and trail it objectively to allow your profits to run.

Define what is “Okay” and “Not Okay”

You can be okay with missing trades or getting small profits, but not okay with taking a loss larger than it should have been because you didn’t find it up front. You should not be okay with getting in a trade late, where it would have been a winning trade if you had followed your rules, but it ends up being a losing trade because you entered late. You should not be okay with missing out on massive profit because you didn’t objectively trail your trades. You can be okay with missing out on a big move, unless you miss it because you got scared and took the profit early.

Find the necessary discipline

All traders have to find the discipline necessary to overrule your own emotional deficiencies. You have to find very objective methods for trailing your stops. An example is to have your trailing stop rule be different from your entry rule. You can also use deviation levels or other indicators to determine your take profits. To be a successful trader, you must set specific rules and follow them, not your emotions, no matter what!

For other trading tips and educational guidance, go to www.apexinvesting.com.