These may be rookie questions, but I am in need of some help, in making sure I understand and am grasping the following questions correctly

Proximity and Risk

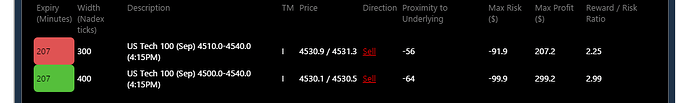

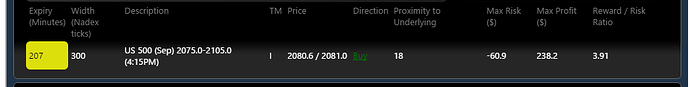

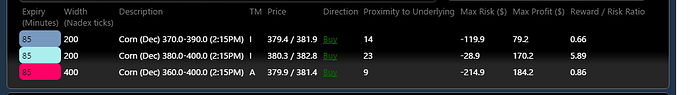

Using a few examples ( taken from today … 7-27-2015 ) :

TF had the following Proximities and Risk … 5 ( proximity ) and -132 ( Risk ) -20 and -157 -15 and -126

YM had the following Proximities and Risk …

1 ( proximity ) and -61 ( Risk )

-7 and -75

8 and -39

CL had the following Proximities and Risk … 3 and -45 -7 and -17

ES had the following Proximities and Risk … 18 and -13 4 and -49

NQ had the following Proximities and Risk … -34 and -72 11 and -48

GC had the following Proximities and Risk … -2 and -134 40 and -6

ZC had the following Proximities and Risk … 14 and -81 -9 and -339

Those of course aren’t all of the available markets ( SI, NG, HG, ZS , FTSE, DAX, NKD and all of the Forex pairs ) What I am confused about are the following…

-

What does it mean , when a spread’s Proximity has a minus sign in front of it and another spread does Not have a minus sign ( assuming both are Bullish/Long spreads ) ?

-

What are the Equivalences for each Markets Proximity and Risk ? Meaning … when we see a -6 or 6 proximity for a spread on YM and we see the same -6 or 6 for a spread on CL or ZC … what do these 6’s translate to, in terms of that Indicatives " Actual " point value ?

For CL and a proximity of 6 , does that mean … .06 cents on the indicative ( $60 ) , and so 6 ticks ? For ES and a proximity of 13 , does that mean … 13 ticks ( $162.50 ) or does it mean 13 points ( $650 ) For ZC and a proximity of 158 , does that mean … .158 ticks ( $790 )

- On one of the webinars I was watching this weekend , it was mentioned that 3 of the Markets ( SI, HG and NQ ) had point values / equivalencies to their spreads , that moved slower / less than that of each one’s Indicative. So if SI moved up .50 cents on the Futures market and you bought 50 Nadex spreads ( to match 1 contract on SI ) , that you would still NOT make a 1:1 PnL for each tick / point that SI moves ?

So with these 3 markets , how can we convert what a 1 tick move in the Indicative equals on these 3 markets … ( SI, HG and NQ ) ?

Hopefully my question makes sense

Thank you for all of the help, I feel like I’m getting t and understanding the Spreads, just have a few things I want to confirm and make sure I understand in there entirety