By Darrell Martin

The Services Purchasing Managers Index report is to be released Friday, June 3, 2016, at 4:30 AM ET. This can be a good news event to trade, due to it being a leading indicator for economic health and tends to move the market, specifically GBP/USD. The Straddle strategy is prepared for catching profit in both directions, as it literally straddles the market using two Nadex GBP/USD spreads. Going for a profit of $40, while risking only $40 or less, the trade is low risk as well.

To produce this report, purchasing managers are surveyed regarding their opinion on current business conditions. The result is a level of diffusion index and a number above 50.0 indicates expansion while below 50.0 means contraction.

Set up the strategy by buying a Nadex GBP/USD spread with the floor being where the market is trading at the time and with a max risk of $20 or less. At the same time, sell a Nadex GBP/USD spread with the ceiling being where the market is trading at the time, also with a max risk of $20 or less. With such low risk, the advantage of this trade is not having to place stop orders. Entry is as early as Thursday, 11:00 PM ET for 7:00 AM ET expiration.

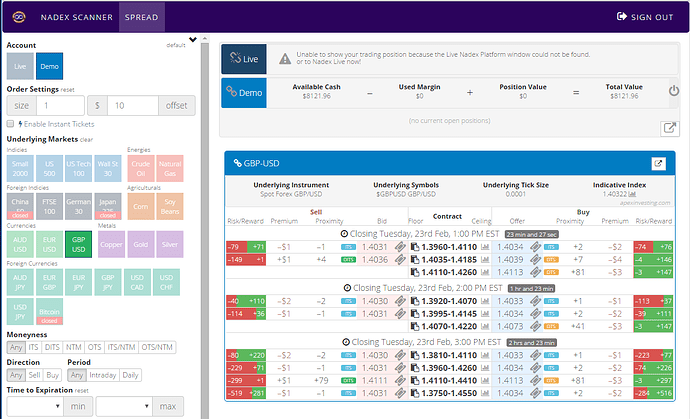

Traders find it beneficial to use the spread scanner, designed for Nadex traders to easily find the right spreads for their strategies. This can certainly be the case, as all information for a Nadex spread is available in one window. For straddle strategies, first, find spreads with the right risk amounts, then confirm the ceiling and floor parameters meet. For a quick glance of the spread scanner, see below.

For this straddle strategy with a risk of $40 or less, place a take profit order where the market would hit 80 pips above or 80 pips below. At those points, profit will cover the cost of the winning spread and the loss on one side, and for a $40 profit.Free trading education and the spread scanner is available at www.apexinvesting.com.