Sell 05/04/16 10:49:50 1 US Tech 100 (Jun) 4300.0-4340.0 (4:15PM) @ 4314.5 $-255.00

Buy 05/04/16 11:00:50 1 US Tech 100 (Jun) 4285.0-4315.0 (4:15PM) @ 4303.8 $-188.00

Settlement Payout 05/04/16 16:15:00 1 LONG US Tech 100 (Jun) 4285.0-4315.0 (4:15PM) @ 4303.8 $242.50

Settlement Payout 05/04/16 16:15:00 1 SHORT US Tech 100 (Jun) 4300.0-4340.0 (4:15PM) @ 4314.5 $307.50.

Risk to place the trade was: 443.00

It returned: 550.00

2 Likes

Nice trade Sharpie! These Siamese Iron Condors have my attention.

I do have some questions though.

-

Is this a premium collection trade? (like a regular IC) And a market neutral strategy where you arent expecting big moves?

-

Do you use stops to protect or reduce your risk?

-

Since it appears that the payout was at expiration, is it normal to let these trades go until expiration?

Sorry for the inquisition! Any advice and insights are appreciated!

Thanks.

It is a PC trade. This one I just let it go to exp.

When I first saw it. the premium was around 56.00 on both sides.

Just noticed that my Siamese Straddle post is also a Siamese Iron Condor.

The sell side. one had a 194/106 risk reward with 75 in premium. Another was 278/122 risk reward with 91.00 in premium. Picked the first one. The second had more risk but could only make 16.00 more.

Have used stops and bin hedges before.This one i just watched it from time to time.

Thanks for the help! I am working on these now - in demo. The low risk is great for the little account guy like me. Helps to keep things manageable and the odds in my favorable for the long run.

Sharpie can you shed some light for everyone what time of day you are entering these and what all you are looking at on the chart, market conditions, etc thank you

Having trouble getting screenshots of the scanner up. The only way I know how is to first use Jing, Place that into the room, then, make a copy of that.

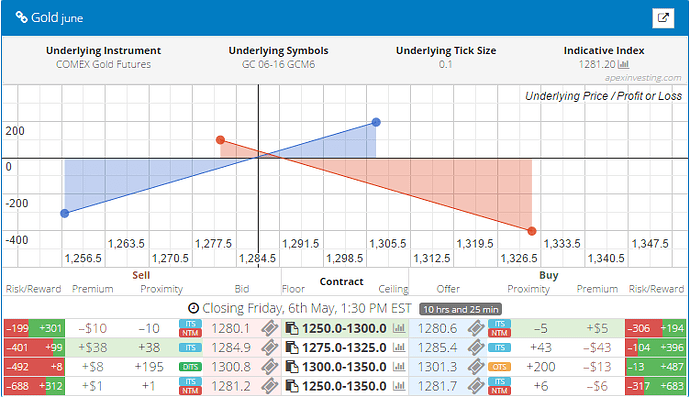

Here is a screen shot of one I found one Gold. I have begun to look for premium and overlapping spreads that present a wide enough range between max profit points to warrant placing the trade. I’m still in practice mode, so feel free to shoot holes in what I show below.

The specifics of my trade are:

Buy 1250-1300 @ 1280.6

Sell 1275 -1325 @ 1284.8

Stops were set at (max prof) for 1300 on the short side and 1275 on the long side. Neither stop was hit and the trade settled at 1293.55. Had either stop been hit, the remaining side would have been exited as well.

Total cost of trade was: -708. Total Payout was 750. Profit of 42.

Nice! I’m up for anything right now, because all of my strategies look good on paper, but are inconsistent. I actually ruled out overlapping spreads a long time ago, but I’m going to study this & see if I can make it work. Thank you!