By Darrell Martin

You may remember the first few articles about synthetic spread trading.

The first one introduced you to what they were and how they were formed. Then, the next two gave you the long and short – of going long and short – when trading with these newly-formed synthetic pairs. In this article, you’ll learn how to take your synthetic pair and use it to place a straddle trade.

If this is your first time trading spreads or straddles, this article is not for you. Save it and come back to it when you have taken the time to try out a few straddle trades. This is definitely an advanced concept.

As a quick review, when forming your new synthetic currency pair, you have to pull out and use your algebra skills:

You can see in the image above, that the “b’s” canceled each other out, leaving “a” over “c." Then, when you plug in the two currency pairs you are using to form the synthetic pair, it makes more sense.

Let’s say you are making EUR/CAD.

Now you can see that USD canceled each other out, leaving EUR over CAD, and that gives you your synthetic pair.

So far, so good. Let’s get a little more complex.

When you place a straddle trade, you want buy a spread above the market and sell a spread below the market. However, you may remember that in order to form the synthetic pair, you have already gone long and short, so this may cause some confusion for you as you try to wrap your head around this advanced concept.

Just hang on! It will make sense.

The simple answer to how to place a straddle trade is that it really is two straddles which, when they are combined, form a synthetic straddle. For those of you that want more than just the simple answer, those that crave the knowledge, read on.

Using the same synthetic pair as above, the EUR/CAD, you would actually place a straddle trade on the USD/CAD and another straddle on the EUR/USD. The USD would cancel out and you would have a straddle on the EUR/CAD.

Both spreads need to line up with the same expiration times.

Let’s look at this more in depth. To create this straddle, you want to first find a 1:1 reward/risk ratio. This can be done easily by using the Spread Scanner found at Apex Investing Institute.

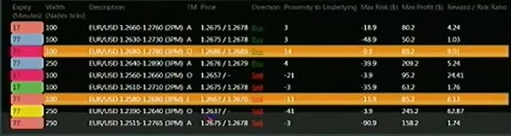

The following image shows an example of an acceptable straddle on the USD/CAD. To view a larger image, click HERE.

This potential USD/CAD straddle would be a risk of about $17, with you buying the upper spread 1.1150-1.1250 for $11, and selling the lower spread 1.1050-1.1150 for $6.

For the next part of this synthetic straddle, you need to place an additional straddle trade on the EUR/USD. This is where it becomes important to make sure that both straddles have the same expiration time.

The following image shows an example of a EUR/USD straddle that meets the criteria to make this strategy work.

Even though this image may be hard to read, the floor and ceiling on both of these contracts is equal at 1.2680. The upper spread contract (1.2780-1.2680) was bought and the lower spread contract (1.2580-1.2680) was sold.

In essence, this creates the synthetic straddle by placing both of these straddle spread trades.

You may remember that part of each of the pairs have to be bought or sold to give us the long or short, depending on the direction you want your trade to go.

For more help and information on trading strategies and systems, or to sign up for courses to help you in your trading, go to www.apexinvesting.com. Apex Investing Institute offers free education, and free access to the Nadex Binary and Spread Scanner Analyzers. Member traders are invited to trade in the chat rooms, take advantage of trade signal services, use key indicators and access the Apex Forum. The forum content is updated daily and includes over 9000 members. In a supportive learning community of seasoned as well as up and coming traders, traders of all levels learn how to trade Nadex binaries and spreads in depth, as well as futures, forex, stock and options, and gain an edge for successful trading overall.