By Darrell Martin

A fair guess about most traders would be that one of the aspects of trading that enticed you to even give it a second look was a chance to make money.As you go about your day-to-day trading, you may shake your head some days and in the words of Jerry Maguire say, “Show me the money!”

There are times like that, but there are also times when everything is working according to your plan. For the times when you may wonder where the money is hiding, there are three basic things to look for, especially when trading spreads. However, this could apply to any kind of trading.

Where Do I Get In?

The examples in this article will focus on spread trading. The first thing to do is to look at your spread trade entry. Where is the spread trading at? Figure out where your profit target is. Where do you think the market is going to go? You need to know how much you would make if you sold the spread at this point and bought the spread back at that point.

Next, what is your risk and your reward? You have to know what your risk is based on a stop loss or a no stop. Also, you have to know what your reward is going to be if you sell at this price and buy back lower or buy at this price and sell back higher on each trade.

The third thing to know that will help you make money is how much time are you giving your trade to work and is it enough? This takes a careful look at what the market is doing and what you expect it to do. Will it make the expected move in 10 minutes or will it take all day?

The Set-Up

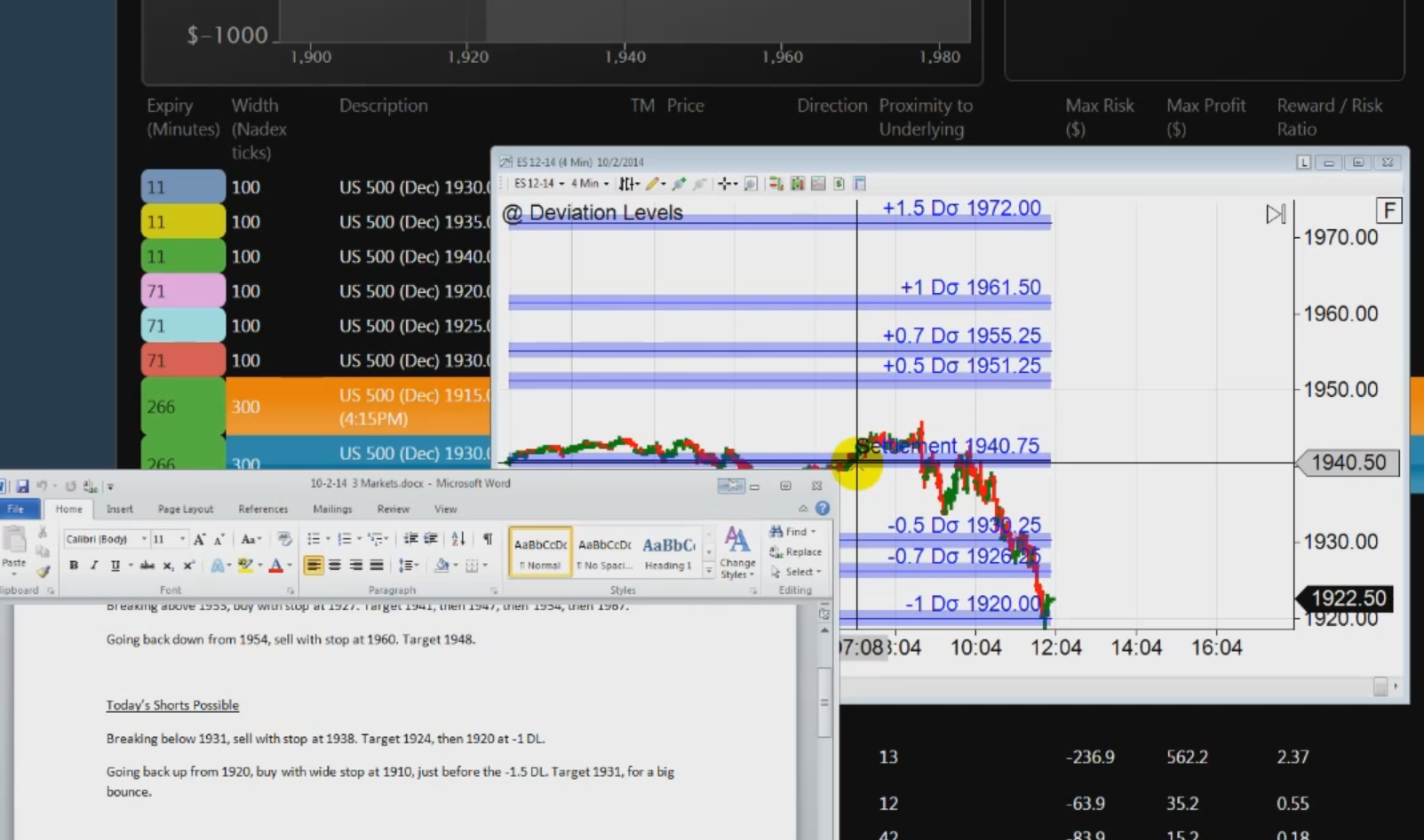

As you can see, it says that if it breaks below 1931, sell with a stop at 1938. The first target is 1924 with a second target set at the -1 Deviation Level of 1920. Then, if it hits 1920, buy with a wide stop set at 1910 which is just before the -1.5 Deviation Level. Set the take profit target for 1931 for a big bounce.

