By Darrell Martin

Scheduled economic news may seem like boring news but not for someone looking for a trade opportunity. If there is any consistency to market reaction in movement to the economic news, then a strategy can be chosen and planned for a high probability trade opportunity. Thursday, April 6, at 8:30 AM ET, Statistics Canada will release Building Permit News. With all the drama in the news lately, this seems like pretty boring stuff. However, based on 12 - 24 previous months’ market reaction, using an Iron Condor strategy trading Nadex USD/CAD spreads can make it much more interesting.

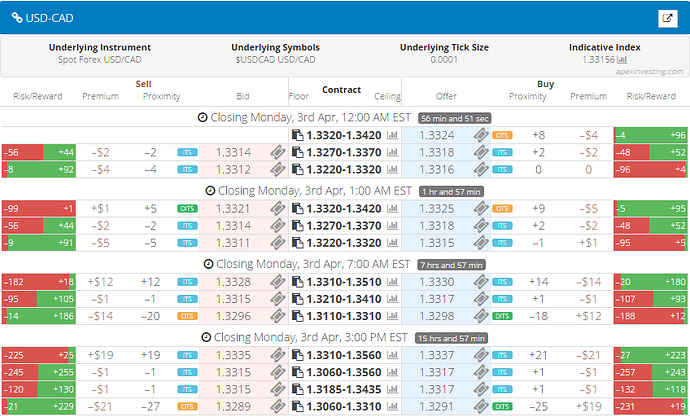

The strategy calls for trading two Nadex USD/CAD spreads, entering around 8:00 AM ET for 10:00 AM ET expiration. The profit potential is $30 or more combined for the trade. One spread is bought below the market with around $15 or more profit potential and with its ceiling where the market is trading at the time. The other spread is sold also for at least $15 profit potential and with its floor where the market is trading at the time along with meeting the ceiling of the bought spread.

All of this can be done in the spread scanner by beginners and advanced traders. The spread scanner will filter down the spreads to the market and time of expiration. Then, the risk reward green and red bars make it easy to quickly see which spreads meet the profit potential criteria. Click on the ticket icons and entry is fairly straightforward. The trader simply needs a Nadex demo account and a free member login for the Apex spread scanner to trade Nadex spreads.

More spreads can be traded as long as the same number is sold as are bought to keep the trade balanced. This market tends to make a move and then pull back after the news is released. On the pullback, depending on where the market pulls back to, both spreads are set up for potential profit, with max profit being where the market pulls back to center between the two spreads. At that point, the bought spread will have profited and so will the sold spread.

Stops can be placed where the market would hit the 1:1 risk reward ratio points of approximately 60 pips above and below from where the market was at entry. A benefit of trading spreads is the capped risk at the floor and ceiling, but also not being stopped out at the floor and ceiling. When stop limit orders are placed, the risk is managed even further.

For free access to day trading education, the spread scanner, and a complete news calendar with trade setups, visit www.apexinvesting.com.