By Darrell Martin

Two news events are scheduled for Canada on Thursday, July 6, at 8:30 AM ET, Building Permits and the Trade Balance. The numbers for both are forecast to go down. Either way, with the right strategy, this scheduled news can be traded. It’s always unknown which direction the market will go in response to news. For that reason, a trader must use a strategy that can profit regardless of market direction.

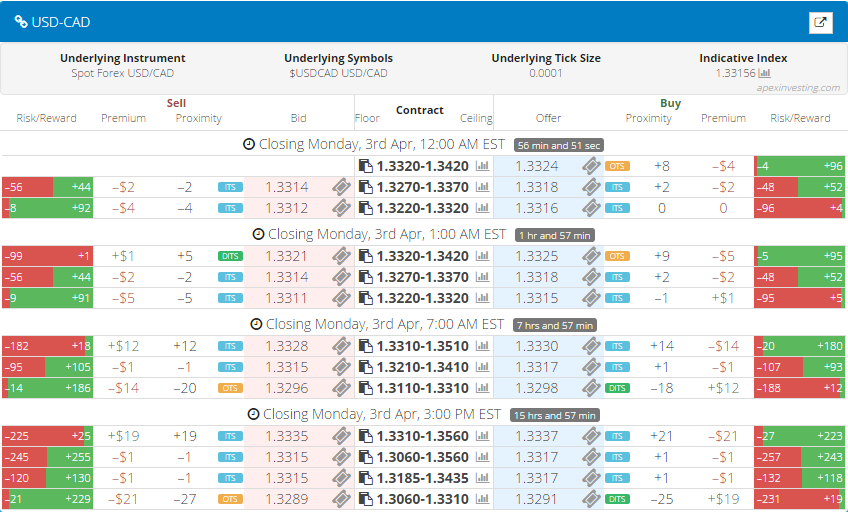

The market tends to move and then pull back in response to these news events. For that kind of movement, an Iron Condor strategy trading Nadex USD/CAD spreads makes for a high probability trade. This strategy includes two spreads, one bought spread trading the bottom range of the market, and one sold spread trading the range directly above the bought spread. The ceiling of the bought spread should meet the floor of the sold spread and be where the market is trading at the time.

Each spread should have a profit potential of at least $15 for a combined minimum profit potential of $30 or more for the trade. If the level of implied volatility in the market is high, then more profit potential will be available in the spreads. If the level is low, then there may be very little profit potential, in which case there is no trade.

The reward potential in every spread can be easily seen at a glance with the color-coded red and green bars and numbers while using the spread scanner pro for entry. The browser based platform makes for easy immediate entry and more accurate trade execution by providing traders all the information for trading any Nadex spread long or short. The spread scanner pro makes trading spreads easy to learn for beginners along with every bell and whistle the advanced trader could want for quick strategy decisions and trade entry.

This Iron Condor trade can be entered as early as 8:00 AM ET for 10:00 AM ET expiring spreads. Risk is capped at the floor and the ceiling of the spreads but risk can be managed further with stops. For this trade with a $30 profit potential, if the market takes off and moves 60 pips above or below from where it was at entry, it will reach the 1:1 risk reward ratio points. That is where to place stops. As long as the market settles somewhere within the 60 pip range of 30 pips above and below from where it started, the trade will profit. With time expired and the market settled between the two spreads, max profit is realized.

For free access to the spread scanner pro and free day trading education, visit www.apexinvesting.com.