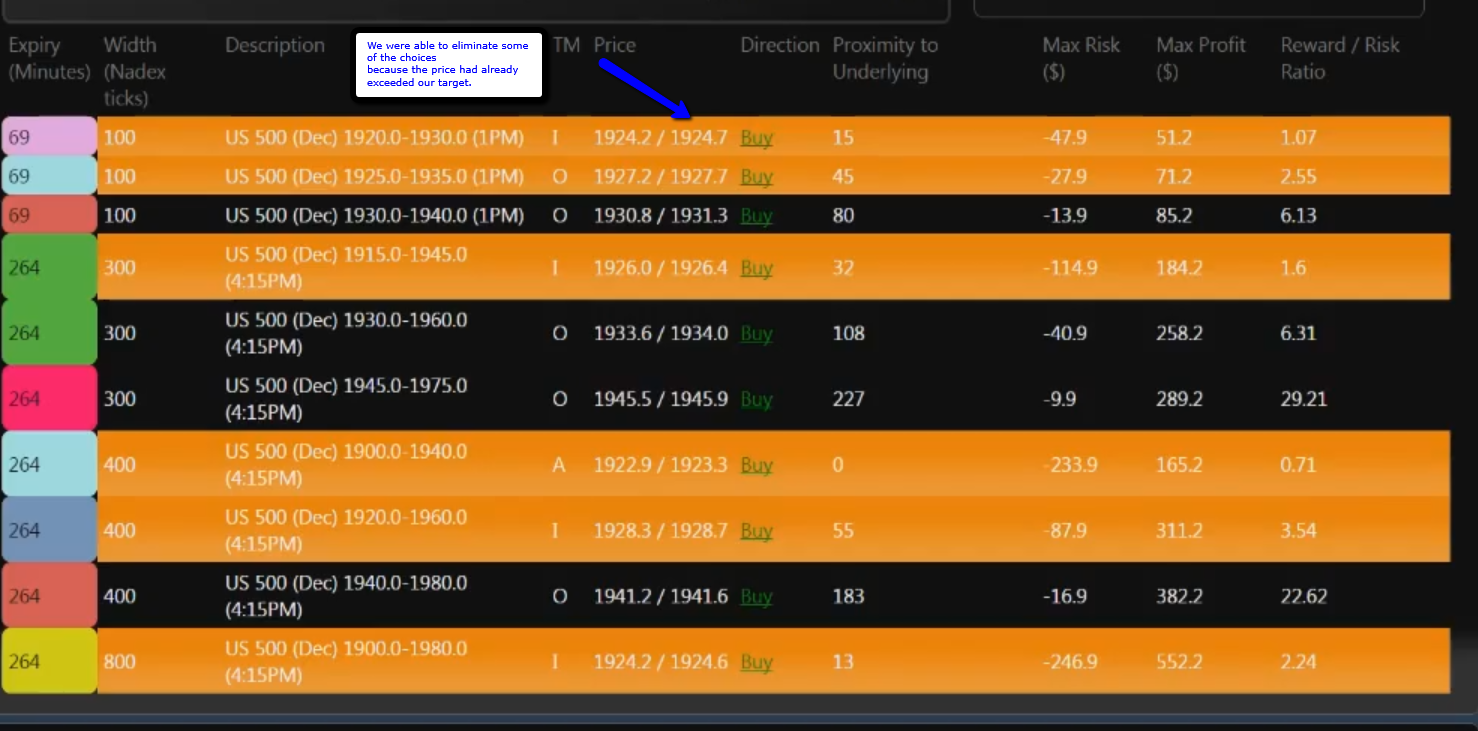

With a trading plan set up like that, you know exactly what to do and what you are looking for in your spreads. This makes it much easier to ascertain if each possible spread meets the above risk, reward and time questions. The challenging part about trading options is that you have choices. As you ask yourself the questions about risk, reward and time needed to be right, it will help you narrow down your choices. This following image shows an example of narrowing down the possible choices because some spreads had already exceeded the rebound target of 1931.

How To Use

By using the spread scanner, it was easy to narrow down the search for a trade entry that answered the questions that would help you make money. Another thing that comes into play is your account size. This is always an important part of the decision making process that goes into placing a trade.

