by Darrell Martin

What trader doesn’t like a nice, fast clean in-and-out scalp? And, a nice fast clean in-and-out big scalp is even better. This is exactly what one of Apex Investing Institute’s own R&D test traders, Lori Hale, has found with this play. This trade employs the slingshot strategy specifically off of settlement or a deviation level.

First, the slingshot strategy rules involve a beginning of a trend, then the first bar with a wick. However, with this strategy you can use the later bars with wicks as well, as long as they qualify. This can be a candlestick bar with a wick or an OHLC bar with a wick/leg, whatever you want to call it. The wick must be somewhat significant, not just two ticks. Normally, the entry is one to three ticks after the high/low of the sling bar in the direction of the trend, not the pullback wick, but the trend.

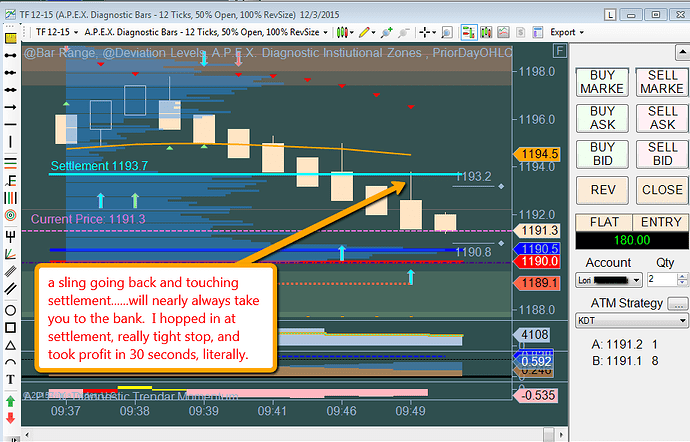

For this juicy little trade though, the entry changes a bit. In this case, the bar with the sling will be the second through fourth bar passing settlement or a deviation level, specifically the .5 or 1 deviation levels not the first bar with a wick. You put your entry one tick past settlement or the .5 or 1 deviation level in the direction of the trend. Then get ready for the slingshot. Should price pullback and one of those bars gets a wick and hits your entry, there is a high probability the trade will shove off settlement or the deviation level and hit a 10 tick or more profit for you.

In the chart example above, you can see an example of a successful trade using this strategy. Be sure to set your stop just four ticks behind settlement or the .5 and 1 deviation levels. For this trade you want a tight stop, just in case price turns around. If it does, your tight stop won’t be too painful.

As Lori describes it, “This beauty of a trade tends to be a direct bus to the bank, fast and easy.” Price seems to pull back and take a nice shove off settlement and/or the deviation level then launches to continue with the trend.

To learn more about this strategy and how to trade futures, forex and CFDs as well as binary options and spreads with Nadex, go to www.apexinvesting.com. Nadex is a US based CFTC exchange and can be traded from 49 different countries. As always, please remember past performance does not guarantee future results.