By Darrell Martin

A strangled butterfly is a more complex butterfly trading strategy. Instead of having one upper, selling contract and one lower, buying contract, there are four contracts. There are two buying contracts and two selling contracts, but they aren’t both upper and lower. They are sandwiched or layered together.

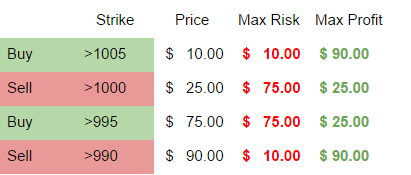

For example, let’s suppose the market is trading at 997.5. All of the following strikes are placed on Nadex binaries expiring at the same time. Here is how the strangled butterfly strategy would be executed:

Total for the whole Strangled Butterfly strategy is a net $30 profit potential and $70 risk.

If the market expires above 1005, at or below 990, or at or above 995, and below 1000, the total potential profit of $30 is reached.

If the market is above 1000 and below 1005, or at or below 995 but above 990, this trade would lose the total possible loss of $70.

Here’s how it breaks down:

If the market closes above 1005 Net +$30 Lose $10 on the 990, make $25 on the 995, lose $75 on 1000, make $90 on 1005

If the market closes above 1000 and below 1005 Net -$70 Lose $10 on 990, make $25 on 995, lose $75 on 1000, lose $10 on 1005

If the market closes at or below 1000 and above 995 Net +$30 Lose $10 on 990, make $25 on 995, make $25 on 1000, lose $10 on 1005

If the market closes at or below 995 and above 990 Net -$70 Lose $10 on 990, lose $75 on 995, make $25 on 1000, lose $10 on 1005

If the market closes at or below 990 Net +$30 Make $90 on 990, lose $75 on 995, make $25 on 1000, lose $10 on 1005

If you would like to learn more about this strategy as well as many other trading strategies, go to www.apexinvesting.com. Apex Investing Institute offers free education, and free access to the Nadex Binary and Spread Scanner Analyzers. Member traders are invited to trade in the rooms, take advantage of trade signal services, have key indicators and access the Apex Forum. The forum content is updated daily and includes over 8000 members. In a supportive learning community of seasoned as well as up and coming traders, traders of all levels learn how to trade Nadex binaries and spreads in depth, as well as futures, Forex, stock and options, and gain an edge for successful trading overall.