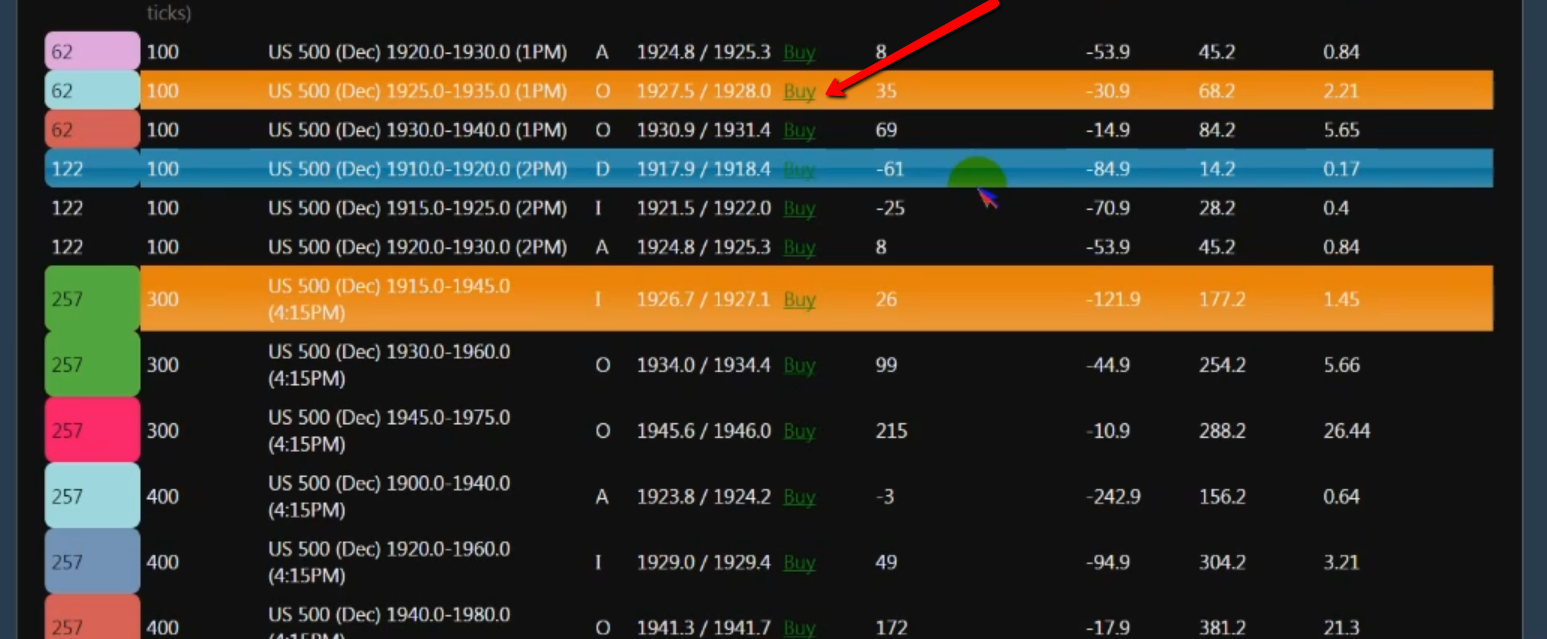

After looking over several contracts, you determined that the US500 (Dec) 1925.0-1935.0 (1PM) would be a contract that you could trade. Let’s look at it closely.

You realized that each contract was a $30 risk and offered a $30 reward because your target was a three point move. That gave you a 1:1 risk/reward ratio. You don’t need a stop loss because you’re only risking $30. After looking at how the market had been moving, you felt that an hour was enough time for the market to move three points, so you bought 10 contracts at 1928.0. You then set your take profit, and you didn’t have to worry about it.

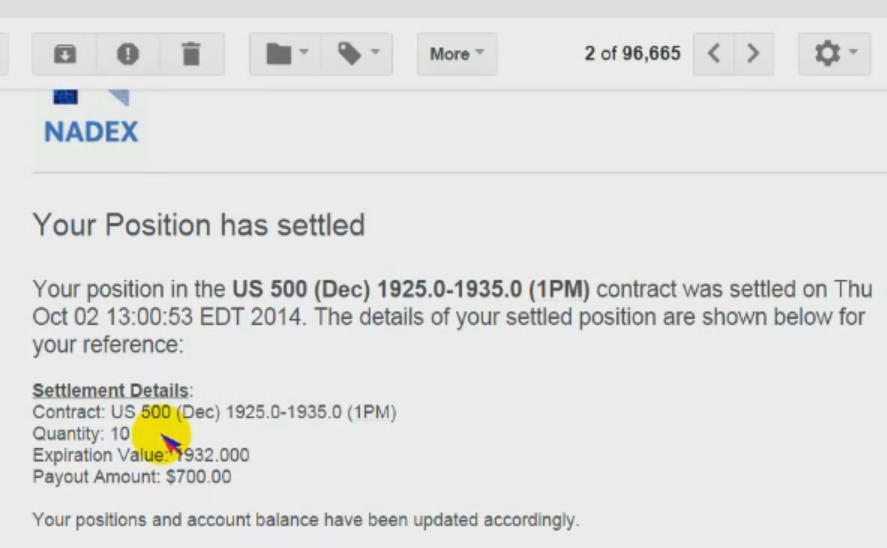

An hour later, you received the following message in your email

On your 10 contracts, you risked $300 and made $400 by simply taking the time to have a plan that answered some simple questions:

- Where is the spread trading at?

- What is your risk and your reward?

- How much time are you giving your trade to work and is it enough?

If you would like more help in your trading education, go to www.apexinvesting.com.