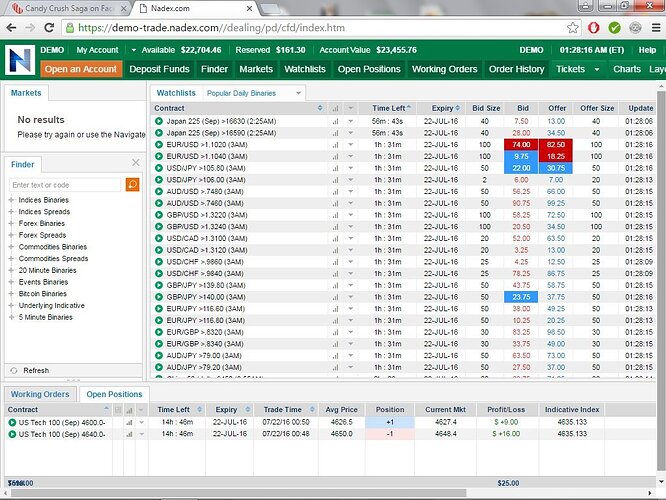

I did an Iron Condor on the US Tech 100 just before 1am in my demo account. One side had $100 of premium, and the other had $85. Remember, this is a SLOW period for the indices. Just 40 minutes later, I was already in profit on both sides!!! I guess the thing to do is look for HUGE premium on both sides when the USA is asleep & reap the benefits.

Good job!. Sometimes you will find the premium better at around this time of the night than at 6pm.

But that is basically the idea… Just sit back and hope the market stays flat and collect all the premium.

That’s what i was telling you the other day Bill. Doing Iron Condors will make u way more profits than doing Iron butterflies and they are less risky. Only thing is u have to av atleast $2500 in you account to do then. I do them on all the indices and i make atleast $20 on each indies with just one contract… I make around $300 more or less a week doing them. Worst case i get out at Break even. I mostly trade futures but wen i don’t have the time to trade futures bcus of work i do Iron Condors. The easiest way to make money while i sleep lol.

Another thing. Don’t get greedy on these and try to get all the premium. Especially on NQ, bcus it moves around a lot. If you have over $30 before market open take it. Because NQ can move 20-30 point in a heart beat and knock you out on one side. Then you run the risk of it coming back and taking out the other side. That rarely happens but it can.

Thanks for your replies. Yes, I agree with the NQ movement. The NQ is what I’ve been studying a lot lately. The one thing I’m wondering is what happens to your p/l if the NQ moves significantly overnight. In looking at the charts on Ninjatrader, I’ve seen NQ move over 30 points in half an hour during the slow overnight period on little volume. I’m thinking since you have a lot of hours until expiration, it probably doesn’t hurt like it would if it moved that far with a lot less time. I want to keep doing this in demo & hope to get varying market conditions overnight. I really like the idea of getting out before the New York market opens.

The problem I was having in the past was I was doing them during high volatility times. It was so frustrating watching the market stay in a good range for a while & eventually break out. I thought iron condors were impossible. These overnight iron condors on the indices are looking great!

I normally set my stop at BE so if it move 20-30 point over night I’ll get stopped out on one side but in order for me to get stopped out on the other side b4 expiration price would have to move back in the other direction 30-40 point to knock me out on the other side in which case i would lose some money. If price doesn’t come back into my spread that is winning b4 expiration then i would win on the other spread and BE. Price coming back into the spread is highly unlikely to happen unless ur trading a really volatile time like when the VIX is around 20-30. I don’t rlly do IC when VIX is that high. It can work in High Volatility times because the volatility is priced into the spread but im just not comfortable doing them in those times.

I prefer going directional in High volatility times with futures. Next week there is a lot of earnings coming out. So just keep that in mind. Try to get 10-15points profit potential on each side @6pm and you should make money b4 the open. I did that on Microsoft earnings a few days ago and made money b4 the open. I normally take $20 or more on each contract b4 the open. The key is to take the money and don’t get greedy bcus the market will make a big move eventually. Just a matter of whether it makes the move pre market or after market open.

