By Darrell Martin

The Bank of Canada releases the Rate Statement and Overnight Interest Rate on Wednesday, May 25, at 10:00 AM ET. This news can really move the market however; it is unknown which direction the market will go.

The Straddle strategy is ideal for capturing profit whichever direction the market moves in reaction to the news when it’s expected the market will make a big move. With this news, it is expected the market will move far enough to use the Straddle strategy and go for approximately $40 profit.

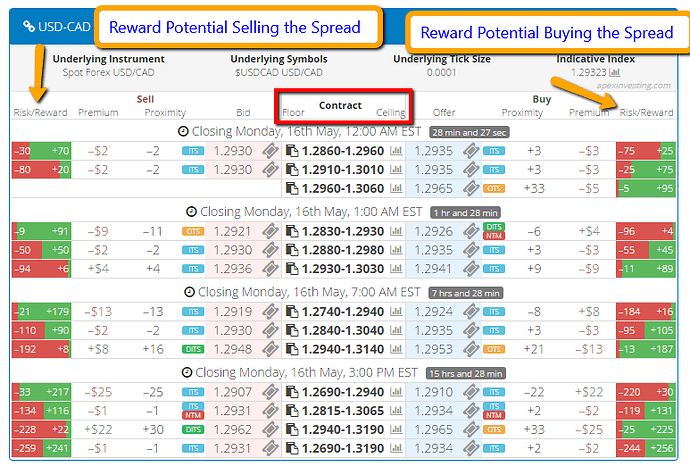

Using Nadex USD/CAD spreads to setup the Straddle strategy, buy a spread with a maximum risk of $20 and sell a spread with a maximum risk of $20. The floor of the bought spread should meet the ceiling of the sold spread. With the release at 10:00 AM ET, entry can be as early as 9:00 AM ET, for 11:00 AM ET expiration.

The Plan Is For One Side To Profit And Cover The Loss Of The Other Side

When trading a Straddle spread strategy, one side will lose and the other side will profit. Therefore, the expected move for the anticipated profit needs to cover the cost of the trade as well as the loss from the other side. For this trade setup, take profit orders should be setup 80 pips up if the market goes long and 80 pips below if the market goes short. Taking profit at either of those points will cover the loss of the other side and make $40 profit depending on the exact entries and exits.

Once the news is released, one side may profit and then the market may pull back. Leave the other spread on and it may make some profit as well, depending on the strength and momentum of the pull back move.

The spread scanner is the ideal tool for finding the right spreads for the strategy. It shows the potential risk for every spread and the direction it’s being traded. Once the spreads are found with the right risk amounts, then the ceiling floor parameters can be easily verified. See below for a glance example of the spread scanner for trading Nadex spreads.

Free education on trading and the spread scanner can be accessed from www.apexinvesting.com.