I would like to share the touch strangles that i have been testing. From what i have seen futures have hit profit more than forex pairs but require more risk.

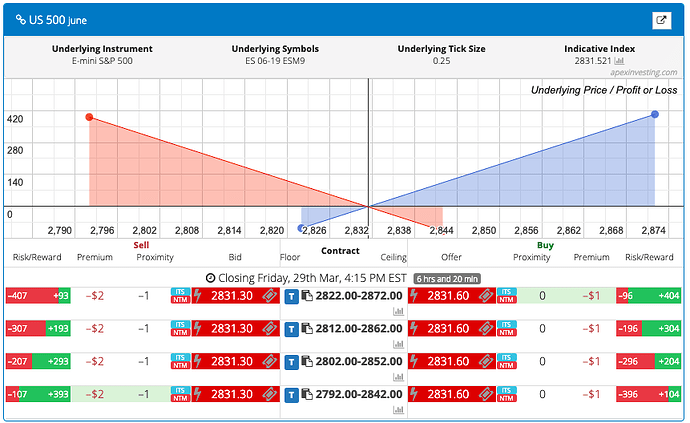

The idea is to buy and sell touch brackets waiting for a trend to occur during the week so that one bracket settles at the floor/ceiling and the other cover the loss of the opposing trade with a set profit defined.

Pros

- Touch brackets have a weekly expiry. So you have all week for the trade to occur in contrast of spread that are daily.

- Is a set and forget trade. Does not require for you to monitor the trade since the define risk/profit is set already

Cons

- You could loose both sides of the trades if the market reverses before your profit is taken. There is a chance you can get in again at the price you got in but will require double the profit.

- Requires more risk than spreads but you have more time for it to go in your favor.

- The bracket will expire automatically at the floor/ceiling unlike spreads.

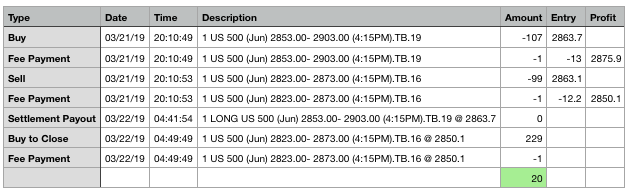

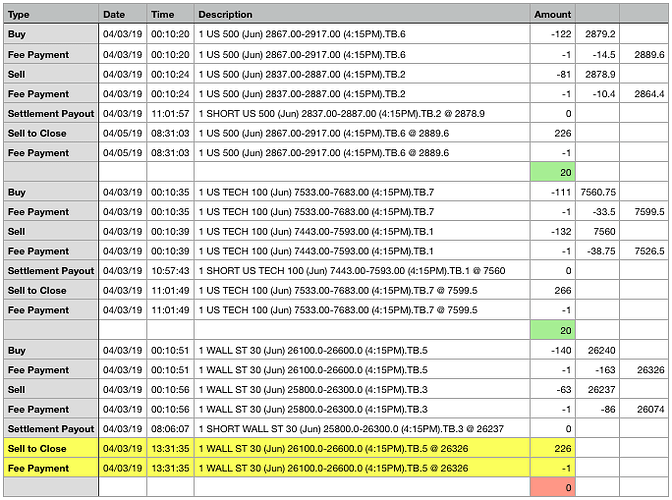

Here is an example with a $20 profit. I calculate the profit adding the risk of the opposing trade plus fees and the profit that i would like to obtain. That would be my profit price that i would place on nadex for it to close. Let me know what you think.

You spent $208 to make $20. Some would say that’s not very a practical way to make money. However, money is money.

You have to keep doing this over a period of time to see if it consistently works. So far, so good.

It would be nice to have more Touch Bracket posts here, but I’m not sure if it’s likely, unless individuals (like yourself) make the posts. Hopefully, you can get this started.

Considering how far the market has to move for you to make any gains with this I’d consider either iron condors or straddles, or non directional binary trades instead. Touch brackets are best for directional trades. That said, if what you’re trying gives you the results that you’re looking for then by all means test it and see what you come up with.

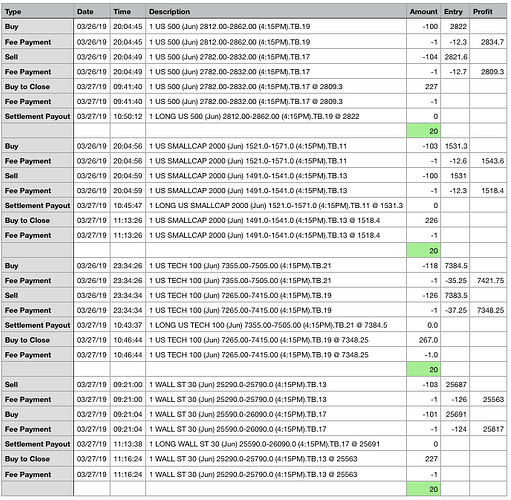

This is what an ideal day looks like!

