By Darrell Martin

Payout is not simply a return on your investment. It is a return on risk. If you have a 70 percent payout, it is not as good as it sounds. This is saying that you can make 70 percent Return On Investment (ROI), but it is also saying that the most you can make on a $100 risk is $70.

Some brokerages may tell you that they only allow you to make 70 percent payout and you may think that sounds fair enough. However, when you take the time to think about it, is it really a good deal?

It is always a good idea to have the risk/reward ratio be 1:1 or greater with the probability proportionate to the reward. If the probability is 50/50, then the risk/reward should be approximately 50/50, less the bid/ask spread.

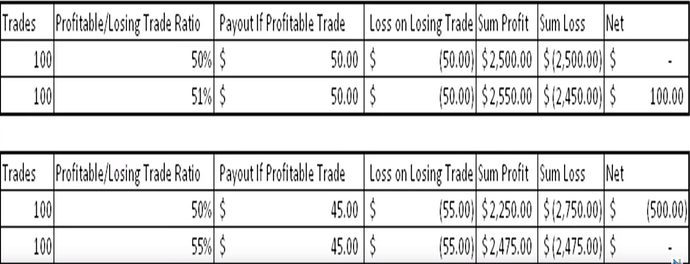

Using the following chart, let’s consider some examples.

If you did 100 trades with 50 profitable and 50 losing, not counting fees, you would be at breakeven. If you increased the risk reward ratio to 51/49, you would be profitable $100. The third line show what happens if the payout is lowered from $50 to $45. You still have the same ratio, but with a lower payout, you are net negative. However, if you increase your winning percentage to 55 percent keeping the same payout, you return to breakeven.

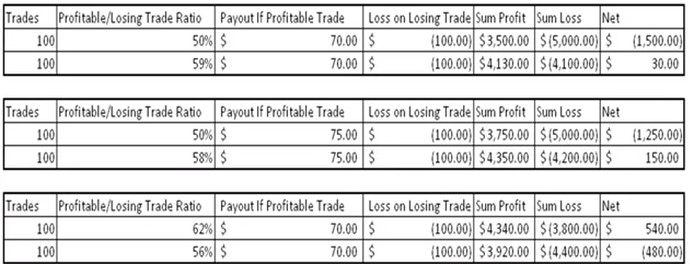

This chart offers some other scenarios. This could be what you might expect when trading with the prospect of a $70-75 payout on your $100 risk.

The top line shows the same 50 profitable and 50 losing trades, but your payout was $70 on your $100 risk, you would be down $1500. Fifty-nine percent of your trades need to be profitable for you to be close to breakeven in this scenario. The next two lines show what happens if the payout is $75 on $100 risk.

The bottom two rows give you one more scenario showing the small difference between 62 percent and 56 percent still with a $70 payout.

You must be aware of the massive impact that this is, not just the return on investment. When you hear 70-75 percent return, you must understand how that relates to the amount you have risked. It is very important to put these numbers in your favor on the trades because your ratio profitable trades have to be much higher if your payout on profitable trades is lower than a 1:1 risk/reward ratio.

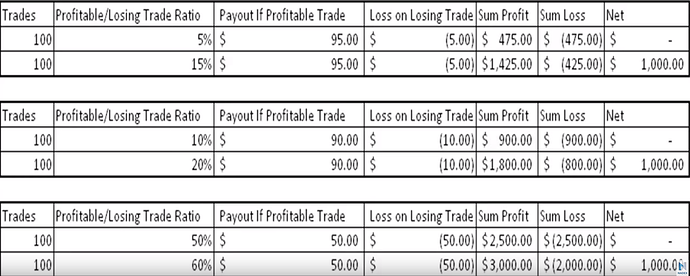

Tiered strikes offer advantages. The following image gives examples of percentages of profitable trades and the corresponding payouts for those trades. You can see how a small risk can remain at breakeven or be profitable with a higher payout available with tiered strikes.

If you were profitable only five percent of the time but your payout was $95 on a $5 risk, you would be at breakeven. Jump that up to being profitable 15 percent of the time and you come out ahead $1000! The other rows show other scenarios.