By Darrell Martin

Up late and want to catch a trade? Or, live on the west coast and like to trade in the evening? Then be ready to place a trade late Monday evening for Australian Interest Rate news released at 12:30 AM ET, Tuesday, August 1. To trade this news, an Iron Condor can be set up at 12:00 AM ET as the day changes from Monday to Tuesday ET. Look for AUD/USD spreads expiring at 2:00 AM ET.

Based on previous market reaction to this news, an Iron Condor can be placed for $30 or more profit potential for a high probability trade. With this setup, the market can move up or down and still have the potential to profit; there is no directional bias.

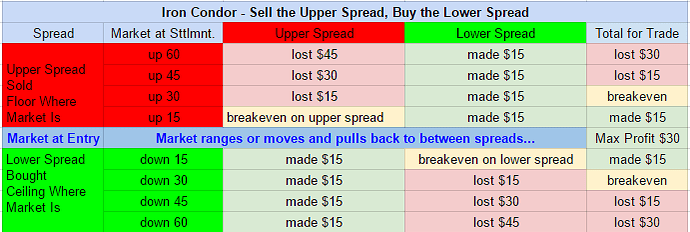

To ensure the minimum profit potential, each spread should have a reward potential of at least $15. One spread is bought with the ceiling where the market is trading at the time, and the other spread is sold with the floor where the market is trading at the time. The market can then move up or down 30 pips from where it started. If the market is within this range, the trade can collect profit as time expires, or if it is within this range at settlement. Max profit is made when the market is centered between the two spreads at settlement. To understand how much profit or loss is made depending on how far the market moves up or down, see the below chart.

Stop limit orders can be placed where the market would hit 1:1 risk reward points. For this trade, those points would be 60 pips above and below from where the market was at entry, as shown above in the chart. If there are no spreads available with that profit potential, then there is no trade. Staying up late to trade this news event may be worth any lost sleep.