Interesting. This is good to see. There needs to be more TB posts on this forum.

I have some questions.

1 - Each TB market has 4 choices. How do you know which two TB’s to choose for your strategy?

2 - It seems most of your TB trades are initiated in the evening for next day results. Is there a reason for this?

3 - It seems more like Hedge trades than Straddles. Is this correct?

4 - Are these Nadex trades Live or Demo? (Live and Demo numbers are frequently not the same.).

5 - You’re right about the risk differences between TB Indices and TB Forex. Have you tried any Forex TB’s? If so, is your strategy the same as with the Indices?

Keep it up and see how long your strategy works. If it works more than twenty trading days (roughly a month), then you are on to something potentially great.

1 - Its the top buy and bottom sell. That is the bracket that has the lowest risk which is what i need.

2 - Yes. I usually see after nadex opens if there is an entry if not i wait till after market opens the next day to get in. Im looking to see an even risk on both trades $100 for US500, SMALLCAP, and WALLST and $120 for USTECH.

3 - I think its a strangle = hedge.

Strangles are good for volatile markets when movement is expected, but direction is unknown. You are expecting one side to lose. Determine your risk and then make up for the amount lost on one side - Martin

4 - Using demo

5 - In Forex even tho they are more cheaper about $50 per side i dont get the move that futures give in one day so they are too wide. Maybe with expected moves with news would be good but i have not tested and i think spreads or binaries would be better.

The scanner is great for entries!

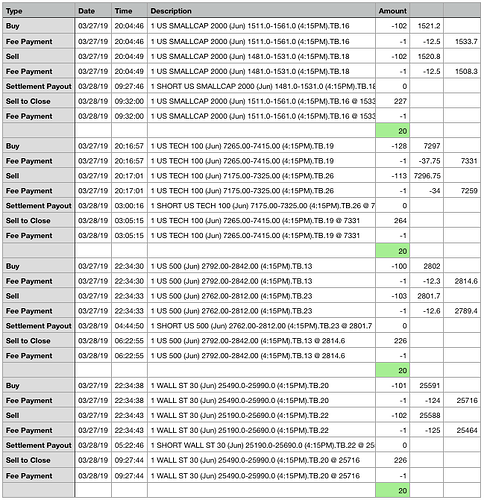

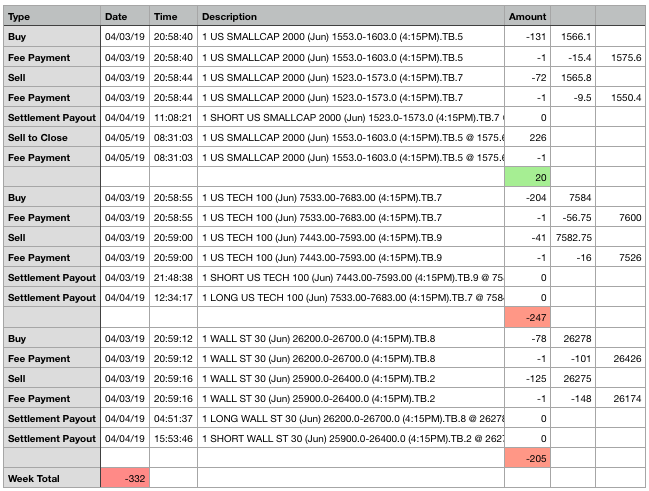

The trades on yellow were not added since market never got to that price yet they got filled somehow in demo. Which leave us with $61.49 for the week.

1 and 2 are somewhat connected. You are using the lowest risk on both sides and having the risk be close to the same on both sides. This seems to provide the ability to do an actual Strangle on a Touch Bracket. (I’m not sure if I’m saying this right.)

3 - I don’t know why I said Straddle. Must have been a misread.

4 - Demo is good for practice, but often Demo and Live can be notoriously different in Nadex. If you go Live, keep us posted on your results.

5 - Yes, there seems to NOT be as much TB Forex movement within one day, unless news and events occur.

In addition, I mentioned that you should do your strategy twenty trade days in a row. This is mostly correct, but no method will ever work every time. There are simply too many factors involved. I guess the best way to determine success is by what your overall profit is by the end of the week or month or year.

Judging by the number of views you’ve had since creating this post, there is a definite interest in what you are doing. Other readers should comment or ask questions on this subject matter.

Again, whether Demo or Live, keep us posted on your results.

Another mysterious fill colored in yellow that i decided to exclude.

We hit the red on Thursday and i was not able to place trades on Friday so that leaves us with $-332. The strategy has small wins but one loss can wipe all the gains.