It’s hard to tell where your breakeven areas are, because time is factored in. The market can move 20 points, but if it’s still early, your spread price won’t move as much. It’s actually in our favor if the moves happen early on an IC. When you’re getting close to expiration, 30 points really does mean 30 points.

I want to just do this one thing over & over. I love how little the indices typically move overnight, and I’m guessing you can usually find some high premium since they don’t expire until 4:15pm the next day. What surprises me is how quickly you can get some of that premium. It’s like an unfair advantage, which is what I need. I want to grab $30-$50 before the market opens. I really want to build my $$$ up so I can do ICs on all of the indices at 3+ contracts. Then those little gains will start to add up!

I’m having a HORRIBLE time trading the news. The market doesn’t move far enough to do the far out OTMs. If it does move far, it’s always toward expiration, which means it has to move even farther. The other OTMs cost too much, or the “middle ground” ones won’t give you enough profit. I can’t do directional trades. No matter how much studying & planning I do, it always goes the opposite direction. I think my best bet is to do ICs on the indices before the market opens. I just wish they didn’t cost so much. If we had the money put INTO our accounts on the sells (like I’m hearing about regular options - premium collection) I’d have it made!!! I’d do the sell first, then the buy & it wouldn’t cost much if anything from my actual account. Of course everything else would still apply on the IC.

I don’t care about the price on the spread. I use the spot trigger to get me out when the indicative price gets to my BE price on the chart, which is normally 20-30 points away for where the market was @6pm. Time become less of a factor as the price moves towards the center of the spread so keep tht in

The only reason I care about the price on the spreads is it’s preventing me from doing multiple contracts. Right now it’s preventing me from doing anything.

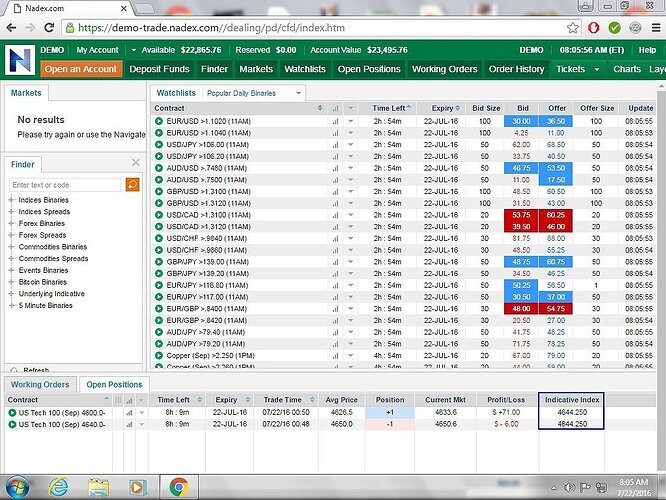

I’m demoing this strategy every day. Yesterday morning I was up about $20 combined on both sides at 8am. By 9:30 I was down over $50 on one side. I had a temporary insanity moment & forgot that I have to do a stop order through apex. I did a limit order to get out when the bad side was at breakeven (including commissions) and it took it out immediately. I took a $53 loss on that side. Then it reversed & the other side was eventually down over $50. Luckily it turned around & I won $83 easily on the other side. This one worked out, but it could’ve ended badly. I don’t see a real foolproof way to do this. I’d like to get out with profit around 8am. It’s not always going to be in profit, and no matter what you do, the market could make you lose overall.

Right now I’m in a demo trade with $106 and $111 premium. My breakeven points are pretty wide. I can definitely see some holes in this strategy, just like any other. I also checked the binaries to see if I could get some OTMs near the breakeven points in my spreads. Of course I couldn’t. Not even close. The market would have to move really far one way to get a good price on the other side.

Nice Bill! Keep us updated, great job