By Darrell Martin

As expiration time nears, you may have noticed there can be extreme price swings when the underlying market price is trading around the binary option strike price. Due to the All or None feature of the binary at settlement, the binary must settle at either 0 or 100. This can potentially result in some dramatic price swings as the binary gets closer to expiration from very little price movement of the underlying market.

Picture the binary price being pulled between the extremes of 0 and 100, knowing that the binary can only settle at one and not somewhere in between. As time gets closer to the expiration, it is as if the binary pricing is being squeezed like a top, waiting to explode from the littlest price movement of the underlying, when the outcome is still in question.

If it’s obvious that the binary buyer will receive the expiration payout, the price of the binary will be quoted close to 100. The binary pricing is this way because the underlying price is far enough above the strike price relative to the time remaining until expiration. The market place assesses that there is little probability the market price will fall below the strike at expiration.

The opposite is true if there is a high probability that the binary seller will receive the expiration payout. In this case, the binary price will be quoted closer to zero. This is because the underlying is far enough below the strike price with little time remaining, there is only a minimal chance the market price will rise above the strike at expiration.

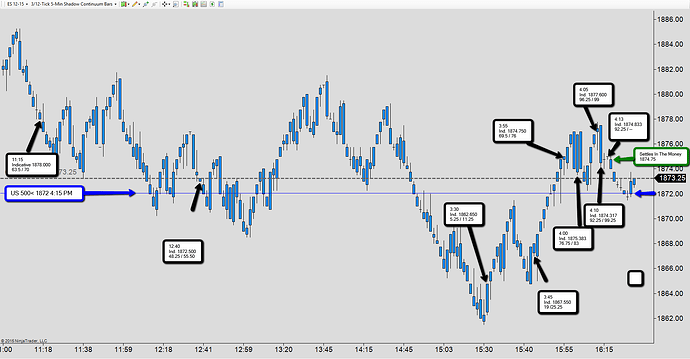

Look at this example of an ES chart. The US 500 binary >1872 contract has an expiration time of 4:15 PM. Starting five hours before expiration, the indicative was at 1878 with the bid/offer at 63.5/70. As time goes on, the market moves up and down relative to the underlying price to the 1872 strike. This illustrates the value of time. When you are trading binary options, your premium is based on the value of time till expiration and the differential between the underlying price and strike. As it gets closer to expiration, the binary pricing can be quite sensitive to underlying price movement when the binary outcome is still in question.

You can see at 3:30, the binary buyer probably would have exited the trade in order to cut some of the loss.

The underlying and the indicative continue moving up and down. With this movement, the binary price fluctuates until expiration when the contract settles in the money. Because of the way binary options are settled with an All or None settlement at expiration, the $100 would go to the binary buyer in this example and the $0 would go to the seller.As the binary price swings and is getting squeezed until it is about to pop from the movement of the underlying, at expiration the binary option will settle at 0 or 100.

Futures, options and swaps trading involve risk and may not be appropriate for all investors. Past performance is not necessarily indicative of future results.