By Darrell Martin

Statistics Canada will release the New Housing Price Index on Thursday, August 10, at 8:30 AM ET. Released monthly, the index shows the change in the selling price of new homes. This is a leading indicator for the health of Canada’s housing market. In the last two reports, the actual was higher than forecast, which is good for currency. There is a strategy to trade the scheduled news event, whether it comes in higher or lower and regardless of which way the market moves in reaction.

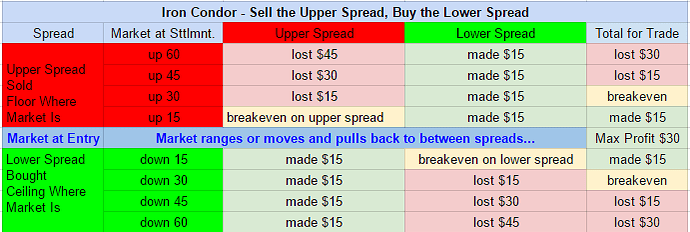

With the Iron Condor strategy and trading Nadex USD/CAD spreads, the market can move up or down and the trade still has potential to profit. What this strategy needs is the market to pull back after a move in reaction to the news, or just range around where it was at entry. Both can be typical after this news is released. Entry can be as early as 8:00 AM ET. One spread is bought below the market and one spread is sold above the market. The ceiling of the bought spread meets the floor of the sold spread and should be where the market is trading at the time.

Each spread should have a profit potential of at least $15 for a combined potential of $30 or more for the trade. The setup creates a range where the market can settle at expiration and profit, as long as it is in the range between the breakeven points. For this trade with a profit potential of $30, the range is between 30 pips above and below from where the market is at entry. Stops would be placed using the Stop Trigger ticket in the Apex Spread Scanner Pro, where the market would hit 60 pips above and below from where the market is at entry. The chart below shows the profit and loss for each spread as well as the total for the trade, based on 15 pip moves up and down from where the market is at entry.