By Darrell Martin

Scheduled financial news can make for scheduled trading. When it’s known certain financial numbers will be released at a specific time and known what markets react significantly to that news, then traders know and are prepared with strategies to trade.

One such strategy, to take out of the tool belt for big moves after news, is the Straddle. There is no need to know which way the market will move, because the Straddle literally straddles the market, ready for a move long or short. Trading two Nadex spreads, one is bought and one is sold. The bought spread’s floor should meet the ceiling of the sold spread and be where the market is trading at the time.

Coming up on Wednesday, October 19, there is scheduled Canadian financial news. At 10:00 AM ET, the Bank of Canada will release their Monetary Policy Report, Rate Statement and the Overnight Rate. This news is similar to the US Federal Open Market Committee Meeting and Rate Statement and the Canadian news tends to move USD/CAD.

The Straddle is also meant for trading when expectations are the market will make a significant move, as is the case with Canada’s upcoming news. Based on past market moves to this news, a Straddle with a maximum risk of $40 makes for a high probability strategy. At only $40, the risk is low; there is no need for a stop. The trade can be entered at 9:00 AM ET for 11:00 AM ET expirations.

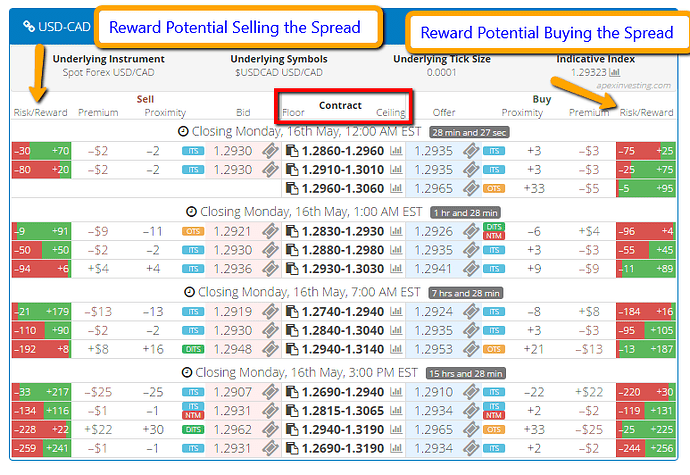

Any trader that has traded Nadex spreads with the Spread Scanner will confirm it is the easiest way to trade Nadex spreads. To find the spreads for this trade, use the filter to bring up the USD/CAD spreads expiring at 11:00 AM ET. The risk/reward columns are color painted to visually show the risk/reward, i.e., the more red, the more risk, along with numbers to display the amount. Traders can choose the sell and buy spread showing the right max risk for the trade. See below for a layout of the Spread Scanner.

The ticket icons, when clicked, open order tickets and the trade can be entered. Directly after entering the trade, take profit orders need to be placed. For a Straddle with a max risk of $40, limit take profit orders should be placed where the market would hit 80 pips above and below from where the trade started. This again can be done on the Spread Scanner. When one of the take profit orders is hit, the trade will make $40 profit for a 1:1 risk/reward ratio. Leave the other spread on in the event the market reverses back toward it. The remaining spread may breakeven or possibly make some profit as well.

For free access to the spread scanner, free day trading education and access to a complete calendar of news events for trading, visit www.apexinvesting.com.