By Darrell Martin

Thursday, November 17, at 8:30 AM ET, a number of economic news reports are scheduled for release. US Building Permits, Housing Starts, Consumer Price Index and Philly Fed Manufacturing are among them. With this much news, the market is sure to make a move.

Using the right strategy and instrument for this expected move can make for a high probability trade. Typically, with this kind of news the market will react, moving and then pull back.

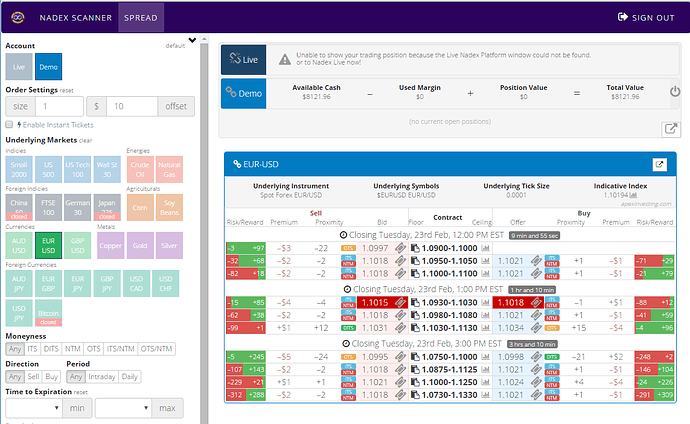

An Iron Condor using Nadex EUR/USD spreads is a neutral strategy. The trade makes profit on the pull back of the market. To set up the strategy, two spreads are traded, one short and one long. The ceiling of the long trade should meet the floor of the short trade and be where the market is trading at the time. The trick is to find both spreads with a profit potential of around $15 each, making for a $30 or more combined profit potential. Finding spreads with that reward potential means buying below the market and selling above the market.

Therefore, the trade will profit after the market moves and it pulls back close to or where it was at entry. If the market moves 30 pips up or down depending on exact entries, the trade will be at breakeven points. Then, pulling back to between the two spreads would be max profit. If the market settles anywhere between the two breakeven points, some profit is made.

Stops should be placed in the event the market decides to take off and not pull back. Nadex spreads have defined capped risk and stops further manage risk keeping it realistic. The 1:1 max risk reward ratio points are where the market would hit 60 pips above and below from where it started.

The trade can be entered as early as 8:00 AM ET for 10:00 AM ET expirations. Using the spread scanner, spreads can be chosen based on their reward potential easily seen by the green bar and number value listed in that column for each spread whether buying or selling.

The spread scanner is available free to all traders trading Nadex. Tutorials are available and it is quick and intuitive for learning and makes trading spreads easy.

For free day trading education, visit www.apexinvesting.com.