What happens to the premium I pay to enter a spread trade? For this example lets say I bought a Forex bull spread at the floor expecting that market to rise. If I close it out early or let it expire assuming 30 pips profit in either scenario do I get back my premium?

Forgive my ignorance but out of the dozens of videos I have watched no one seems to cover it.

If you bought a spread near the floor, then there would not be any premium to collect

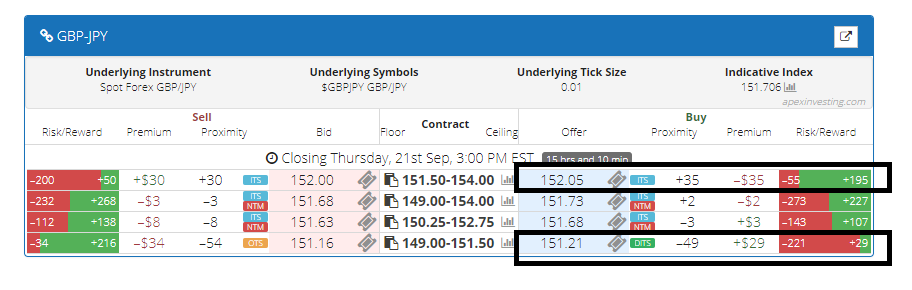

Notice how if I bought the 151.50-154.00 contract the premium value is negative???

If I was wanting to collect money I would either sell that contract or buy the 149.00 -151.50

As far as getting the money back… If the market remained flat until expiration (3 pm) then yes I would get the money back. Also if there was a huge move in favor of the direction of the spread, I could potentially collect most of the premium (but not all) if I sold early.

For a buy… since there is $29 in premium… the market could move against me 22 ticks (I am including the $5 bid/ask price and the $2 Nadex fee) and you would basically break even

So is the sweet spot buying in the middle of the spread as far as return of premium is concerned?

If you are trading directionally and want to pretty much match the market tick for tick, then yes, the sweet spot is trying to get in the middle of a spread.

Easiest way to do that, is to find Near The Money (NTM) Spreads. Those will most often have the price of the spread near the middle of the range and will pretty much match the indicative in both ticks moved and in speed.

There will pretty much always be some form of premium when trading Nadex.

So unlike a binary where say I buy in at $25 for a call strike and it closes in ITM I get $100 which includes the $25 I put up. Spreads don’t work the same?

Correct. Depending on the spread you get… A lot of the profit / loss will come from what the market itself does. Market goes up and you have bought a contract… you will generally make as much as is moves. And then of course the opposite… Market goes up… but you have sold a contract… then you will generally lose as much as the market moves against you.

Since every Nadex trade has a capped risk/reward amount… you will know how much you stand to lose or make anytime you enter a trade

So after buying a bull spread at 6pm on the USTECH100 at the floor and then selling 30 points away from the floor with 5 hours to go to expiration I would lose some are all of the original premium?

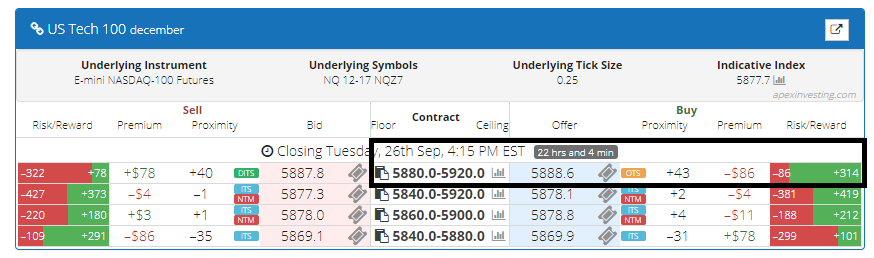

This is what you would be buying… there is NO premium if I am BUYING at the FLOOR

If wanting to collect premium you would buy the 5840 - 5880 one

O.K. so I am confused on my terms. Say it costs $43 to buy 1 bull spread (sorry I believe I’ve been referring to that as premium) do I get that back in the same scenario above when closing out with a 30 point gain?

If you have a $100 account and you spend $43 to open a position, then your buying power is reduced to $57. But your account value is still $100

100 - 57 = 43

If the Spread price goes up 30 ticks and you take profit there… Then your overall account value will be $130 (well less because Im not including fees)