By Darrell Martin

When you began trading, you may have started out trading binary options because they are easy to understand, but as you keep trading them, you may realize that they are hard to do. If you compare binaries to spreads, it may seem that spreads are harder to understand at first, but end up easier to trade.

Iron Condors An iron condor is a strategy that is traded on spreads. When using this strategy, you must understand what premium is. Premium is the difference between where the spread is priced and where the market is currently at or quoting.

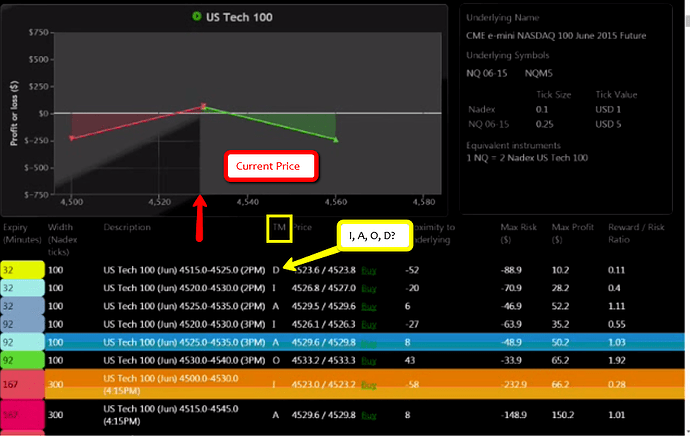

NASDAQ As an example, the following image shows the 4500-4530 NASDAQ spread with a 4:15PM ET expiration. The market is currently quoting at 4529.75. The risk is very controllable. This is not like a binary, meaning that you are going to make or lose everything based on a tenth of a tick or a pip.

This is an In The Money (ITM) spread. This spread example is trading in the money which means that it is trading between the floor and the ceiling of the spread. The following image shows that the gray area is the market. It is currently at 4529 which is right between 4500 (floor) and 4530 (ceiling).

The yellow box in this image is around the letters T M which stands for The Market. Each of the letters that appear in the column below those letters reference the particular strike price in relation to the market. “A” means At The Market/Money and the proximity is low. If it has an “I” or an “A”, that means the market is trading right in between the floor and the ceiling of the spread. If it is In the Market/Money, then whatever the proximity is that is shown on the scanner is the premium you can collect when placing this trade. “D”is for Deep in The Money/Market meaning if you are buying the spread, the market is past the spread’s ceiling or if you are selling the spread, the market is already below the spread’s floor. “O” is for Out of The Money/Market meaning the market is closer to the floor of a long spread and closer to the ceiling of a short spread.

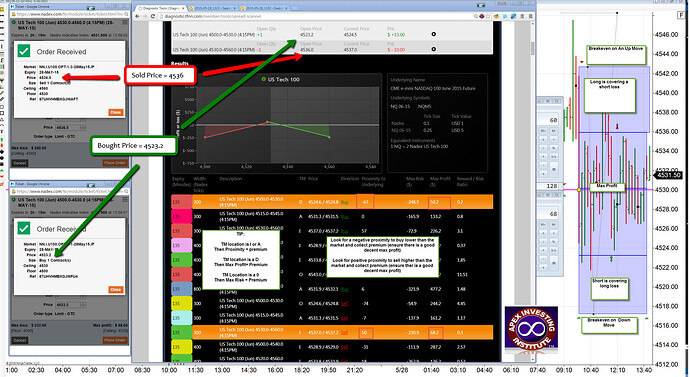

Buy The Lower Look at the orange highlighted spread. You can see that the buy price is 4523.2. If the market is quoting at 4529, that means you can buy the spread six points cheaper than where NASDAQ is currently trading. When you buy this lower spread, that gives you half of your Iron Condor.

Sell The Upper Iron condors are great for range bound trades. When you place both parts, the upper spread and the lower spread, it is like you are encircling an area in which the market will be contained. Since the ceiling of the lower spread must be equal to the floor of the upper spread, for this example you need a spread that has 4530 as its lowest number. The 4530-4560 is the contract you choose to sell at 4536 which is eight points higher than where the market is currently trading.

Why Place This Trade? In analyzing the logistics of this trade, you can say that the risk is high and the profit is low in comparison. You are taking advantage of the premium and buying lower than the market and selling higher than the market. On the buy side, you know that if the market goes up or stays flat, you will make max profit. For this trade, you bought at 4523.2, so you can make up to the ceiling of 4530 for max profit. 4530-4523.2= 6.8 which on Nadex is equal to $68. For every tick that it settles below the ceiling, you are giving up $1 of profit. Remember, you also sold another contract that you can use as a hedge with the long contract. You can suffer a loss of 6.8 points and still break even which will put it at 4536. Going up another 6.8 points, to 4542.8 has you getting all of your money back and still being at break even for both contracts.

What If The Market Pulls Back? It was established that you could make $68 if the market flew up and hit the ceiling on your long contract, but what if the market goes down? You also sold a 4530-4560 contract.

As shown in the image above, you can see that you sold at 4536. If it expires below 4530, you will still make $60. The market can go as far down as 4517 to hit breakeven. This is a massive range of 25 points on the NASDAQ where the market can move. You will make some amount of money if it stays within that range. To figure out this range for any market, take the total premium and times by two. This gives you the number of how far it can move up and down. You will remember for this example trade, there was a potential profit (premium) of $68 on the upper spread and $60 on the lower spread. Add those together for the total of $128. Therefore, the market can move 128 ticks up and/or 128 ticks down. You make $128 if the market expires right in the middle and you would lose $1 for each tick that it moves up or down from the middle.

If you would like to watch the radio show where this trading strategy was explained in even more detail,

To further your trading education, visit www.apexinvesting.com, a service provided by Darrell Martin.