By Darrell Martin

It’s that time of year. Someone just cut you off while driving, took the parking place that you thought had your name on it or grabbed the last item off the shelf that you needed to finish your holiday shopping. You are ready to strangle the next person that gets in your way!

When you look over your trading day, you notice that there is a suggestion to place a strangle trade on the next news event and you say to yourself, “Sure! I’ll be happy to strangle something or someone! Just send them over!”

How is a strangle applied to binary option trading? A strangle is a strategy used when you expect movement, but you don’t know which way it is going to move. This strategy involves buying and selling Out of the Money (OTM) binary contracts on both sides of your trade. A very simplified definition for an OTM contract is that it has less than $50 risk. This article will deal specifically with binary strangles.

A binary strangle has low risk because you are buying and selling two contracts that are both out of the money, thus limiting your risk. Since your risk is limited, no stop loss is needed.

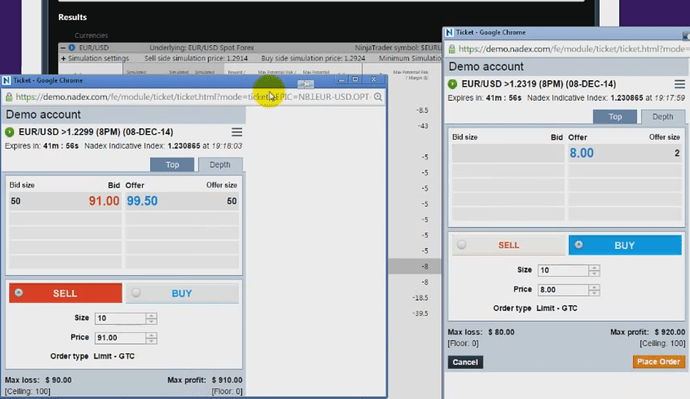

For an ideal strangle set up, you want a 1:1 risk/reward minimum taking into account that you are expecting one side to lose and one side to profit. However, if there happens to be a retracement before expiration, it is possible to profit on both sides. The following image shows tickets from contracts bought and sold that create a binary strangle.

You can see in this image that both contracts are OTM. The BUY contract, EUR/USD>1.2319, was bought for $8. It was OTM because it was greater than the current market price. The SELL contract, EUR/USD >1.2299, was sold for $91 and was OTM because it was lower than the current market price.

The combined risk on this trade would be $17, with $8 on the buy side and $9 on the sell side. Because the risk is so low, you can see why there is no need for a stop loss. Since you know that your risk is $17, in order to obtain the 1:1 reward, you need a minimum $17 profit. This amount will cover a loss on either side and still give you a profit. Of course, that is the minimum.

The last thing that you must have for a profitable strangle strategy is exceeding volume. If volume is not exceeding expectations and the market is range bound, you will have a full loss on your trade and lose on both sides. In the case of a flat market, or a range bound market, you need to choose a different strategy. That is why it is important to know and be able to use varied strategies. In golf, sometimes you need a putter, an iron, a sand wedge or a driver. In trading, you also need to be able to use the tool or strategy that will get you the best results depending on the market conditions. To read a related article, click HERE.

Now the next time you see the suggestion to place a strangle trade on a news event, you will know that it does not mean to take out the stress and aggression you might be feeling over that smug driver next to you. Demo trade the binary strangle strategy first, but try it out.

To learn other strategies and systems, go to www.apexinvesting.com. Apex Investing Institute offers free education, and free access to the Nadex Binary and Spread Scanner Analyzers. Member traders are invited to trade in the chat rooms, take advantage of trade signal services, have key indicators and access the Apex Forum. The forum content is updated daily and includes over 9000 members. In a supportive learning community of seasoned as well as up and coming traders, traders of all levels learn how to trade Nadex binaries and spreads in depth, as well as futures, forex, stock and options, and gain an edge for successful trading overall.