By Darrell Martin

It is all about supply and demand right now in the housing market. Not enough supply to fill the demand. People are holding on to their homes and not moving. US Existing Home Sales for May 2017 will be released Wednesday, June 21, at 10:00 AM ET. This produces a trade opportunity trading Nadex spreads for an Iron Condor setup.

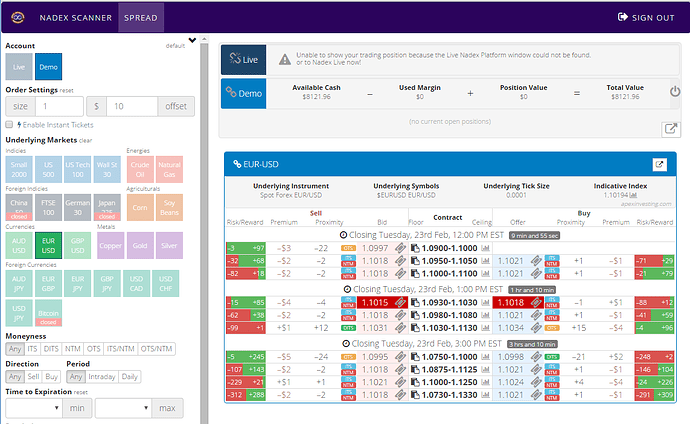

Trading two Nadex EUR/USD spreads, buy one below the market with $15 or more profit potential, and sell one above the market with $15 or more profit potential. Nadex spreads have a ceiling and floor noting the range of the market that can be traded long or short. There is no profiting or losing past those points. If the market goes beyond the floor or ceiling, the trade is still active until the trader exits or until settlement, but the risk and profit are capped. The ceiling of the bought spread should meet the floor of the sold spread and be where the market is trading at the time. The trade can be entered as early as 9:00 AM ET for 11:00 AM ET expiration.

Beginners and advanced traders can find an advantage in trading spreads using the spread scanner. For example, in this trade to easily find the desired spreads, the trader need only to look at the risk reward columns for each spread in the spread scanner. Visually, $15 or more of green space should be available in the reward bar. For advanced traders, multiple contracts can be traded, immediate entry is available, and multiple markets as well as expiration times can be seen in one screen.

For this trade, stop orders should be placed. Typically, for this kind of news, the market can make a move and then pull back. The market can also stay in a range and the trade can profit. The trade bought below the market and sold above the market. The market returning to right between the spreads, at or near settlement, is ideal and brings the greatest profit. In the event the market takes off, the stops will close out the trade at a 1:1 risk reward ratio. For this trade, those points are 60 pips above and below from where the market was at entry. The market settling anywhere in between the 60 pip range, between the breakeven points of 30 pips up and down from where it was at entry, will bring in profit.Visit www.apexinvesting.com for free day trading education and for access to the scanner.