By Darrell Martin

Most traders, investors and even the uninitiated are aware that US stocks moves in pennies: 100.01, 100.02, 100.03. And every penny move is worth just that – one penny.

However, trading can seem very daunting when you starting hearing words like ticks and pips. To get you started, it’s important to understand that a penny is a tick or a pip. One tick or a pip is the smallest standard increment move something is quoted. Since US stocks are quoted in $0.01, then you could say a tick on a stock, like AAPL is .01, or a pip on the GLD is .01. After all, when you buy Gold you are buying (or selling) dollars. Once you understand that the word pip and tick just mean minimum move, it makes things a little easier.

The next challenge is in trading forex. When you trade forex, you have to deal with currency conversion. The FX pair may be quoted in JPY, GBP, CHF, USD etc. This makes many traders very leery to trade forex, as they just want to buy at one price and sell at another price and know the profit or loss results, without any calculations beyond simple addition or subtraction. Forex is quoted in pips but, depending on how the forex pair is quoted, it may be in different currencies. Yet forex is one of the best trending markets because it allows traders to trade at night and gives traders leverage with smaller accounts.

Futures can be even more challenging as you have varying tick sizes. There are instruments that tick in 1/8, .005, .10, .1, and even others tick in whole points. And every instrument can have a different dollar amount per tick. For example, ES, (The S&P E-mini 500 Futures) ticks in .25 with a value of 12.50; TF (The ICE Russell 2000) ticks in .1 with a value of $10 per tick; (CME’s Comex Oil Futures) CL ticks in .01 with a value of $10 a tick, and NQ (CME’s Nasdaq 100 Futures) ticks in .25 with a value of $5 a tick.

So what is a simple solution without all the confusion?

The Nadex exchange has made trading futures and forex extremely simple with the Nadex Spreads. On Nadex, everything moves in an increment of 1. So you can remember a tick or pip is 1 on all instruments. Now, the decimal may be in a different place, but all the indices, futures, and forex pairs all move in an increment of 1. Whether its 1 or .1 or .01 or .001, or .0001 for that specific instrument, they all move in an increment of 1 tick/pip. And every single instrument has a value of $1.00 per tick.

Nadex stands for North American Derivatives Exchange and offers spreads on numerous underlying markets in the stock indices, commodities, and currencies. The prices are derived from the underlying markets and like anything else you are used to trading, if you think the market is going to go up, you buy, and if you think the market’s going to go down, you sell.

You have 100 percent defined risk (no margins call worries), you don’t ever have to get stopped out and your risk will not increase. You have effective and massive leverage (unlike stock). You can trade Sunday through Friday, days and evenings, and more. One of the things that makes it easy to trade Nadex spreads is every tick or pip is worth $1.

No matter if the underlying market is the E-mini S&P 500, or a commodity like Gold, Oil or Corn, or a currency pair such as GBP/JPY or AUD/USD Spot Forex, the tick/pip move is always going to be 1.

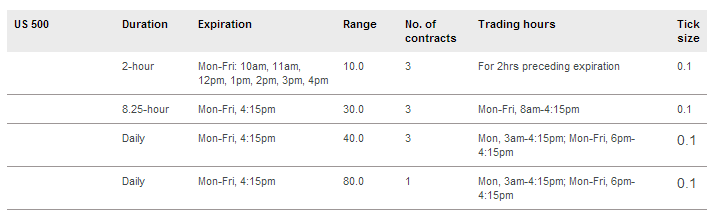

When you trade on Nadex, the value of that tick or pip always going to be $1. As stated earlier, a tick on the E-mini S&P 500 Futures is worth $12.50 and moves in .25 increments. On Nadex, the corresponding market is the US 500 and its lowest increment is .1, moves by 1 and is valued at $1.

So, if you want to trade a 100 tick wide spread, its total value is $100. You can trade as many contracts of a Nadex spread as you like, 1, 5, 10, 50, or 100; whatever is appropriate for you, your account size, and risk management.

View the image of the US 500 (ES) contract specs here

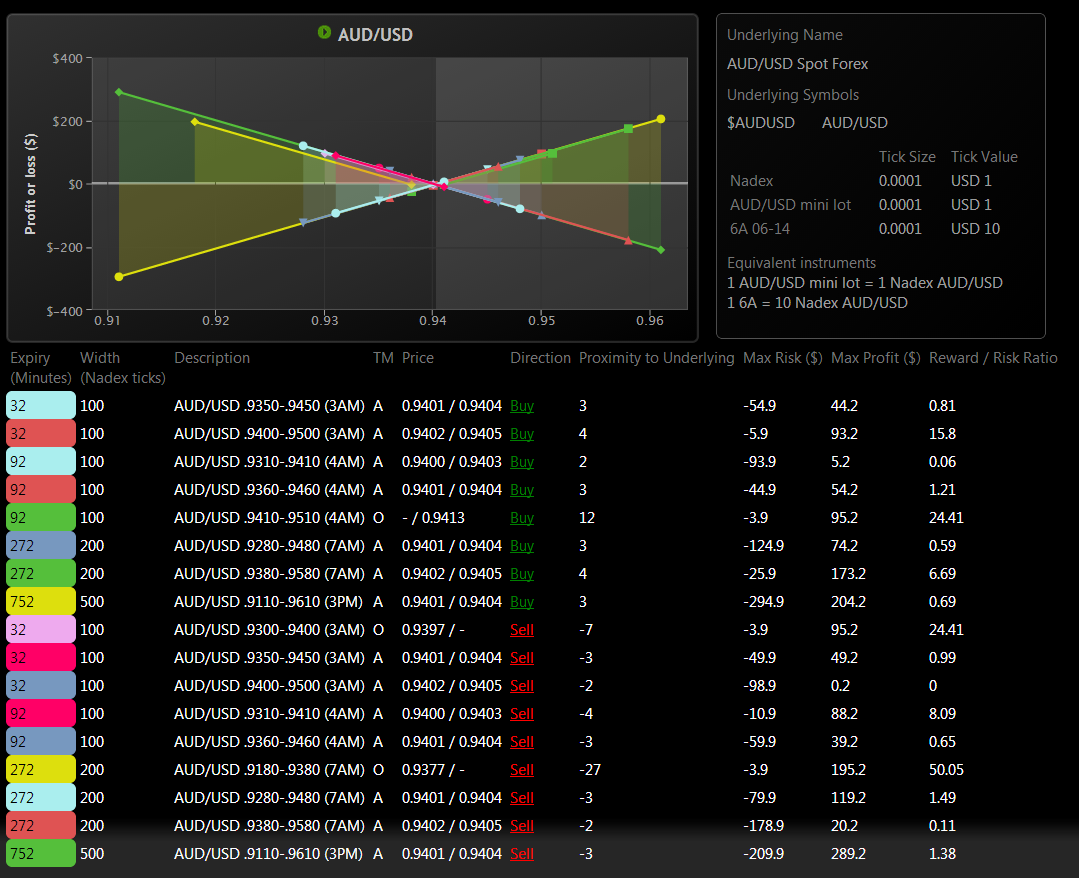

Below, you will see spread information for all the available Nadex spreads for the currency pair AUD/USD. APEX Investment provides the Spread Scanner for traders to see all the necessary tick size and value information for trading a Nadex spread at a glance.

Looking to the right hand side, the underlying market name and symbols are listed, as well as the tick size for each market and its value. If you wanted to hedge a trade in the AUD/USD spot forex, it also gives you the number of equivalent Nadex spread contracts to 1 mini lot of AUD/USD.

View the image of the spreads scanner here

For more information on Nadex spreads and how to trade them and get access to the free spread scanner, go towww.apexinvesting.com.

To practice trading spreads on a free demo account go to www.nadex.com and click on trading demo trading account.

See article on Benzinga